Viettel Construction Joint Stock Corporation (Viettel Construction – code CTR) has just announced its estimated business results for February 2024 with a revenue of VND 834.4 billion, up 4% compared to the same period in 2023. However, pre-tax profit decreased by 4% compared to the same period in 2023, reaching VND 44.6 billion. One of the reasons is the long Tet holiday.

In February 2024, Viettel Construction implemented many important projects such as Investing in infrastructure for BTS rental in 2024 with a total investment capital of up to VND 1,460.4 billion; Signing construction projects with Bach Viet Land (VND 32 billion), Cau May Sapa resort (VND 15 billion)…

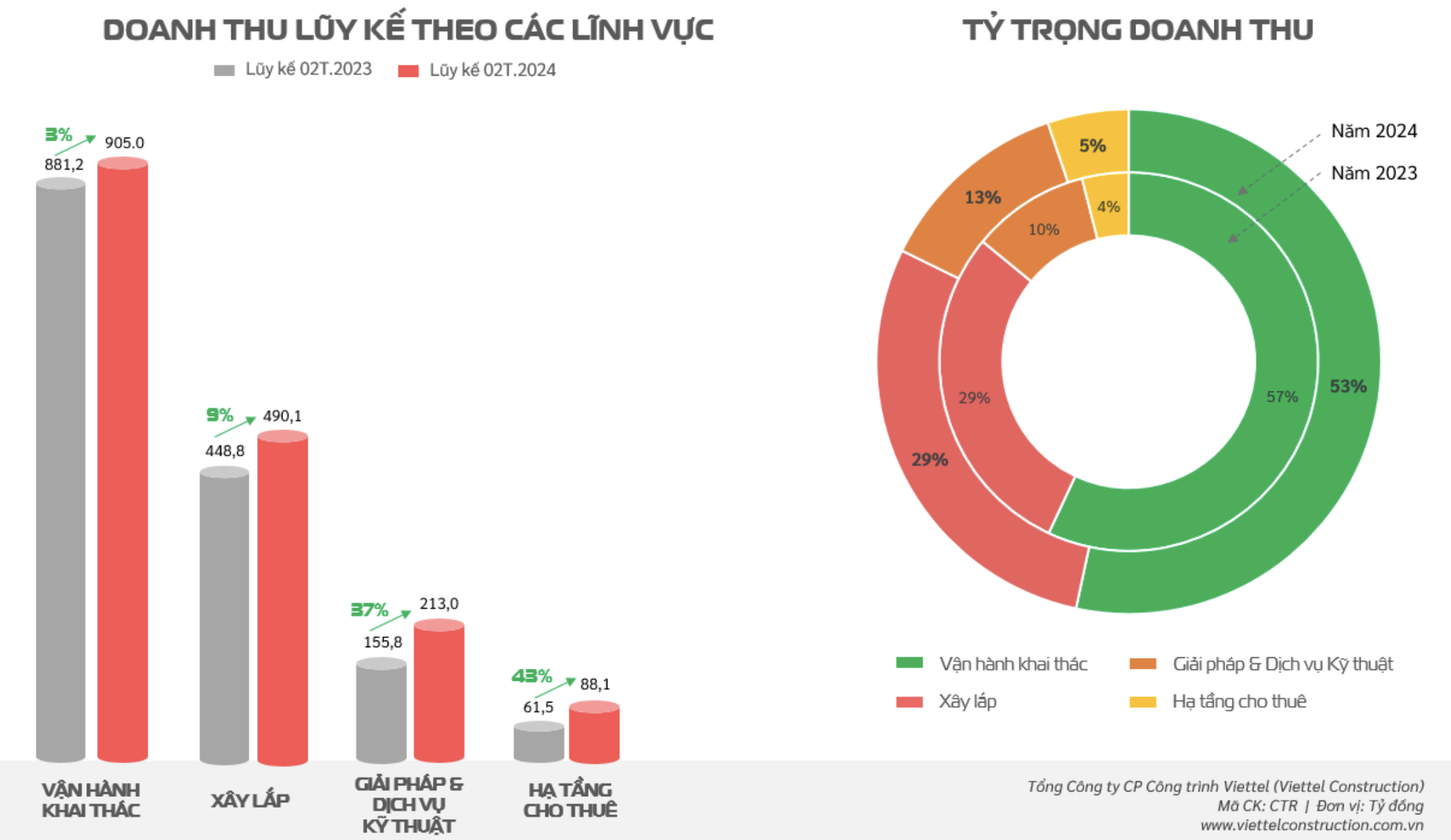

During the first two months of the year, Viettel Construction is expected to achieve VND 1,703 billion in revenue and VND 94.3 billion in pre-tax profit, increasing by 9% and 6% respectively compared to the same period in 2023. With the achieved results, the company has fulfilled 13% of the revenue plan and 14% of the profit target set for the whole year of 2024.

In the field of BTS infrastructure rental, by the end of February 2024, Viettel Construction owned 6,436 BTS stations (maintaining the position of Vietnam’s number 1 TowerCo); 2.45 million m2 of DAS; 2,716 km of transmission; 16.87 MWp of solar energy. Among them, 218 BTS stations have more than 2 tenants. The sharing rate reached 1.03. The revenue in this area recorded a growth of 43% compared to the same period in the first two months of the year.

In the Construction field, the B2B project source reached VND 350 billion in the first two months of the year, an increase of 17% compared to the same period in 2023. The B2C&SME project source reached nearly VND 337 billion, an increase of up to 97% compared to the same period in 2023. The rate of completion of construction projects by Viettel Construction: 686/701 districts (equivalent to 98%); 2,565/10,609 communes (equivalent to 24%).

In the field of Solutions & Technical Services, Viettel Construction has provided and installed an 800KWp solar project for Sovi Group; provided tablets for the Department of Education and Training of Kon Tum province; provided and installed air conditioning systems for Thanh Minh Construction & Electrical Construction Company (Binh Duong); provided and installed camera systems for Green I-park Joint Stock Company (Thai Binh).

In addition, the company also developed a retail business model combined with Online and Door to Door (delivery, deployment) with 17,433 subscribers buying goods in February 2024. Among them, 10,671 were new subscribers, an increase of 77% compared to the same period in 2023. At the same time, it successfully signed a maintenance contract for air conditioning systems for the Guardian retail chain of Lien A Chau Company.

In the Operation and Exploitation field, Viettel Construction has put into operation 817 new stations, raising the total number of operated stations to 53,220. The company also contacted and worked with domestic TowerCos, expanding the source of projects in 2024. In foreign markets, the company ensured 100% system power for Mytel (Myanmar), MetFone (Cambodia), and other TowerCos.

With the successful auction of the right to use the 2,500-2,600 MHz band for commercialization of 5G mobile technology on March 8, 2024, SSI Research predicts that the total number of Viettel Construction BTS stations will increase by 70% compared to the same period in 2023 The year 2024, benefiting from the gradual shutdown of 2G and the deployment of 5G, which could support a 53% increase in revenue in the rental infrastructure sector compared to the same period. In the long term, this analysis department expects the profitability contribution from this area to be even higher.