The VN-Index witnessed a volatile trading week. Although the index increased compared to the previous week, it fluctuated significantly due to various influencing factors. The move by the State Bank of Vietnam (SBV) to resume bond auctions after a 4-month pause to regulate exchange rates triggered negative investor sentiment, causing the market to drop by nearly 12 points in the first session of the week. However, subsequent buying pressure helped the index recover for 2 consecutive sessions before market volatility caused a downward adjustment towards the end of the week.

The VN-Index ended the week up 1.3% to 1,263.78 points, with improved liquidity as the trading value on the 3 exchanges reached VND 30,135 billion per session. Foreign investors continued to sell with a total value of over VND 2,800 billion across all three exchanges.

Regarding the stock market outlook for the upcoming week, most experts maintain a relatively cautious stance. The short-term upward trend has not been completely broken, but the pressure for correction is gradually increasing. Investors can still hold stocks with solid fundamentals while limiting chasing during market rallies and controlling the use of margin.

Waiting ahead of the FED meeting, the range of 1.280-1.300 points could be the peak of the first half of 2024

Analyzing the current context, Mr. Bui Van Huy – Director of Ho Chi Minh City Branch, DSC Securities believes that there have not been any major risks yet, but the market is gradually acknowledging more negative factors. Currently, the global stock market is in a sensitive area as the upward momentum of stock markets is slowing down due to overbought signals and waiting for the FED meeting next week. The US CPI for February continued to rise sharply and US government bond yields rebounded significantly, these are important signals to take note of. The FED meeting on 20-21 March will have a significant impact on asset markets.

Domestically, there are still positive fundamental factors such as low interest rates and economic recovery, as well as the story of market upgrade. However, negative factors are gradually appearing. This relates to exchange rates and the trend of increasing bond yields. The domestic market next week may trade with caution, observing global market movements.

The strong selling trend of foreign investors in the past 2 weeks, according to Mr. Huy, is an understandable negative trend. On the other hand, domestic investor sentiment has become more neutral, with excitement on one hand, but profit-taking and defensive sentiment emerging as risks gradually appear.

“Next week’s trading will be extremely important with many notable events. New risk factors are gradually emerging, and they are not too negative yet, but I tend to believe that the market will face pressure next week. The current resistance level of the VN-Index is around 1.280-1.300 points; meanwhile, the important support level is around 1.235-1.240 points. If VN-Index breaks below this support level, then the next support level will be around 1.160-1.180 points“, Mr. Huy commented.

Mr. Huy maintains the view that there is a high probability that the range of 1.280-1.300 points could be the peak of Q1/2024 as well as the first half of the year. The probability of the market breaking out above 1.300 points is lower.

Regarding the impact of the SBV’s bond issuance, experts believe that there is no direct impact on liquidity and the stock market as these two markets are separate. However, understanding the reasons behind the SBV’s decisions will explain the impact. As in the period of September-October 2023, the drain of money caused a sharp drop in the stock market.

According to Mr. Huy, this time’s decision to drain money, if considered specifically from the perspective of exchange rate management, is a correct decision as the exchange rate has been under pressure since last year. The SBV’s actions are also reasonable, as a proactive step. If the FED takes tough actions on monetary policy and the US Dollar strengthens accordingly, the SBV has already taken reactive actions, has room for further measures, and is in a more proactive position to respond. Conversely, in a negative scenario, they may continue to drain money, but the proactive drain will not cause market panic. If the FED’s direction becomes less hawkish and stabilizes global markets, the SBV may stop draining and gradually inject the drained money back into the system.

From the above actions, it can be seen that not only domestic investors but also global markets and regulatory agencies are still eagerly awaiting this FED meeting. It can be said that this FED meeting is of utmost importance.

