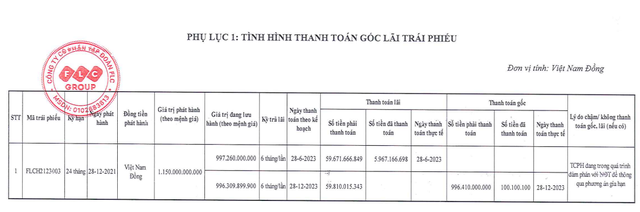

According to information from the Hanoi Stock Exchange, in 2023, FLC Group (stock code: FLC) has to pay a total of 120 billion VND in interest and 996.4 billion VND in principal to reconcile the FLCH2123003 bond issue. However, by the end of the year, the company only managed to pay 6 billion VND in interest and 100 million VND in principal.

FLC said it is currently in negotiations with bondholders to extend the deadline and is expected to make the payment by December 28, 2025, if approved by the bondholders.

The FLC bond issue was issued on December 28, 2021, with a term of 2 years. The volume consists of 115 thousand bonds with a face value of 10 million VND, totaling 1,150 billion VND. The interest rate for the first term is 12% per year.

By September 2023, FLC had repurchased 153 billion VND. Since then, the company has continued to repurchase in 3 batches, with amounts of 200 million VND, 750 million VND, and 150 million VND, respectively. As of the end of February 2024, FLC still owes nearly 996 billion VND in principal.

Previously, on December 22, 2023, FLC announced the results of a bondholders’ opinion poll on 4 options for extending the bond issue with the bondholders, mainly revolving around exploitation or transfer or offset of the FLC Hai Ninh 2 project, but ultimately no options were approved.

It is known that FLC Hai Ninh 2 is part of the FLC Quang Binh ecotourism complex. The mega project has a total investment of 20 trillion VND, implemented on an area of 1,954 hectares. As of the end of 2022, the project has put into operation two golf courses and a number of coastal villas.

In late February, FLC held its first extraordinary General Meeting of Shareholders in 2024. The management stated that the years 2022-2023 were a very difficult and challenging period, facing many difficulties in operations due to direct impacts from the information and issues related to the incident of former top leaders.

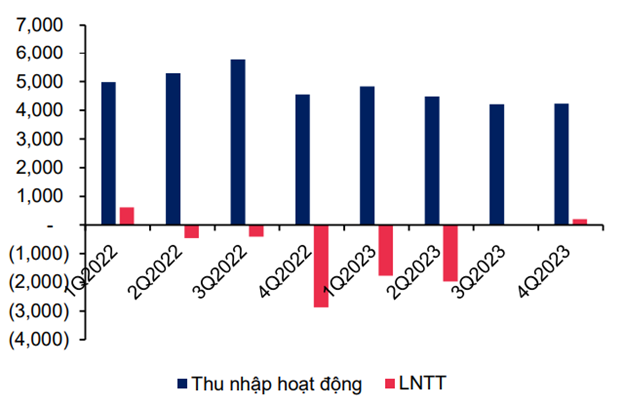

FLC has not released financial reports from the fourth quarter of 2022 to the present, and the financial situation is still a big question mark. According to the announcement at the meeting, the estimated total value of existing assets reached over 21 trillion VND. FLC has completed the payment of state budget of about 800 billion VND, and fulfilled debt obligations of about 4,400 billion VND.

After a strong restructuring process, FLC’s personnel ratio decreased by 60% to more than 3,500 employees, merged 50% of departments, established the new Business & Strategy Department, and the IT Department. The company’s system includes 14 subsidiaries (in which FLC owns from over 50% to 100% of charter capital) and 1 affiliated company.

Towards 2024, FLC will continue to strongly promote restructuring and redefining core areas with three main pillars: real estate business, resort business, and M&A projects to restructure debts and maintain business operations. The target for the real estate business segment is to achieve a revenue of 1,187.2 billion VND, and the resort business segment is to achieve 1,213 billion VND; profits are sufficient to maintain the organization and fulfill commitments to related parties.