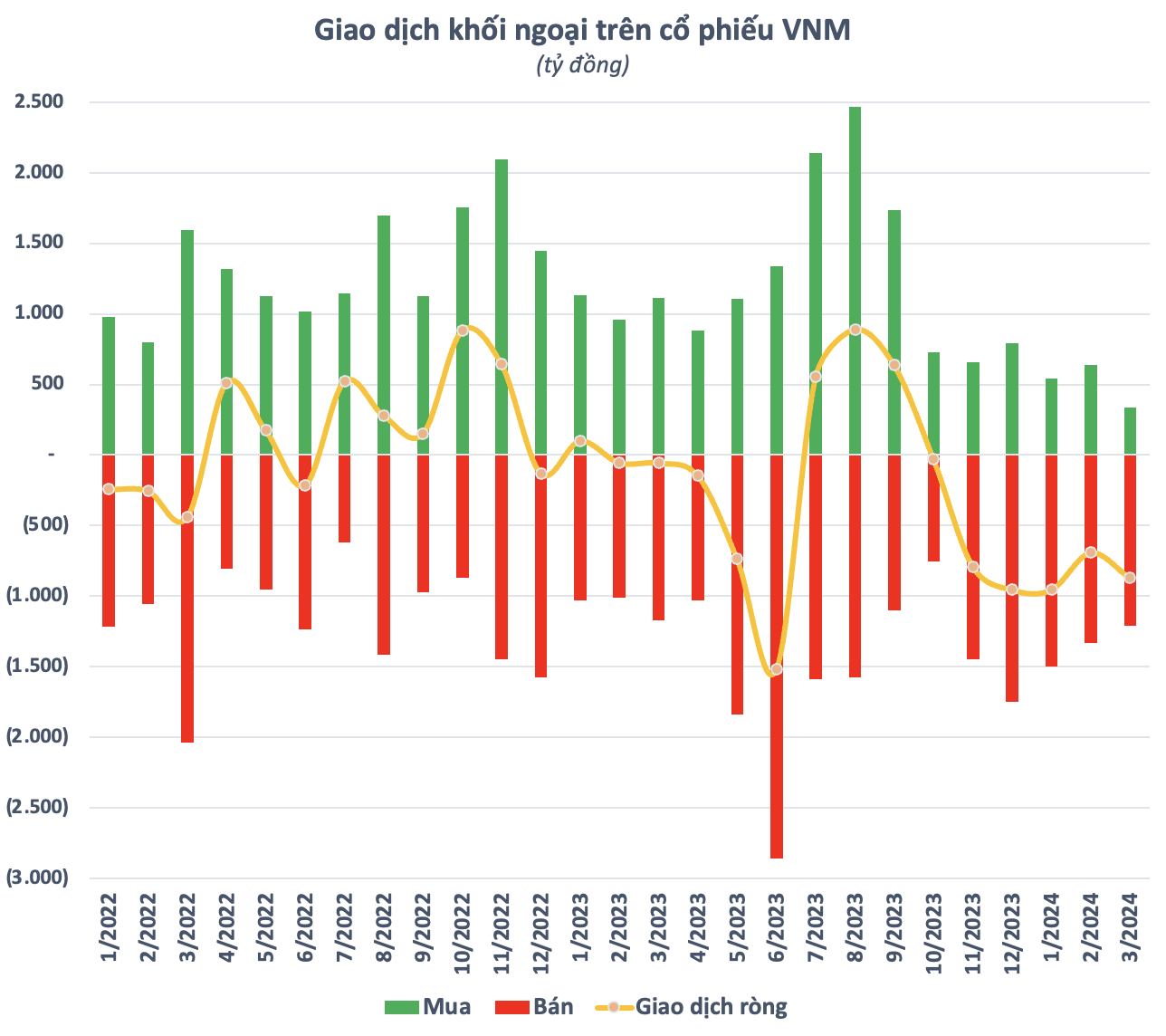

After a “break” in early 2024, foreign investors quickly returned to strong selling on the Vietnamese stock market. Shares of VNM from Vinamilk are one of the focal points as they continue to fall into the top of the most heavily sold stocks on the market.

Since the beginning of March, VNM has seen net sales of VND 870 billion, bringing the total net selling value to over VND 2,500 billion since the beginning of 2024, the largest in the market. Since the reversal in October last year, foreign investors have been selling for 5 consecutive months on this stock.

Looking further back from the beginning of 2023 to now, only the third quarter of the previous year was when foreigners really bought shares on VNM. This was also the period when the leading dairy stock strongly recovered to its 2-year peak. The remaining time, the trend of selling continued to dominate.

The pressure from foreign investors is one of the reasons why VNM shares have not been able to have a “long-term” trend despite strong domestic capital flow. Since the beginning of 2024, this stock has only increased by a slight 4% while VN-Index has increased by nearly 12%.