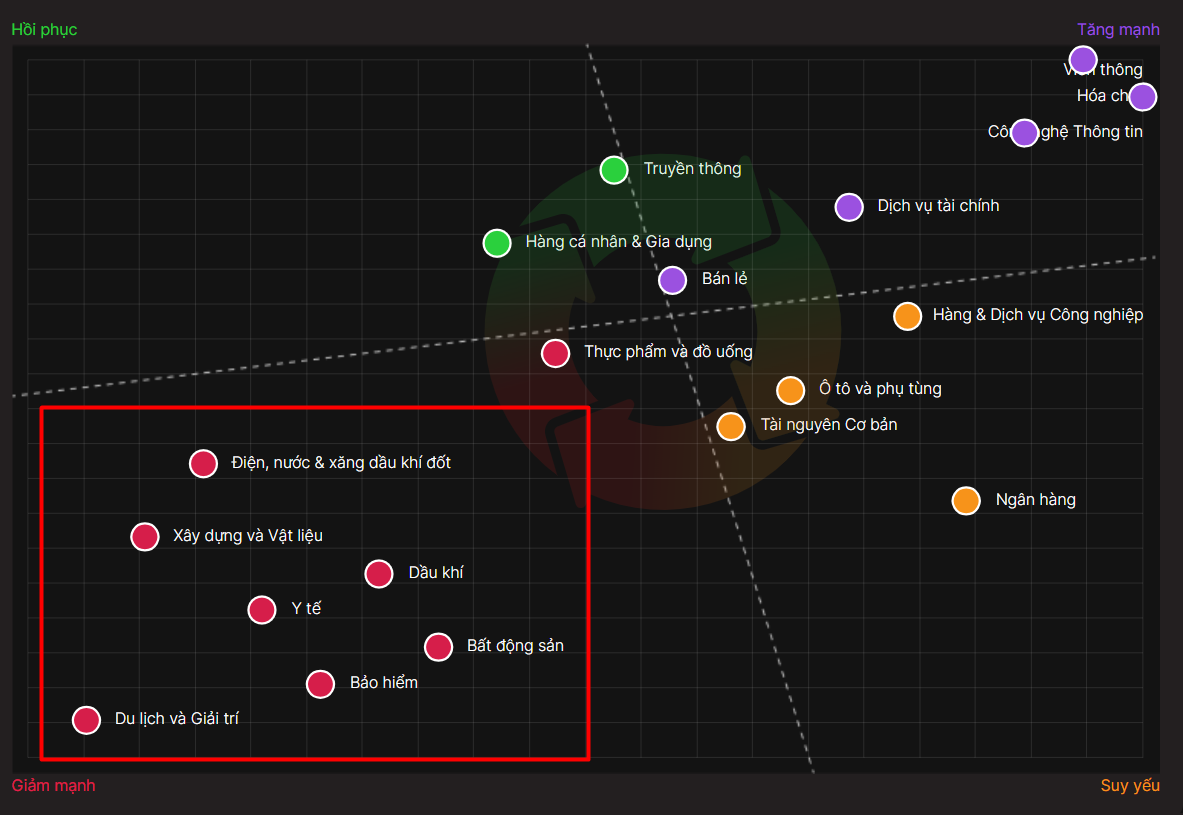

The Director of DSC recommends that short-term investors may reduce exposure as more signs of weakness appear. The probability of a breakout is lower than the probability of the market entering a correction phase. Regarding sector rotation, Mr. Huy believes that at this stage, funds are likely to flow into sectors that have not seen much recent gains and are weaker than the overall market, such as real estate, electricity, petroleum, gas, and oil. Meanwhile, sectors that have experienced strong gains will face clearer selling pressure, especially sectors that have weakened such as banking and basic resources.

DSC’s sector rotation

Risk of a double top pattern will be considered if the support level of 1.250 points is breached

According to Mr. Nguyen Anh Khoa, Head of Analysis – Research Department at Agriseco Securities, the stock market will continue to experience ups and downs with a wide range during the coming week before a clearer trend emerges as the range of 1.280-1.300 points is considered a strong resistance level for the VN-Index. Additionally, momentum indicators are showing signs of weakness, indicating that the index needs time to consolidate if it wants to continue the upward trend. The risk of setting up a double top pattern can only be truly considered if the significant support level of 1.250 points is broken.

Regarding the impact of strong selling by foreign investors last week, Mr. Khoa assesses that most of it came from ETFs rebalancing their investment portfolios. This is a regular trading activity and has been pre-announced, so it is considered to have a negligible impact on the market.

“The trend of net selling by foreign investors has been going on for many months and there are no signs of a swift reversal. Forecasting the exact time when foreign investors will stop selling does not make much sense because ever since the end of 2023, the stock market has continued to show positive developments despite aggressive net selling by foreign investors“, said Mr. Khoa.

Agriseco Research recommends that investors continue to hold the positions they have opened in recent times, limit trading during exuberant rallies, and use margin cautiously. Maintaining a cash balance of around 30% is considered appropriate for waiting for new investment opportunities when market corrections appear, as the long-term and mid-term upward trends of the index are still dominant.

There are some noteworthy sectors that are expected to continue attracting capital in the coming period, including the banking, seafood, garment, and logistics sectors.

Cautious ahead of the FED meeting

According to the perspective of Mr. Dinh Quang Hinh, Head of Macro and Market Strategy Department at VNDirect Securities, the stock market is heading towards an important trading week as the Fed will have a monetary policy meeting on 19-20 March and the VN-Index may “test” the resistance level around 1,280 points.

Mr. Hinh said the market is expecting new insights into the future direction of the Fed, specifically the expected start time for interest rate cuts and the expected extent of cuts this year. If the Fed’s scenario is not too hawkish compared to the market’s previous expectations (starting rate cuts from Q2/2024 and at least 3 rate cuts in 2024), it is fully possible to expect a positive reaction from financial markets worldwide.

Returning to domestic issues, the stock market’s reaction to the bond issuance is not too negative because the current market has more supporting factors than when authorities made similar moves last year, including a clearer economic recovery outlook, positive 1Q financial results, and strong domestic liquidity supported by a low-interest-rate environment and the expectation of market upgrades.

In general, the market’s upward trend since the beginning of the year has not been compromised and the VN-Index can retest the resistance level around 1,280 points next week. VNDirect experts recommend investors to continue holding stocks, focus on allocating capital to stocks with supportive fundamental factors such as securities, consumer goods, exports, and industrial real estate.