A recent report by Momentum Works has revealed that the milk tea craze has generated a market of nearly $3.7 billion in Southeast Asia. Vietnam ranks third in this market with a value of over $360 million, equivalent to more than 8,500 billion VND according to Momentum Works.

This explains why there are still many new brands entering the Vietnamese milk tea market. Most recently, in early March, the Thai brand ChaTraMue opened its first store in Hanoi. This is ChaTraMue’s second store in Vietnam, after the company entered the Ho Chi Minh City market in June last year.

ChaTraMue is a popular brand in Thailand. Currently, ChaTraMue has over 100 milk tea shops in their home country. They also have more than 40 shops in international markets such as China, Singapore, Malaysia, and South Korea.

Prior to that, the Chinese low-cost milk tea brand Mixue also gained a lot of attention when it quickly spread to different provinces in Vietnam. Similar to its operation in China, Mixue entered Vietnam with affordable, simple, and convenient products that can be taken on buses, trains, or while walking.

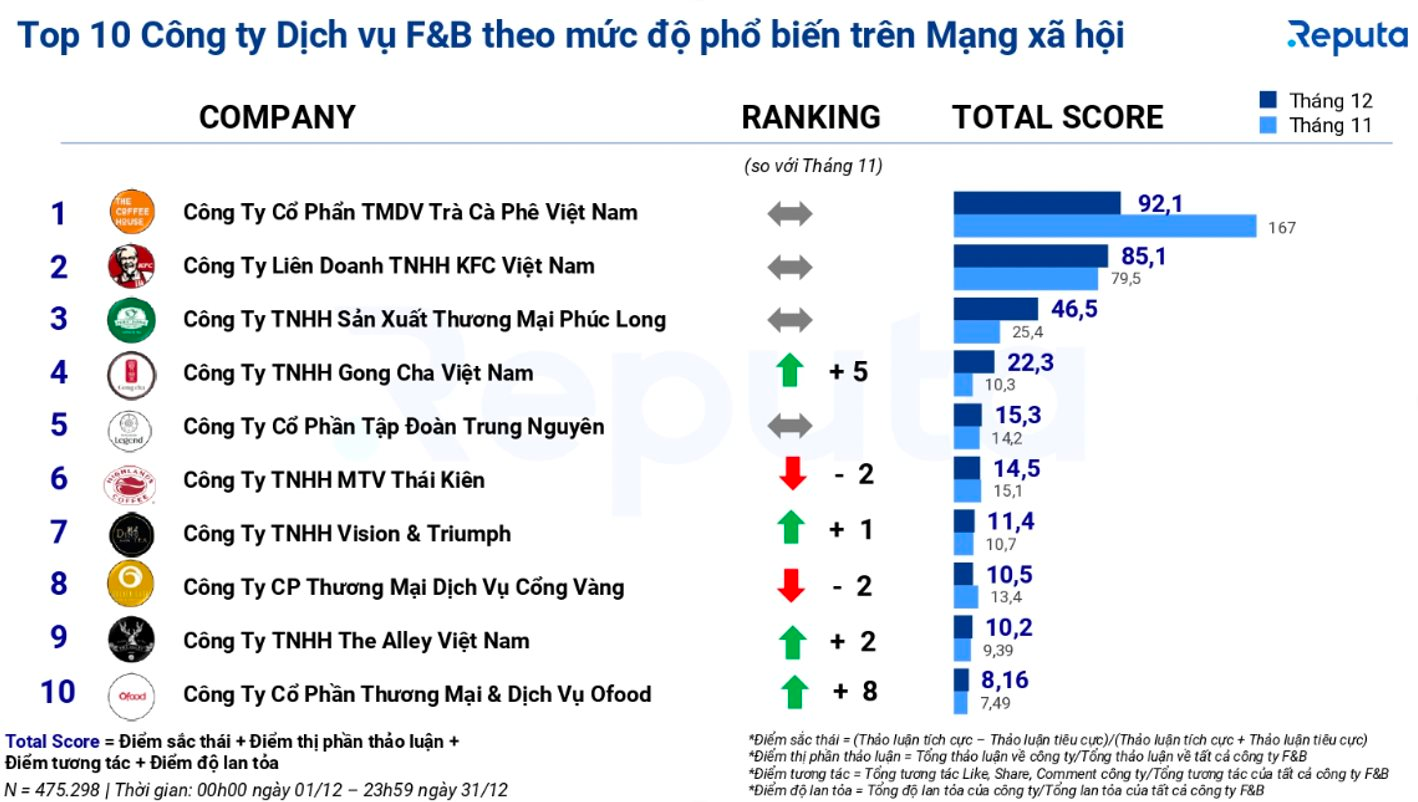

And other brands are also exploring the Vietnamese market such as Gong Cha, KOI, Phê La, Toco Toco, Xing Fu Tang, and The Alley. At first glance, the milk tea industry seems to have a high turnover rate, as many players who previously opened stores have now closed them, making way for new names…

From an insider’s perspective, Gong Cha representatives state that the “turnover” here is the result of whether a brand can meet or satisfy the minimum requirements of consumers. Even large brands with years of experience in the industry must constantly evaluate all the criteria set by customers to ensure that customers feel satisfied and comfortable enough to keep using their services.

“In Vietnam, we have a large variety of products related to tea with different brands. Therefore, competition in the business of tea and milk tea products is becoming increasingly difficult with intense competition,” added the representative.

