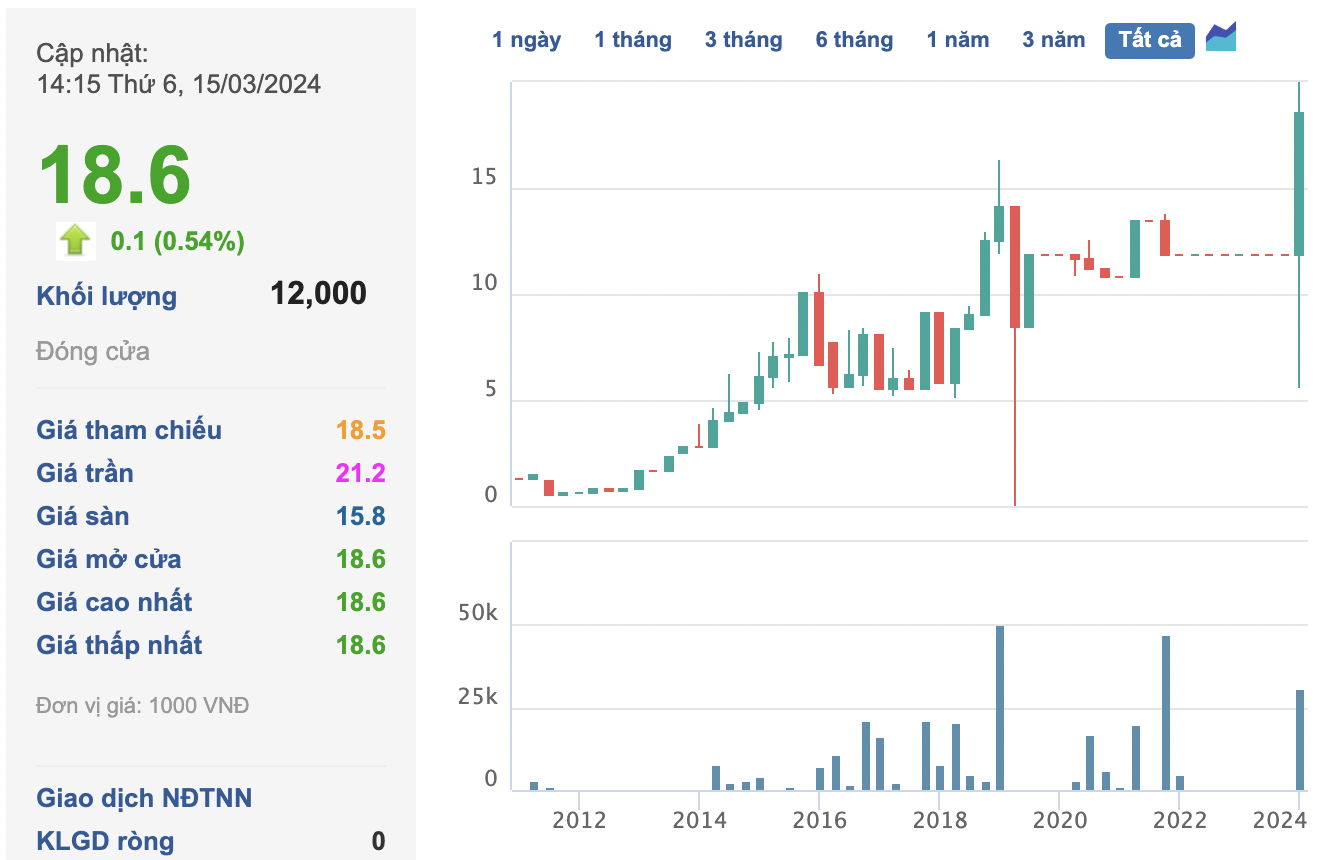

Specifically, the TMW code of Tan Mai General Wood Joint Stock Company has continuously hit the ceiling from February 27th to March 7th, 2023. The TMW stock price has nearly tripled to 18,600 VND per share.

The company has also provided an explanation for the consecutive 5-day increase in the stock price. Tan Mai General Wood stated that after a sharp decline in the stock price due to market influences, the TMW stock has gained the trust of investors, leading to an increase in market demand.

“The trading decisions of investors regarding the TMW stock are beyond the control of the company. The company does not have any direct impact on the trading price in the market,” the document stated.

The remarkable rise of TMW attracts attention, as the company has been listed for many years but almost without liquidity. Furthermore, the business performance of Tan Mai General Wood has not shown signs of improvement and is even in a downward trend.