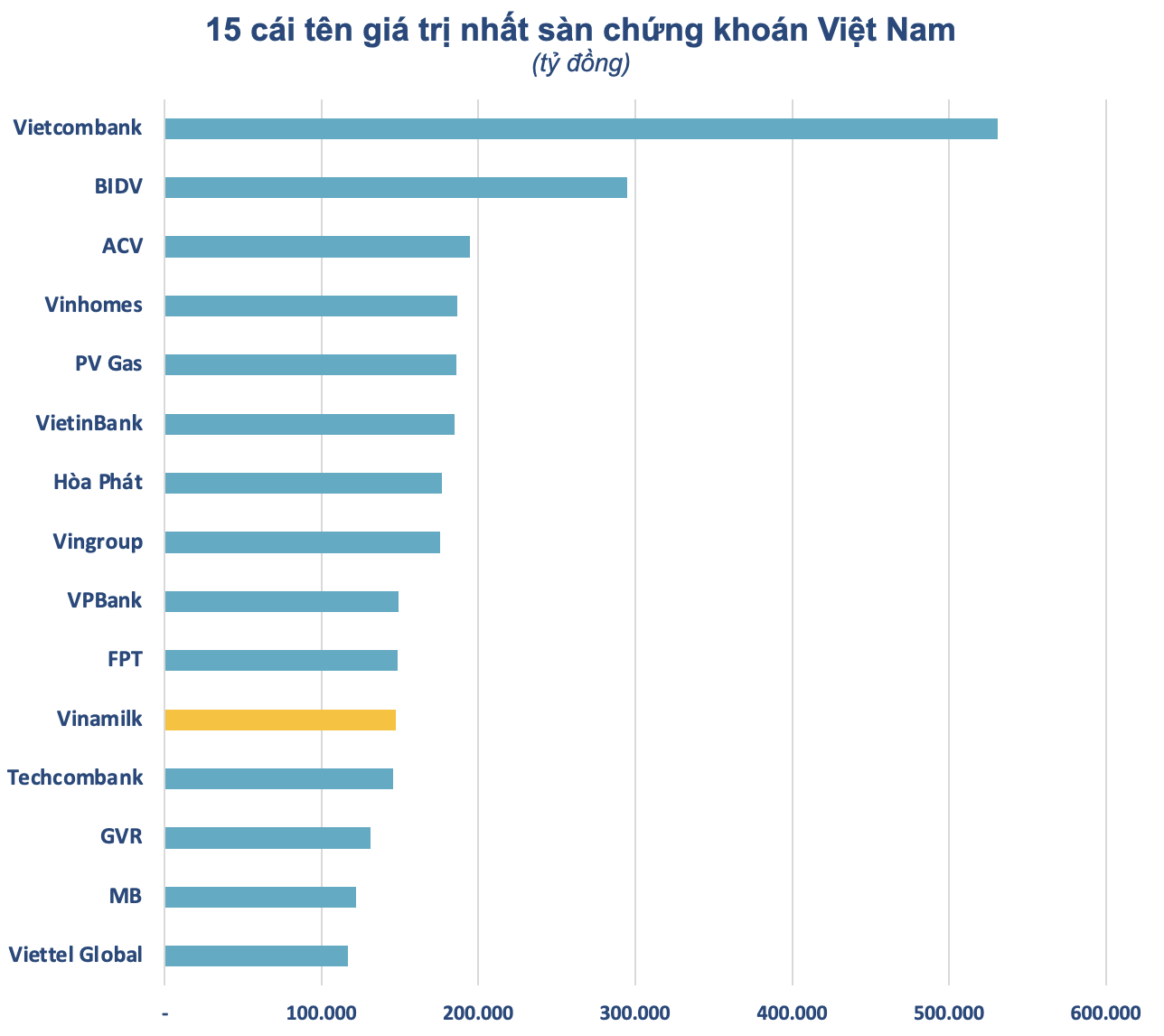

Based on the current market price, the market capitalization of Vinamilk is about VND 147,000 billion (~USD 6 billion), not enough to be in the top 10 most valuable stocks on the stock exchange. This number is also much lower than the peak period at the beginning of 2018 when the dairy “giant” was the most valuable name in the market with a market capitalization of over USD 10 billion.

In a report in early March, BIDV Securities (BSC) expects a successful market upgrade in 2025 to be an important factor in improving cash flow for large-cap stocks like VNM. However, this story is still in the future and the impact of upgrading on foreign capital inflows into Vietnam still needs to be carefully considered.

