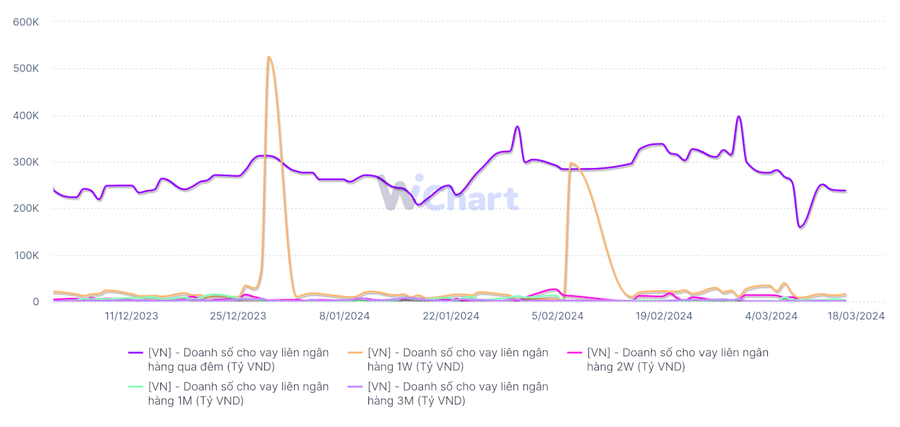

From March 11 to 15, the State Bank of Vietnam regularly withdrew money through the 28-day treasury bill channel, with a value of approximately 15,000 trillion VND per session and an interest rate of 1.4%. This attracted participation from fewer than 10 market members per session. In total, the State Bank of Vietnam withdrew a net amount of 75,000 trillion VND over the course of 5 sessions.

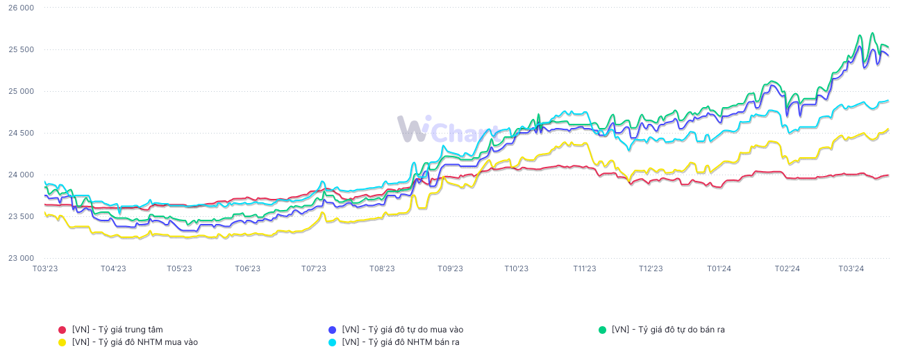

This move by the State Bank of Vietnam comes as the free market exchange rate and commercial bank exchange rate have been rising since the beginning of March.

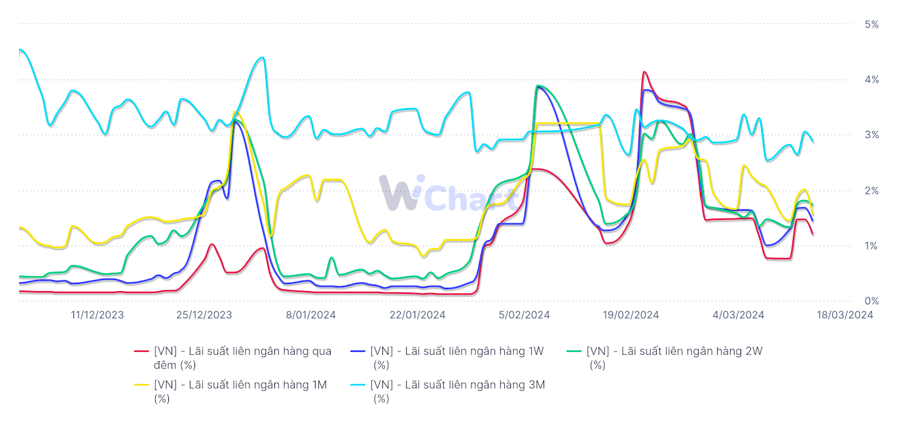

After the State Bank of Vietnam initiated the money withdrawal on March 11, the overnight VND interest rate almost doubled from 0.71% to 1.47% per annum on March 13. The 1-week VND interest rate increased from 1.29% per annum on March 11 to 1.68% per annum on March 13. Similarly, the 2-week interest rate increased from 1.33% to 1.81%.

