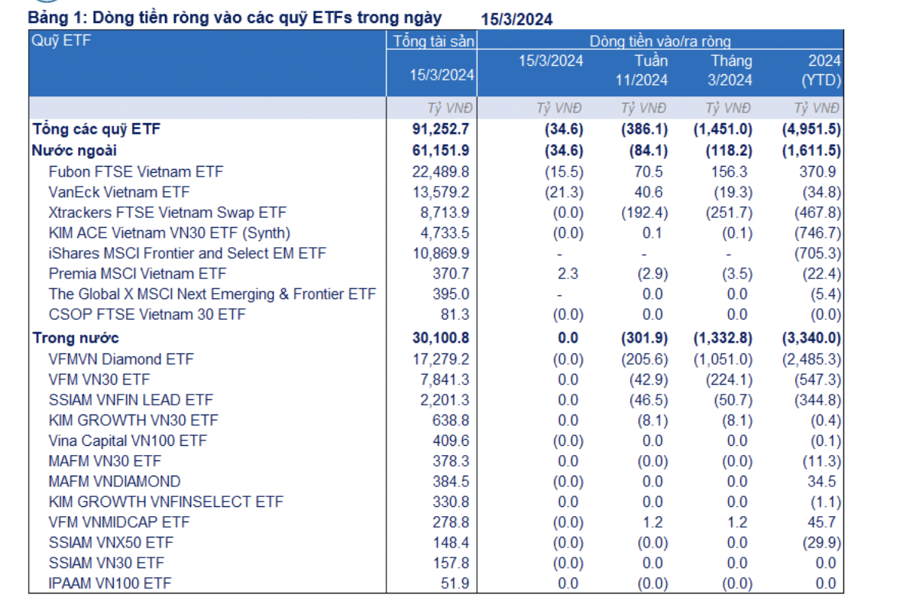

During the week of March 11th to March 15th, 2024, the outflow of money from ETF funds continued with over 386 billion VND ($16.6 million) and this is the 5th consecutive week of outflows, but the outflow size decreased. This trend is observed in 9 out of 20 ETF funds, both domestic and foreign ETFs.

Thus, since the beginning of 2024, the total outflow from ETF funds is 4,951 billion VND ($213.1 million).

Specifically, foreign ETF funds continued to have net outflows of over 8.4 billion VND ($362,600), mainly from the Xtrackers FTSE Vietnam Swap ETF with a net outflow value of over 19.2 billion VND ($827,100). On the other hand, Fubon FTSE Vietnam ETF and VanEck Vietnam ETF had net inflows of over 7 billion VND ($301,900) and 4 billion VND ($172,500) respectively.

Domestic ETF funds also had strong net outflows of over 301 billion VND ($12.9 million), with the two funds managed by Dragon Capital, VFM VNDiamond ETF (-205 billion VND) and VFM VN30 ETF (-42 billion VND), showing the highest outflows. In addition, SSIAM VNFIN LEAD ETF also recorded net outflows of over 46 billion VND ($1.9 million).

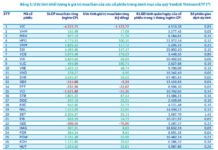

On March 18th, 2024, Fubon FTSE Vietnam ETF had net outflows of 30 billion VND ($1.3 million). However, the fund made strong net purchases of STB shares (4.2 million shares), EIB shares (4 million shares), PDR shares (3.1 million shares), and FRT shares (966 thousand shares) in its investment portfolio. Meanwhile, VFM VN30 ETF had no significant changes in net cash flows.

The most sold stocks in the past week include HPG, SBT, VCB, MSN, VNM, SSI, VRE, DGC, VND, VJC….

According to BSC’s statistics, the Banking and Real Estate sectors are the two main sectors in the portfolio composition of large ETFs investing in the market. For domestic ETFs, the Banking sector has the largest weighting, while the Real Estate sector has the largest allocation in foreign ETFs.

This clearly reflects the impact and market capitalization of the Banking and Real Estate sectors in the Vietnamese stock market – these two sectors account for 52.2% of the total market capitalization on HOSE and HNX exchanges, with the Banking sector accounting for 35.46% (~1.7 quadrillion VND) of market capitalization (as of December 31st, 2023).

According to BSC’s assessment, the ETF market continues to attract new investment funds both domestically and internationally with an increasing number of funds each year. Especially, in the case that Vietnam is upgraded to a secondary emerging market by FTSE in 2024-2025, ETF funds will continue to develop strongly in the future – especially the capital flows from foreign ETFs that track the FTSE index.

BSC Research provides two scenarios for foreign capital and ETFs in 2024: in the positive scenario, foreign capital will increase by 700 million USD with supporting factors including the gradual narrowing of the interest rate spread between USD and VND as the Fed begins to reduce interest rates; Progress in the upgrading of a new emerging market by FTSE is seen as positive; Thai investors gradually become active again after the new tax regulation takes effect on January 1st, 2024.

The total foreign capital and cash flow into ETFs in the positive scenario is 1 billion USD.

In addition, there is a transition and attraction of new capital flows for newly listed domestic ETFs on the market, specifically: ETFs referencing the VN-Diamond index (CTQLQ Mirae, Bảo Việt), FinSelect ETF (CTQLQ Kim Quản Lý). ETFs by Fubon, FTSE, and Vaneck are not expected to have significant movements, the expectation for foreign ETFs comes from new ETF funds as the upgrading issue shows positive trends.