Weakness of domestic businesses in the instant coffee industry

According to the Vietnam Coffee and Cocoa Association, out of the TOP 10 coffee exporters of roasted and instant coffee in the first 5 months of the coffee crop (from October 2023 to September 2024), there is only one domestic company which is Trung Nguyen.

Specifically, NESTLÉ Vietnam (Switzerland) leads with an accumulated export turnover of about 57.5 million USD.

Following are the brands: OUTSPAN Vietnam, Cà phê Ngon, Trung Nguyen Group, IGUACU Vietnam, URC Vietnam, TATA COFFEE Vietnam, INSTANTA Vietnam, SUCAFINA Vietnam, and Lựa chọn đỉnh.

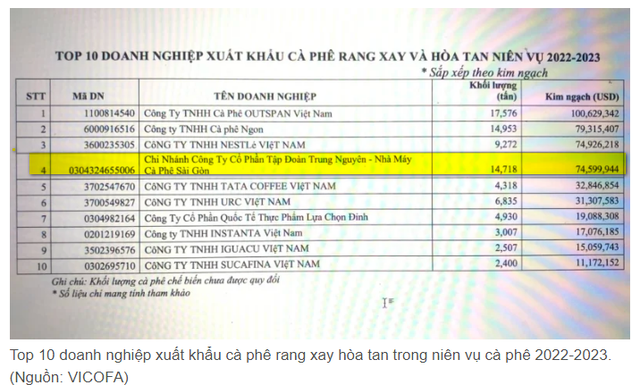

In the crop year 2022-2023, Trung Nguyen was also the only Vietnamese brand to appear in the TOP 10 coffee export companies for roasted and instant coffee.

Lao Dong newspaper quoted Mr. Nguyen Nam Hai – Chairman of the Vietnam Coffee and Cocoa Association (Vicofa) as saying that the proportion of deep-processed coffee exports from Vietnam is very low. Vietnamese enterprises mainly export raw materials to foreign partners.

The main reason is that most Vietnamese enterprises have small scale and difficulty with capital issues. To invest in a completely new instant coffee processing system with a capacity of 3,000 tons per year, the cost is about 30 million USD (equivalent to about 600 billion VND), which exceeds the capabilities of these businesses.

According to Mr. Hai, because they don’t have the capital to invest in machinery, many enterprises choose manual roasting and grinding to serve European customers, accepting to export 1-2 containers per month to maintain production and profit.

Meanwhile, FDI businesses with financial strength, technology, and market are increasing their market share. Although the export volume is small, investing in deep processing helps FDI businesses exploit high value.

“FDI businesses are actively investing in the Vietnamese coffee industry to enjoy two advantages: Vietnam has a very rich coffee raw material area, so they can utilize the available raw material source. Moreover, Vietnam’s participation in a series of free trade agreements, with reduced tariffs to 0%, is very favorable, so FDI enterprises all want to enter the coffee processing market,” said the Chairman of Vicofa.

Outspan Factory

The Vietnamese instant coffee market is a vibrant and potential market with many manufacturers, importers, and distributors competing with each other. According to a report by Mordor Intelligence, the size of the Vietnamese instant coffee market is expected to increase from 472.61 million USD in 2023 to 706.06 million USD in 2028, with a compound annual growth rate (CAGR) of 8.13%.

The expansion of the instant coffee market is due to the high consumption demand for coffee at home among the middle-class population in developing countries. Along with the convenience and flexibility of instant coffee for different tastes and preferences of consumers, as well as the ability to distribute through a variety of channels that support the growth of this market.

However, as the Chairman of Vicofa pointed out, the biggest weakness of domestic businesses in this potential market is capital. Some domestic companies that produce instant coffee, such as Masan (acquired Vinacafe Bien Hoa), Phuc Sinh (K-coffee), etc., are well-known names with strong financial resources. However, their products have not made a mark in the international market like Trung Nguyen.

In terms of the domestic instant coffee market share, the top 3 are Vinacafe, Trung Nguyen, and Nestle.

Illustrative image

One “hopeful star” of instant coffee exports in the future is Intimex, Vietnam’s largest supplier of robusta coffee.

Since 2019, to reduce the risk of raw coffee export prices depending on the prices of the London market and the expectation of higher profits, Intimex has started to participate in the production of instant coffee.

Officially launched in December 2019, the Intimex instant coffee plant is located in Vietnam Singapore II-A Industrial Park (Binh Duong), operating at 100% capacity of 4,000 tons of spray-dried coffee per year.

Intimex plans to invest in phase 2 of the instant coffee processing plant, increasing the total capacity to 8,000 tons per year. Intimex’s ambition is to achieve 18,000 – 20,000 tons per year by 2026, becoming a leading instant coffee export company in Vietnam.

Intimex Factory