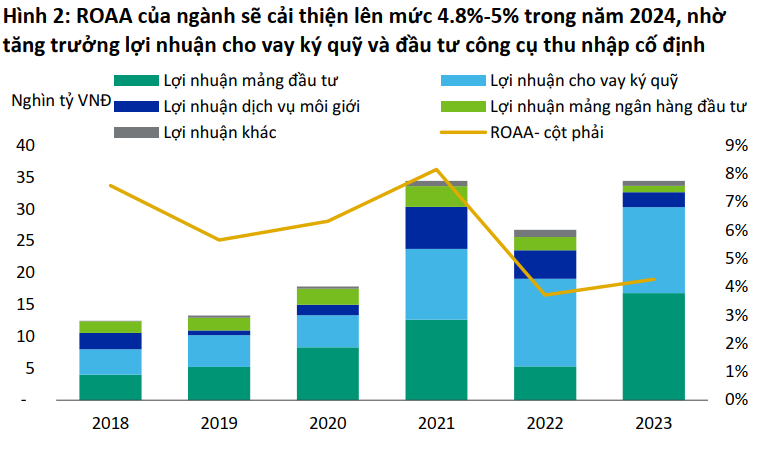

In the recent Securities Sector Outlook Report published by VIS Rating, it is stated that the prospects for the securities industry in 2024 continue to improve as the profitability of securities firms’ lending and investment activities grows in favorable conditions.

Specifically, according to VIS Rating, the return on average assets (ROAA) will improve by 50-70 basis points compared to the previous year, reaching 4.8%-5% in 2024 thanks to the growth in fixed income investment and lending activities.

Furthermore, with improved market sentiment, large-scale securities companies will increase their investments in fixed income instruments. With their large capital base and wide customer network, these large companies have a competitive advantage in expanding their margin lending activities, especially in an environment of low interest rates.

In addition, the government’s plan to upgrade trading infrastructure and remove pre-trading collateral requirements for foreign investors will also attract new investors over time.

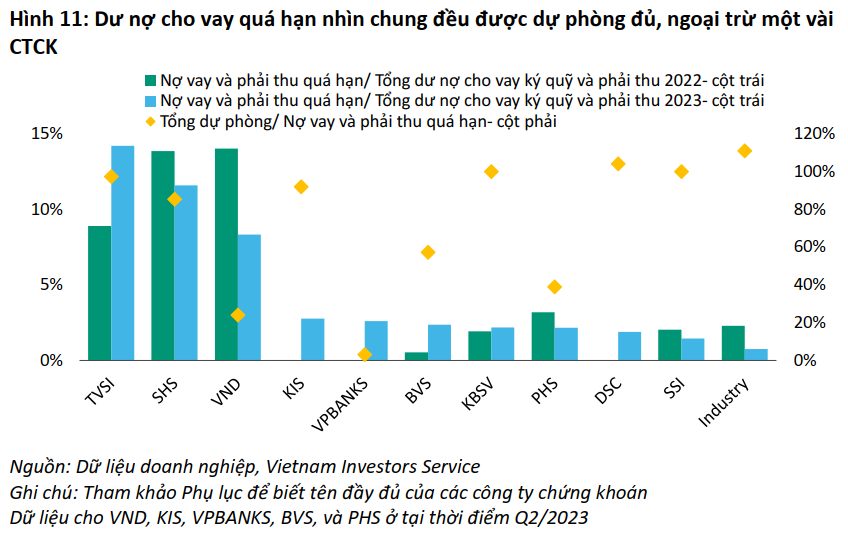

However, according to VIS Rating, the growth of brokerage income for securities companies will be constrained by intense fee competition, especially from foreign securities companies with lower profit margins. Along with that, the quality of assets will gradually stabilize as the rate of corporate bond defaults slows down.

“However, asset risks still remain high for some securities companies focused on distributing bonds due to the increased holdings of high-risk assets, including unlisted stocks and newly originated corporate bonds, as market sentiment improves. These assets are often concentrated in a few large clients and expose securities companies to event risks,” the report noted.

Furthermore, as securities companies ramp up bond distribution activities, they may commit to buybacks requested by investors more frequently. As a result, the risk of margin lending will be well-managed due to large collateral values and the recovery of stock prices.

Leverage in the sector will increase to support the expansion of margin lending and investment portfolios, but risks will be mitigated through recent capital raising exercises. Domestic securities companies will increase their borrowings and raise new capital to support their asset growth. Overall, Vietnam’s securities leverage ratio is among the lowest in the Asia-Pacific region.