Waiting for a turning point after business restructuring

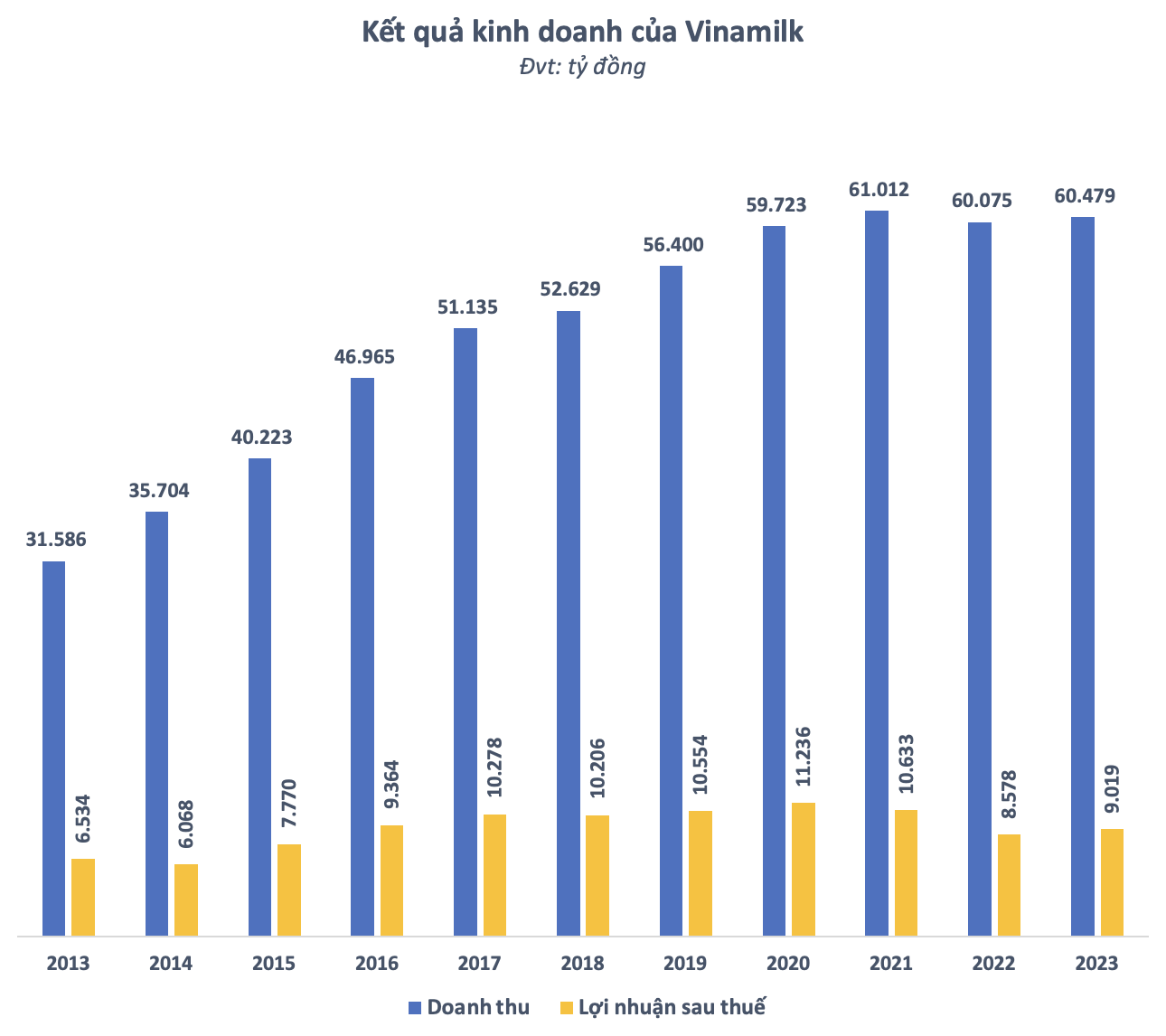

In general, foreign capital has not been “favorable” to VNM shares in recent years partly due to Vinamilk’s difficulty with growth. After a period of explosive growth, Vinamilk’s revenue has stagnated around VND 60,000 billion for the past few years. Net profit, which had been maintained above VND 10,000 billion for a long time, also sharply decreased in 2022 to below VND 9,000 billion.

The situation has been more optimistic in 2023 when Vinamilk’s net profit returned to positive growth after 2 consecutive years of decline. Although the increase was only over 5%, this is still a noteworthy result in a year when Vinamilk made efforts to restructure the business, highlighted by a strategy to change the brand identity to meet the development of the new generation of consumers, expand the customer base without age limits, and promote the image in global markets.

The brand innovation in 2023 has helped the beverage segment regain a 2.8% market share, and Vinamilk’s overall market share has also been restored in the past 2 quarters. Vinamilk said it will continue to focus on developing mid-range products, plant-based products, and will enhance the powdered milk segment to strengthen its market share. Along with the recovery of domestic consumption, Mirae Asset expects Vinamilk’s domestic revenue to improve in 2024.

Meanwhile, the foreign market continues to show promising growth, with net export revenue increasing by over 19% to reach VND 1,298 billion, mainly thanks to the Middle East and Asian markets recovering along with the low base of the same period. Vinamilk’s export revenue in January 2024 also grew outstandingly by 20% compared to the same period last year.

Vinamilk said it will continue to participate in trade promotion activities, and also develop new market groups such as South America, Caribbean, and West and South Africa. Therefore, Mirae Asset expects that export revenue will be the key to boost foreign revenue growth in the future.

Similarly, BSC also evaluates Vinamilk’s growth potential in 2024 based on the assumptions that (i) Consumer demand will recover, (ii) Domestic market share will improve, and (iii) Gross margin will recover thanks to a decrease in input prices. On the other hand, BSC also points out some risks for Vinamilk, such as the risk of losing market share due to competitive pressure and increasing input raw material prices that narrow profit margin.