On the international market, the USD-Index increased by 0.71 points compared to the previous week, reaching 103.45 points.

The price of USD increased sharply after a deep decline due to the accelerating inflation in the US in February 2024. This has made the Federal Reserve have to wait longer before deciding to lower interest rates.

According to a new report released by the US Bureau of Labor Statistics, the Consumer Price Index (CPI) has increased by 0.4% compared to the previous month, in line with forecasts. However, compared to the same period last year, the US CPI increased by 3.2%, surpassing the experts’ forecast of 3.1% and also exceeding the 3.1% mark in January 2024.

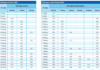

Source: SBV

|

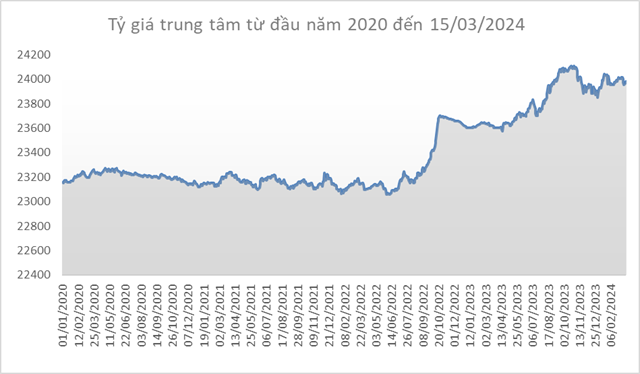

Locally, the central exchange rate between the Vietnamese dong and USD decreased by 17 dong/USD compared to the previous week (session on 08/03), down to 23,979 dong/USD in the session on 15/03.

The State Bank of Vietnam (SBV) maintained the spot purchase rate unchanged at 23,400 dong/USD. Meanwhile, the operating banks reduced the spot selling rate by 18 dong/USD compared to the day of 08/03, down to 25,127 dong/USD.

Source: VCB

|

In contrast to the central exchange rate, the quoted exchange rate at Vietcombank increased by 50 dong/USD in both directions, reaching 24,520 dong/USD (buying) and 24,890 dong/USD (selling). With this level, the USD price at the bank is still 352 dong/USD higher in the buying direction and has exceeded 18 dong/USD in the selling direction compared to the historical peak set in 2022.

Source: VietstockFinance

|