The “carpet bombing” phenomenon that is often seen in the closing auction (ATC) has also appeared in the ETF restructuring session and the pressure has caused the VN-Index to not be able to maintain its green color at closing. However, the late afternoon recovery indicates that domestic capital is ready to take on the pressure. The VN-Index closed down only 0.48 points, which is very light compared to the nearly 12-point loss at the beginning of the afternoon session.

The breadth of this session shows a clear positive trend. At the end of the morning session, the VN-Index had only 123 gainers/339 losers. When the index hit its low, there were only 109 gainers/353 losers. Until 2pm, the breadth was still only 150 gainers/329 losers. However, in the last 30 minutes of continuous matching orders, the correlation changed significantly with 199 gainers/258 losers and closing at 217 gainers/249 losers. So from a wide decline, the market has shown positive recovery.

Bottom fishing is the main reason why stocks rebound. Today, liquidity on HoSE increased by 30% compared to the morning session, of course, with the large trading factor in the ATC session. However, the price effectiveness is evidence of the active buying effort to pull up. In the context of the VN-Index being stagnant at the peak level, the strong buying from the market is a strong signal.

In terms of points, the different impact of individual stocks is the reason why the VN-Index cannot turn green. At the time of the continuous matching trade, the index increased by 1.15 points compared to the reference. From this perspective, the “carpet bombing” pressure in the ATC session only caused the VN-Index to drop by 1.62 points (closing down 0.48 points), which is very light.

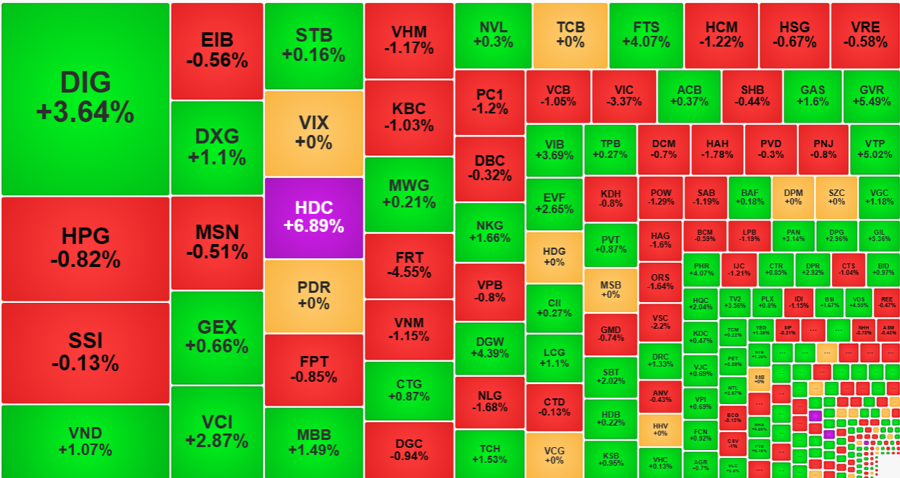

VIC collapsed separately in the ATC session with a 2.52% decrease and closed down 3.37% compared to the reference, which had a significant impact. VCB fell 4 price steps in the ATC session, ending down 1.05%. These two stocks alone took away 2.84 points. In addition, VHM and VNM were also pressured on price. Of the top 10 largest market cap stocks, only 3 stocks increased: BID increased 0.97%, GAS increased 1.6%, and CTG increased 0.87%.

VN30-Index closed down 0.31% and only lost about 1.4 points in the ATC session, with a breadth of 13 gainers/15 losers. 7 stocks in this basket decreased by more than 1%. VN30 is weaker than other stock groups and today’s restructuring session was the same: Midcap decreased by 0.03% and Smallcap increased by 0.65%. Of course, the Smallcap group was not affected by the restructuring trading and still received a good amount of capital.

In the 217 stocks that gained on HoSE at closing, 60 stocks increased by more than 2% with many very strong representatives: DIG had a record-breaking massive liquidity of VND 1,989.1 billion, and its price increased by 3.64%. Foreign investors had a net purchase of VND 98.8 billion of this stock, accounting for only 5.5% of the total liquidity. Securities group stocks, VCI increased by 2.87%, with trading value of VND 535.6 billion; FTS increased by 4.07% with VND 306.5 billion. Stocks DGW, EVF, VTP, SBT, PAN, DPG, GIL, PHR all increased very well with high liquidity. HoSE had 98 stocks that increased by more than 1% with concentrated liquidity accounting for 32.7% of the total trading value of the exchange. On the other hand, although there were 249 stocks that decreased, only 54 stocks decreased by more than 1% and the liquidity accounted for 16%.

With the ability to support prices and maintain a slight adjustment range, low liquidity but strong growth and higher liquidity. This structure contributes to confirming the very high liquidity level today with many positive aspects.