However, on March 14, the VND interbank interest rates for short terms showed a slight decrease compared to March 13. Specifically, the overnight rate was 1.21% per annum, the 1-week rate was 1.45% per annum, and the 2-week rate was 1.74% per annum.

The VND interbank interest rates for the 1-month and 3-month terms fluctuated less than the short terms.

From March 18 to 22, the global foreign exchange market is awaiting policy decisions from major central banks such as the US Federal Reserve (Fed) and the Bank of Japan (BOJ).

Higher-than-expected consumer price and production data from the US last week have caused economists to lower their expectations of a rate cut by the Fed this year.

All attention is now focused on the Fed’s meeting this week in search of any signals regarding the central bank’s interest rate cut prospects, the US economic recovery process, and inflation expectations.

Earlier this month, Fed Chairman Jerome Powell said that Fed members “are more confident that inflation is progressing sustainably” towards the central bank’s 2% target, but they want more evidence that inflation is slowing before starting to cut interest rates.

The BOJ’s meeting on Tuesday (March 19) could be one of the most impactful meetings in many years as officials decide whether to end the negative interest rate policy after 8 years, a turning point for the country’s massive stimulus program.

The market has high expectations for this possibility as the country’s largest companies have just agreed with labor unions to raise wages to the highest level in 33 years in annual wage negotiations. In addition, the market is also paying attention to any signals that the BOJ may give regarding the pace of interest rate increases in the second half of this year.

The central mid-rate is currently at 23,979 VND/USD, a decrease of 17 VND compared to the previous week. However, the USD/VND exchange rate on the interbank market increased by 75 VND during the week, closing at nearly 24,720.

During the previous week, the exchange rate on the free market decreased by 20 VND for buying and increased by 140 VND for selling.

Today (March 18), the central bank’s exchange rate increased by 15 VND/USD compared to March 15, reaching 23,994 VND/USD. With the +/- 5% band as regulated, the floor exchange rate is 22,794 VND/USD and the ceiling exchange rate is 25,195 VND/USD.

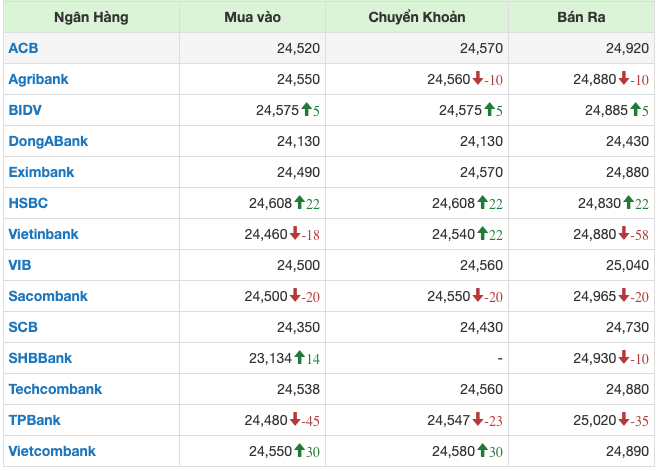

The USD exchange rate at commercial banks has seen inconsistent movements. Vietcombank quotes buying and selling rates at 24,550 – 24,890 VND/USD, with a 30 VND increase in buying and unchanged selling compared to the previous week’s closing price.

BIDV quotes buying and selling rates at 24,575 – 24,885 VND/USD, with a 5 VND increase in both buying and selling compared to the previous session.

ACB’s Financial Market Division predicts that the exchange rate will continue to rise this week, with a target range of 24,750 – 24,800 VND/USD.