According to the indictment, Tan Hoang Minh Hotel Service Trading Company Limited (abbreviated as Tan Hoang Minh Group) was established in 1993 with a charter capital of VND 10,000 billion. To expand its business scope, Do Anh Dung has established 45 additional companies, including Viet Star Real Estate Investment Company Limited, Soleil Hotel Investment and Service Joint Stock Company, and Winter Palace Joint Stock Company.

These companies were either newly established or acquired shares and capital in other companies, and then designated relatives or related individuals or entities to contribute capital and own shares.

LEGALIZATION OF BOND ISSUANCE FILE

As determined by the investigation, from June 2021 to March 2022, Dung directed some employees to carry out fraudulent acts in legitimizing the issuance plan of 9 separate corporate bond packages; creating the buying and selling of bonds by running “fake” cash flows, thereby creating “virtual” bond values, legitimizing the change of bondowners to Tan Hoang Minh Company, and then selling and misappropriating over VND 8,643 billion. The number of victims identified is over 6,600.

The indictment shows that at the beginning of 2021, Tan Hoang Minh Group faced difficulties in business and investment activities. To have financial sources, Dung directed Do Hoang Viet, Deputy General Director in charge of finance, to seek options and methods to mobilize capital for the group.

After reaching an agreement, Tan Hoang Minh Group issued privately placed corporate bonds, non-convertible, not accompanied by warrants, and secured by assets.

According to the regulations at point b, d, clause 1, Article 9 and point b, clause 4, Article 12 of Decree 153/2020/ND-CP dated December 31, 20220, which stipulate the conditions, documents for bond offering by enterprises must meet: “… payment of all due debts in the 3 consecutive years prior to the issuance (if any); having the audited financial statements of the immediately preceding year of the issuance audited by qualified audit organizations …”.

The indictment shows that the defendants modified the financial statements of Viet Star Company, Soleil Company, and Winter Palace Company regarding financial indicators, debts, falsified revenue recognition…

The defendant Phung The Tinh (Director of the Financial Accounting Center, Director of the Finance Accounting Board) contacted Bui Thi Ngoc Lan, Director of Nam Viet Financial Consulting and Accounting Company Limited and South Viet Financial Consulting and Accounting Company Limited to conduct the audit of the 2020 financial statements of Viet Star Company, Soleil Company, and Le Van Do, Director of Hanoi Accounting and Auditing Company Limited, to audit the 2020 financial statements of Winter Palace Company.

The auditing firms issued an “unqualified” opinion in the fastest time possible to serve the purpose of bond issuance for Tan Hoang Minh Company. In December 2021, Phung The Tinh resigned, so Hoang Quyet Trien continued to exchange and agree with Do to carry out the 2021 audit report of Winter Palace Company.

During the auditing process, the auditors did not comply with the regulations of Vietnam Audit Standards, many main items were not reviewed or lacked audit evidence, but they still signed off on the issuance of independent audit reports with an “unqualified” opinion.

According to the indictment, the defendants Le Van Do, Phan Anh Hung, Deputy Director of CPA Hanoi Company; Nguyen Thi Hai, Deputy General Director cum Head of the auditing team of CPA Hanoi Company legitimately issued audit reports to create conditions for Tan Hoang Minh Group to create deception in bond issuance.

In addition, the asset valuation firms also did not comply with item 1, item 4, Section II of Vietnam Valuation Standards No. 05.

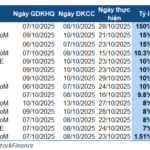

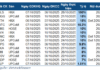

After completing the file, the defendants Nguyen Manh Hung, Tran Hong Son, and Nguyen Khoa Duc representing Viet Star Company, Soleil Company, and Winter Palace Company signed and submitted documents to the Hanoi Stock Exchange to announce the sale of 9 separate corporate bond packages, with a total issuance value of VND 10,030 billion.

To legalize Tan Hoang Minh Company as the primary bondowner, from July 5, 2021, to March 4, 2022, Do Anh Dung authorized individuals under his command to sign “fake” contracts to repurchase the issued bond packages.

To widely sell bonds to the people, bypassing the provisions at point a, clause 1, Article 8 of Decree 153/2020/ND-CP (regarding bond buyers being professional securities investors), Dung established the Bond Business Center under Tan Hoang Minh and authorized subordinates and 21 individuals at companies within Tan Hoang Minh Group to sign investment cooperation contracts for bonds, collecting over VND 13,972 billion. The collected money was used up, not in accordance with the purpose, and the issuance plan.

To sell bonds to individuals, Dung created a “fake” process of selling bonds through the establishment of companies in Tan Hoang Minh Group. They signed “fake” economic contracts (investment cooperation, deposit, share purchase) between the issuing company and companies or individuals within Tan Hoang Minh Group to legitimize the bond issuance process.

The investigation agency determined that they must follow the instructions of the leaders; they did not participate in discussions, did not know the bond issuance procedures were fabricated and legitimized, and did not have the right to manage and operate the companies, so it is appropriate to recommend administrative handling instead of criminal liability.

Similarly, other individuals authorized by Dung to sign documents and files in bond trading contracts, deposits, payment confirmation, contract liquidation with investors; acting as legal entities or shareholders, contributed capital to companies, had the acts of signing procedures such as meeting minutes, resolutions, economic contracts to legitimize the bond issuance, public offering process.

The investigation results determined that they did not participate in the procedures, did not know about the fabricated procedures, the legitimate bond issuance, and did not have the right to manage and operate the companies, so recommending administrative handling is appropriate.

Individuals at other valuation firms, individuals at banks involved in signing contracts to provide asset management services and bond accounts did not have signs of agreement, agreement in violation of regulations, so they are not subject to criminal liability.