On the other hand, nowadays consumers are always cautious about their choices for themselves, their friends, and their loved ones. A milk tea brand must not only guarantee food safety, but also have stores located conveniently for transportation. The products must be diverse, prices must be reasonable and affordable for everyone, and most importantly, the brand must ensure a balance for the health of consumers,

Regarding fast food trends that come and go quickly, such as hand-crushed lemon tea or grilled milk tea from Taiwan, Gong Cha believes that this does not have much impact on the current F&B brands in general, and milk tea brands in particular.

According to Gong Cha, in the current context, “trendy” products are valuable assets that brands have spent a lot of time researching and developing. So in general, the acceptance and satisfaction of customers with these “trendy” products depend on their own experiences and the amount of time spent. Gong Cha also continues to learn a lot from these products, searching and studying to bring new developments.

On the other hand, in Vietnam, there are still many customers who choose different brands that may have higher prices, but offer other benefits such as unique spaces, a wider variety of drink options, and suitability for dates, work, or gifting. In this case, a cup of milk tea is no longer just a cup of milk tea; it becomes a connection, a space for communication.

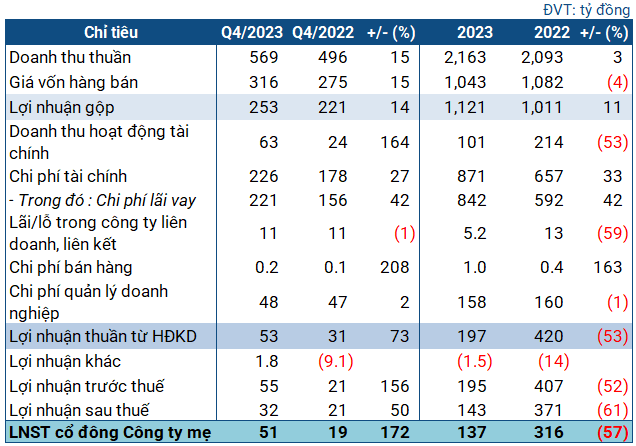

Sharing about the business situation over the past year, Gong Cha says that 2023 was a truly difficult year for the F&B industry due to customers tightening their spending from other macroeconomic influences. The company’s revenue only saw a slight increase compared to 2022. Gong Cha still maintained 40 stores and continuously invested in renewal and repairs to enhance the customer experience and provide better services.

In 2024, Gong Cha says it still prioritizes renovation and revitalization of deteriorating stores, improving service quality and speed. Recently, Gong Cha Vietnam was honored to receive a high award from Gong Cha Global for evaluating customer satisfaction. This is an accolade given by the corporation based on various evaluation criteria, conducted in 34 countries and over 2,000 stores worldwide.

“Therefore, this year we will also review and study new cities and districts to develop more stores to bring convenience to Gong Cha customers in Vietnam,” the representative added.