This is QNS Corporation (UPCoM: QNS), the parent company of Vietnam Soya Milk Company (Vinasoy) – known for the Fami brand. In addition to Vinasoy, QNS Corporation has many subsidiary units operating in different fields, such as Dung Quat Brewery, Biscafun Confectionery Factory, and Thach Bich Mineral Water Plant.

According to the annual general meeting documents published by QNS Corporation in 2024, the company plans to distribute dividends for the record-breaking profit in 2023 at a rate of 40%, which means each share will receive 4,000 VND. This is the highest cash dividend payout in the past 10 years for QNS Corporation.

QNS Corporation is about to distribute dividends to its shareholders. Photo: QNS

Prior to that, QNS Corporation had two interim dividend payments, with a total rate of 20%. As planned, by April 17th, the company will finalize the shareholder list to pay the remaining 20%, equivalent to an amount of 714 billion VND.

- In reality, with nearly 356 million circulating shares, it is estimated that the parent company of Vinasoy will have to spend up to 1.428 trillion VND to pay dividends to shareholders.

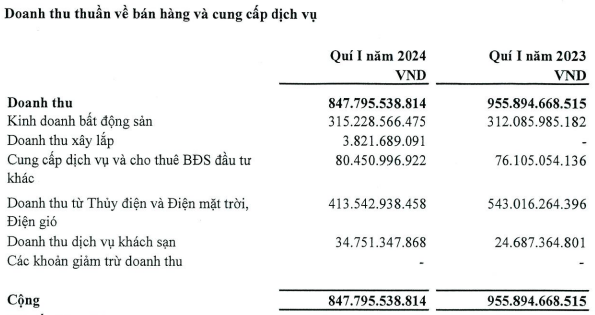

Daily revenue of nearly 29 billion VND

| Net revenue | Net profit after tax | |

|---|---|---|

| 2018 | 8,031 | 1,240 |

| 2019 | 7,681 | 1,292 |

| 2020 | 6,213 | 1,104 |

| 2021 | 7,335 | 1,254 |

| 2022 | 8,255 | 1,287 |

| 2023 | 10,516 | 2,183 |

Business results of QNS Corporation from 2018 – 2023 (according to financial reports). Chart: MH

By the end of 2023, QNS Corporation achieved record-high net revenue and net profit after tax. The net revenue and net profit of the enterprise reached 10,516 billion VND (up 23% compared to 2022) and 2,183 billion VND (up 70% compared to 2022). With such impressive revenue, it means that QNS Corporation earns nearly 29 billion VND per day. This outstanding result helps the company exceed its revenue target by 19% and its profit target by 117% for the year.

According to the company’s management representatives, although the global and Vietnamese economies are gradually recovering after the Covid-19 pandemic, purchasing power has not fully recovered. Therefore, the consumption of products such as milk, mineral water, beer, etc. is still decreasing. However, thanks to cost control efforts, the profit of these products is still maintained at a level approximately similar to the same period of the previous year.

Despite achieving record-breaking business results in 2023, QNS Corporation is relatively cautious in setting its goals for 2024. Accordingly, the company sets a target of total revenue of 9,000 billion VND and net profit after tax of 1,341 billion VND, corresponding to a decrease of 14% and 39% compared to 2023.

QNS Corporation is the parent company of Vinasoy, a well-known company with the Fami brand. Illustrative photo

In addition, at the AGM, QNS Corporation’s Board of Directors will present the ESOP issuance plan for more than 10.7 million shares, equivalent to 3% of the current outstanding shares. The issuance price will be determined based on the book value at the end of 2023.

According to the announcement from Quang Ngai Sugar Company, the total amount of money expected to be collected from the share issuance will be added to the working capital to serve business activities. Specifically, if the share issuance is successful, the company’s charter capital will also increase from 3,569 billion VND to 3,676 billion VND.

Since being listed on the stock exchange (in 2016), QNS Corporation has only carried out one ESOP share issuance in mid-2019, with a volume of 5.85 million units.

QNS Corporation originated from a Sugar Factory built by Japan before 1975. The predecessor of this business was Quang Ngai Sugar Company under the Ministry of Agriculture and Rural Development. Since January 1st, 2006, Quang Ngai Sugar Company has been transformed from a State-owned enterprise into a Joint Stock Company.

Quang Ngai Sugar Company is currently a multi-industry, multi-field business, including agricultural product processing industry, food and beverage industry. The main products of the company are cane sugar, soya milk, mineral water, beer, confectionery, sugarcane varieties, etc.

QNS Corporation owns strong brands such as QNS, Vinasoy, and reputable product brands in the market such as Thach Bich Mineral Water, Biscafun, etc.

After nearly 20 years of equitization, QNS Corporation is a large-scale operating enterprise and also one of the major sugar and downstream product processing centers nationwide. The company’s products are present in all provinces and cities throughout the country and are exported to countries worldwide, such as Russia, Thailand, Cambodia, China, the United States, etc. For example, Vinasoy’s Fami soya milk has been exported to markets such as China, Japan, South Korea, and the United States.

Minh Hang