VN-Index showed a slight increase at the beginning of the session, approaching the previous short-term peak before reversing and experiencing a consolidation phase for the majority of the remaining time. VN-Index closed the session on March 14 with a decrease of 6.25 points (equivalent to 0.49%) to 1,264 points. The money flow was high with a trading volume on HOSE exceeding VND 26,800 billion.

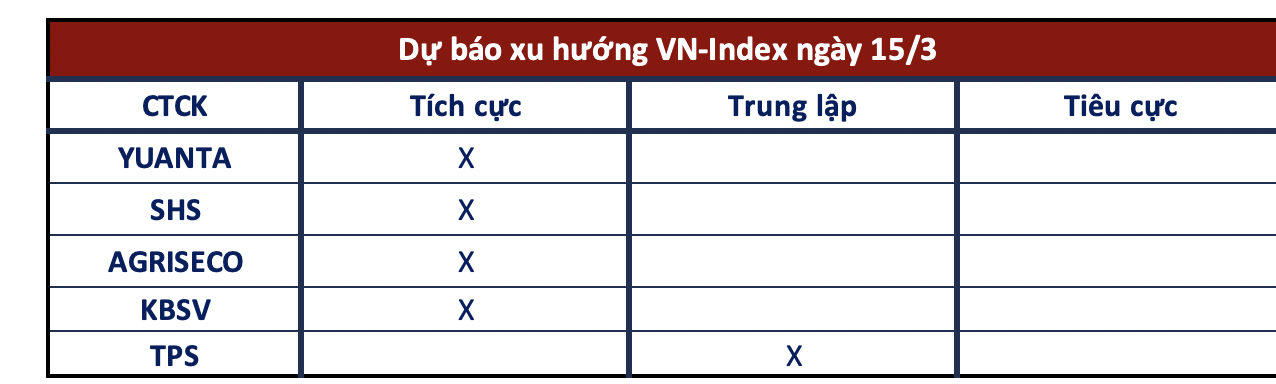

According to market analysis for the upcoming sessions, securities companies believe that the risk of creating new peaks is not high and the market can soon return to an upward trend.

Returning to the upward trend

Yuanta Securities

The market may return to an upward trend in the next session. However, ETF funds may perform portfolio restructuring in the session on March 15, 2024, so the market may experience strong fluctuations, especially in the ATC session. The positive point at the moment is that money flow continues to increase strongly, especially in the Midcaps and Smallcaps stock groups, so the market only experiences slight adjustments and quickly returns to the upward trend.

SHS Securities

In the short term, the market has made a strong recovery to the previous short-term peak, and the fluctuations today are normal. Although in the short term, VN-Index may continue to increase to the strong resistance zone of 1,300 points, the risk of unusual market fluctuations is high as the previous level of 1,250 points has not been convincingly surpassed. After the end of the excitement phase, VN-Index will adjust back within the range of 1,150 – 1,250 points.

Risk of creating new peaks is not significant

Agriseco Securities

Technically, profit-taking pressure around the previous peak level has caused the index to decrease with an expanding opening range. However, with the upward trend still dominating in the medium term, the opportunity to widen the index and move towards the next resistance zone around 1,290 (+-10) is still maintained. The support level around 1,250 points is expected to play an important role as a noteworthy level for the index and as long as this level is not breached, the risk of creating new peaks is not significant. Agriseco Research advises investors to continue holding the opened trading positions, only re-opening buy orders during slight corrective movements when the index approaches the mentioned support zone.

KBSV Securities

The movement of money flow is currently focused on the mid-cap stock group and some slow-moving stocks, while the leading stock group in the previous rising phase has weakened, indicating that the uptrend is lacking sustainability. The positive point is that the upward trend is still maintained, and the opportunity for the VN-Index to recover in the coming sessions is still open.

However, if the index surpasses the peak level again but the trading volume weakens, the risk of a significant correction appears and needs to be carefully considered. Investors are advised to avoid chasing buying orders during recovery phases, and can implement partial profit-taking and reduce the proportion of trading positions when the index approaches the next resistance zone around 1,300 (+-10).

TPS Securities

With trading volume still at a high level and the upward trend spreading evenly to all sectors, TPS predicts that VN-Index will come closer to the range of 1,270-1,275 in the next trading sessions. Although the likelihood of this scenario is assessed to be higher, scenarios with selling pressure dominating in the resistance zone can cause VN-Index to reverse and decrease to the range of 1,250-1,255 points. The support zone for VN-Index is located at 1,230-1,235 points.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)