On March 18th, Hoa Sen Group (HOSE: HSG) held its annual general meeting for 2024, presenting several important plans to shareholders.

Hoa Sen Group is currently borrowing at an average interest rate of 2.1% per year

Speaking at the annual general meeting in 2024, Chairman Le Phuoc Vu stated that if the company can make a profit of 1 billion dong in the 2023 fiscal year, it would be considered a success and worthy of rewarding the management board, as the company incurred a loss of 800 billion dong in the first quarter

Mr. Vu explained that this is completely objective as Hoa Sen is both an importer, manufacturer, distributor, and exporter, so inventory must always be maintained for 4 months. In the first quarter of 2023, raw material prices dropped from $1,000 to $500. With 4 months of inventory, an 800 billion dong loss is natural

In the last three quarters, prices continued to fluctuate due to the weakening of both the domestic and export markets. Therefore, Hoa Sen making a profit of 30 billion dong is a remarkable effort by the management board

As a result, the retained profit as of the end of 2023 is over 4,400 billion dong, with a positive cash flow of over 1,000 billion dong and no medium or long-term debt. Chairman Le Phuoc Vu believes that if HSG were to suddenly close and cease operations, there would still be enough money to repay the bank debts

With such a financial situation, HSG has had access to low-cost capital from international financial institutions at a cost of 2.3% with a 4-month term

If HSG is unable to generate good cash flow, it would not be able to access such cheap loans, considering the current complex political situation in the world, including warnings of a third world war, added the Chairman of HSG

Chairman of Hoa Sen Group – Mr. Le Phuoc Vu

Mr. Vu also added that the company’s credit limit is currently at 17,000 – 18,000 billion dong, with an average interest rate of 2.1% per year. Hoa Sen respects financial institutions, so it does not borrow money and then deposit it at banks to enjoy the interest rate difference of 4-5%

Although the financial situation of the company is favorable, Mr. Vu also mentioned that: We should not be complacent and should be more defensive. The shareholder’s money still has over 4,000 billion dong of retained profit. If this is kept, it will create value for the shareholders in the future, and a strong internal force will create value for the shareholders in the future

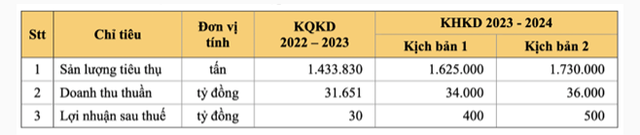

Hoa Sen’s capital utilization situation and forecast

Mr. Tran Ngoc Chu, Deputy Chairman of the Standing Board of Directors, stated that the expected debt would be maintained below 3,000 billion dong. This year, Hoa Sen is expected to make a profit of at least 400 – 500 billion dong. Nearly 100 billion dong is depreciated each month. Up to now, Hoa Sen has made a profit of 400 billion dong. Average monthly revenue is 3,000 billion dong

Annual general meeting of shareholders of Hoa Sen Corporation 2023-2024

This leader informed that the current debt has increased to 5,000 billion dong, but it is only for the moment, as the orders arrived early, causing inventory to increase. Under normal circumstances, Hoa Sen’s debt is only 3,000 billion dong, with an average interest rate of 2.1% per year

“I affirm that no enterprise has access to such a cheap capital source. Our cash flow is positive every year. Up to this month, profit is below 400 billion dong. Cash flow this year is positive 1,500 billion dong“, Mr. Chu said at the meeting

Regarding business results, in the first quarter of the 2023-2024 fiscal year, Hoa Sen recorded net revenue of over 9,000 billion dong and net profit of over 103 billion dong, more positive than the heavy loss situation in the same period

For the fiscal year 2024, the steel market leader has built two business scenarios. In the most optimistic scenario, the Group expects to consume more than 1.73 million tons of products, achieve net revenue of 36,000 billion dong, and post-tax profit of 500 billion dong

In scenario 2, the consumption volume reaches 1.625 million tons, net revenue is 34,000 billion dong, and post-tax profit is 400 billion dong