The beginning of the trading session on March 18 left investors with negative sentiments. The market experienced a deep decline as hundreds of stocks sank into the red. VN-Index dropped nearly 30 points, approaching the 1,230 level, amidst widespread selling pressure, especially in large-cap stocks.

The market saw a recovery as demand bottomed out due to stocks hitting the floor price. This helped narrow the main index’s significant decline. At the close, VN-Index decreased over 20 points to 1,243.56, equivalent to a 1.6% decrease; HNX-Index dropped 2.86 points (1.19%) to 236.68 points, while UPCoM-Index slipped 1.03 points (1.13%) to 90.32 points.

With VN-Index’s decline came the “disappearance” of over VND 82,000 billion in HOSE market capitalization, remaining at nearly VND 5.1 million billion.

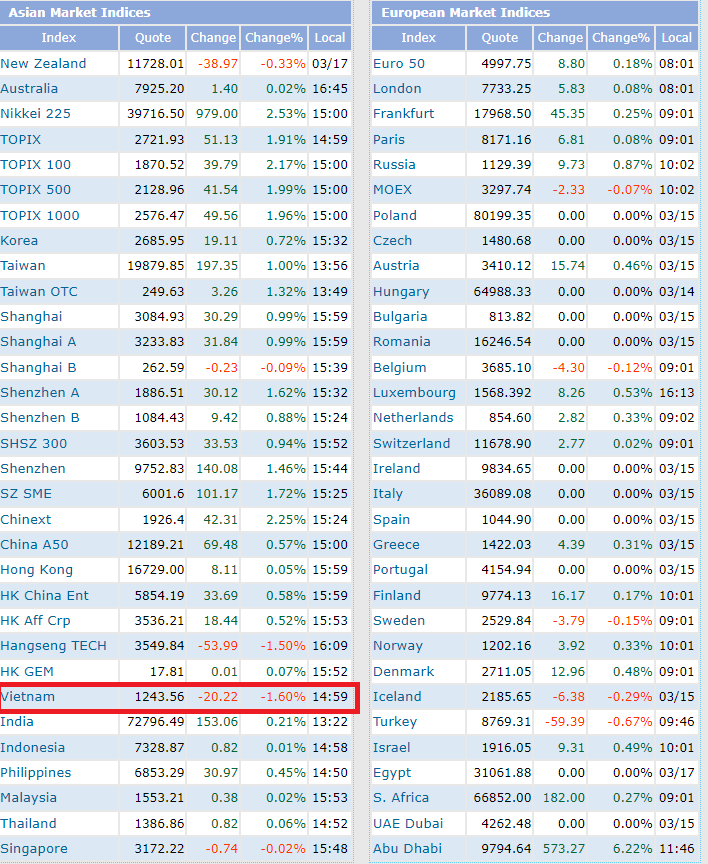

The 1.6% decrease of VN-Index also made Vietnam’s stock market the strongest declining market in Asia during the March 18 session, going against the trend in major stock markets such as Japan, South Korea, etc.

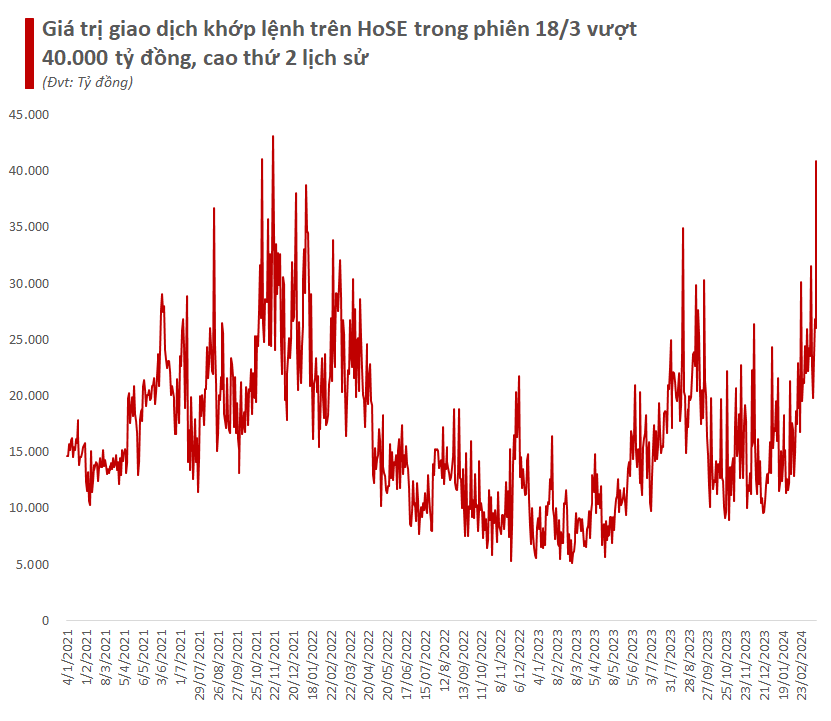

In particular, on a day when the market lost tens of thousands of billion of VND in market capitalization, a large amount of money poured into the market, helping the value of transactions on all three exchanges exceed VND 47,900 billion (USD 2 billion).

On HoSE alone, the value of matched trading exceeded VND 40,000 billion, rising nearly VND 23,000 billion compared to the previous session. This liquidity level was the second highest in the 23-year history of Vietnam’s stock market, second only to the record set in the November 19, 2021 session of VND 44,800 billion.

The trading volume also soared with over 1.6 billion shares matched during the session, the second highest in history after the August 18, 2023 session (1.65 billion shares).

In terms of individual stocks, DIG stock topped both trading volume and value with nearly 79 million shares and about VND 2,360 billion. This was also a booming trading session for this real estate stock as the price reversed and hit the daily limit increase of 6.8% to VND 30,450 per share, despite the overall market downturn. DIG has increased 14% in price compared to the beginning of 2024.

Following DIG were SSI securities, DGC chemical stock, and “national” stock HPG in terms of trading value. However, the price development of these stocks all declined significantly, with DGC even falling to the floor price of VND 118,200 per share.

In terms of trading volume, lower-cap stocks VIX and VND still dominated the top positions, along with HPG and SSI recording a trading volume of about 50 million shares.

In the fiery red session, foreign investors continued to create additional pressures with a net selling value of nearly VND 950 billion on HoSE, of which the selling value was approximately VND 4,200 billion, mainly concentrated in FUEVFVND, VHM, DGC, VPB, etc.