Despite reaching an all-time high of $73,700 on March 14, Bitcoin has had a sideways week, raising concerns for investors that a price correction may be imminent.

Famous analyst Willy Woo shared his valuable insights, stating that ” Bitcoin’s SOPR peak indicates that the remainder of March will be a period of consolidation around the recent all-time high.”

Woo pointed out that when SOPR reached a similar peak in the past, Bitcoin experienced significant pullbacks, offering buying opportunities.

“Last time this happened was in Q4 2020, the buy opportunity on pullback was -17% and previously, in Q1 2017, it was -31%.” He noted and added that BTC would trade below $80,000 in March.

SOPR measures Bitcoin transaction profitability by comparing the selling price of Bitcoin to the price at which it was bought.

However, the balance on accumulation addresses has reached an all-time high and Bitcoin Exchange-Traded Funds (ETFs) are increasing their holdings.

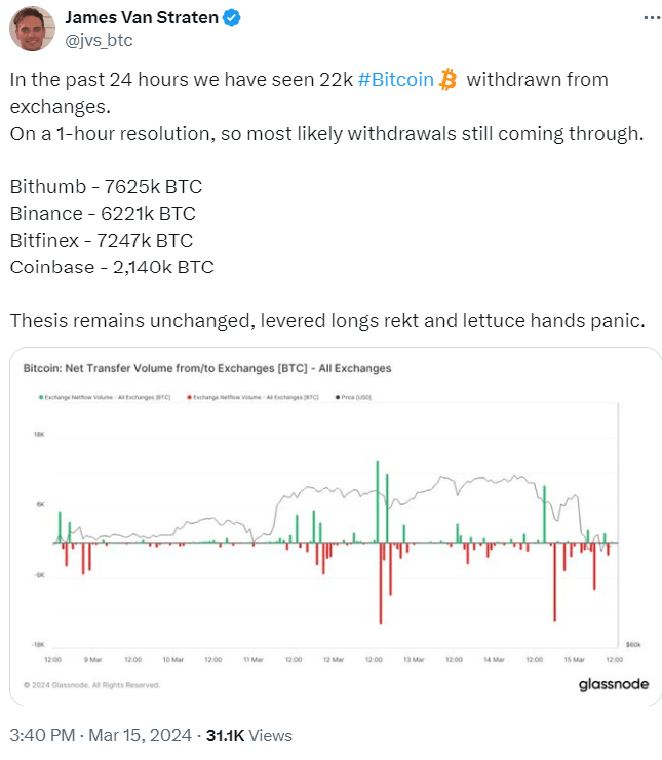

According to Glassnode data, over the past 48 hours, around 22,000 Bitcoin has been withdrawn from exchanges, indicating investors’ preference to hold rather than sell.

In a Saturday tweet, analyst Ash Crypto emphasized important support and resistance levels for Bitcoin. According to the expert, Bitcoin’s first support level based on the 0.236 Fib ratio is $65,461, where a bounce occurred.

He told his 1 million followers on X that Bitcoin could continue to oscillate around this level until the Federal Open Market Committee (FOMC) meeting on March 20. The analyst identified the next support level at the 0.382 Fib ratio, at $60,318, while highlighting the golden ratio at 0.618, at $52,000.