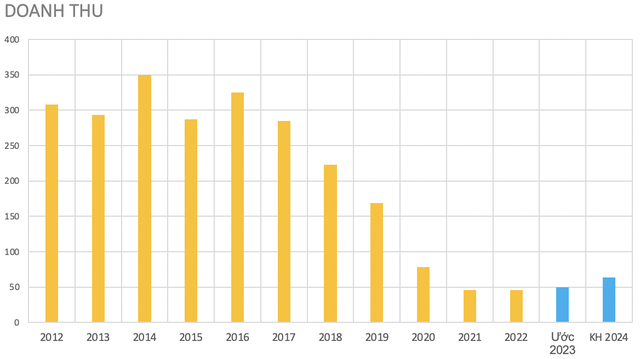

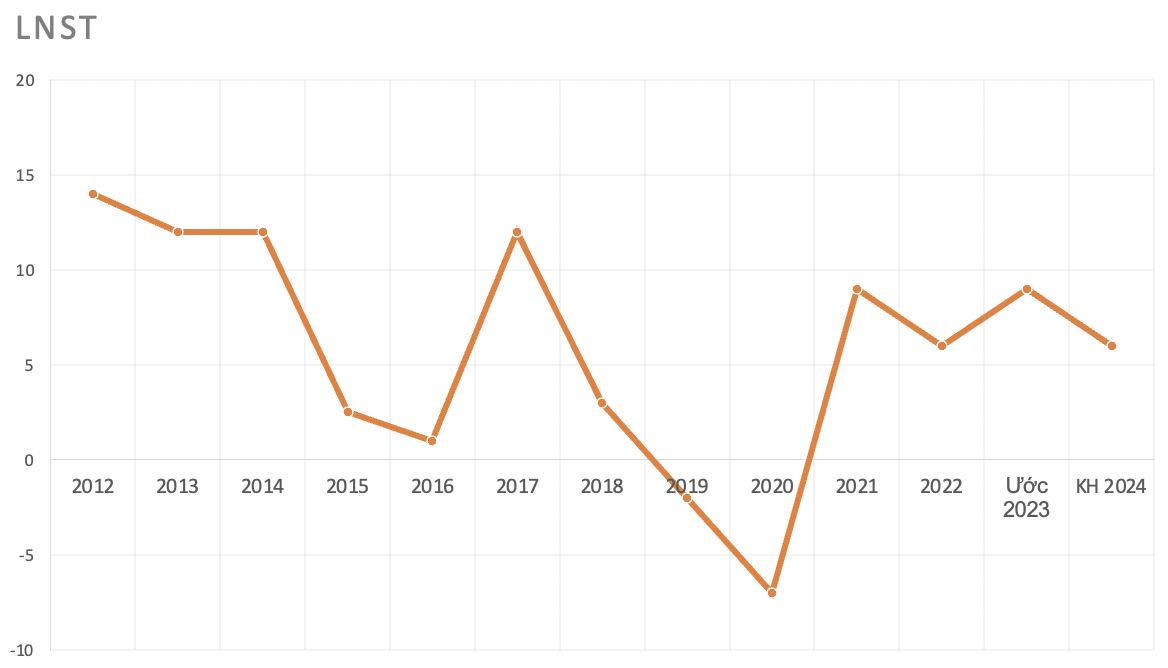

During the period of 2012 – 2016, Tan Mai General Wood had a good business performance with an average annual revenue of 300 billion VND. Starting from 2017, the company’s revenue has declined and officially dropped below 100 billion VND in 2020. This is also the second year the company suffered heavy losses.

It is worth noting that Tan Mai General Wood can be considered the oldest wood industry company, with its predecessor being Tan Mai Wood Processing Company – a state-owned enterprise specializing in wood processing, established since 1975. In March 2006, the company underwent equitization and changed its name to Tan Mai General Wood Joint Stock Company, belonging to Dong Nai Food Industry Corporation. Up until now, the charter capital remains at 46.62 billion VND.

The company operates in the fields of plywood production, coffa plywood, veneer plywood, raw wood, and export garment. Specifically, the raw wood products of the company are exported to countries such as Taiwan, Japan, South Korea, Denmark, and France. The garment products are directly exported to markets such as Japan, Germany, Russia, and Taiwan.

Tan Mai General Wood also leases warehouses and has started trading agricultural products since 2023. Although newly engaged in this business, the company’s plan for 2024 aims for agricultural products to contribute half of the total revenue, doubling the traditional plywood segment.

In 2023, the company estimated a total revenue of over 50 billion VND and a net profit after tax of more than 9 billion VND, which is twice the assigned target. In 2024, the company set a target of 63.7 billion VND in total revenue and 6 billion VND in net profit after tax.

On May 31st, Tan Mai General Wood will advance interim cash dividends for 2023 at a rate of 10% (1,000 VND per share). In the previous years, the company has regularly paid dividends to shareholders in cash at rates ranging from 7% to 30%.

Regarding the current capital structure, according to the company’s management report for 2023, as of December 31st, 2023, Tan Mai General Wood has three major shareholders holding a total of nearly 87% of capital, including:

– Thanh Binh Limited Liability Company (owns 47.01%);

– Dong Nai Food Industry Corporation (holds 33.12%);

– Dong Nai Development Investment Fund (holds 6.48%).

Among them, Mr. Pham Duc Binh – Chairman of the Board of Directors of Tan Mai General Wood is also the Chairman of the Supervisory Board of Thanh Binh Company (currently the largest shareholder of the company).

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)