Stocks soar but shareholders are still struggling after 10 years

The skyrocketing effect of global oil prices at their highest level in 4 months and new developments in the super project “Lot B” have sparked the explosion of the oil and gas stock group. With high speculation based on oil price fluctuations, PVDrilling’s PVD shares have always been one of the hot names sought after by investors.

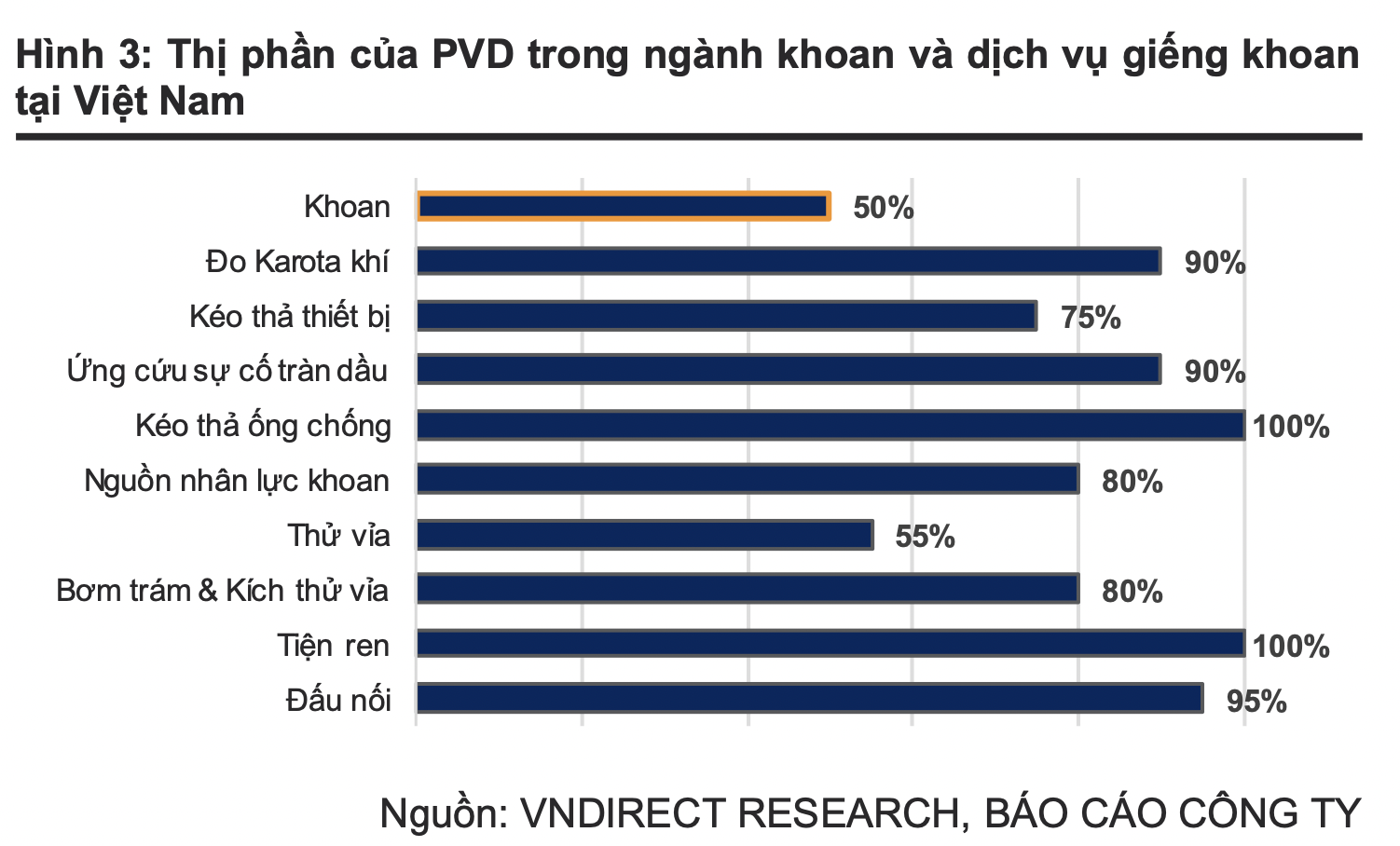

PVD is currently the leading Vietnamese market player in oil rig services. Not only holding its position domestically, PVDrilling is also known as the leading drilling contractor in Southeast Asia, operating in Malaysia, Indonesia, Brunei, Thailand, and Cambodia.

Looking back at the past, after its listing on HOSE in 2006, PVD shares have continuously surged along with the unprecedented rise of oil prices. Continuously conquering new heights, the “rookie” PVD caused a sensation when it quickly became one of the most expensive stocks on the stock exchange at that time.

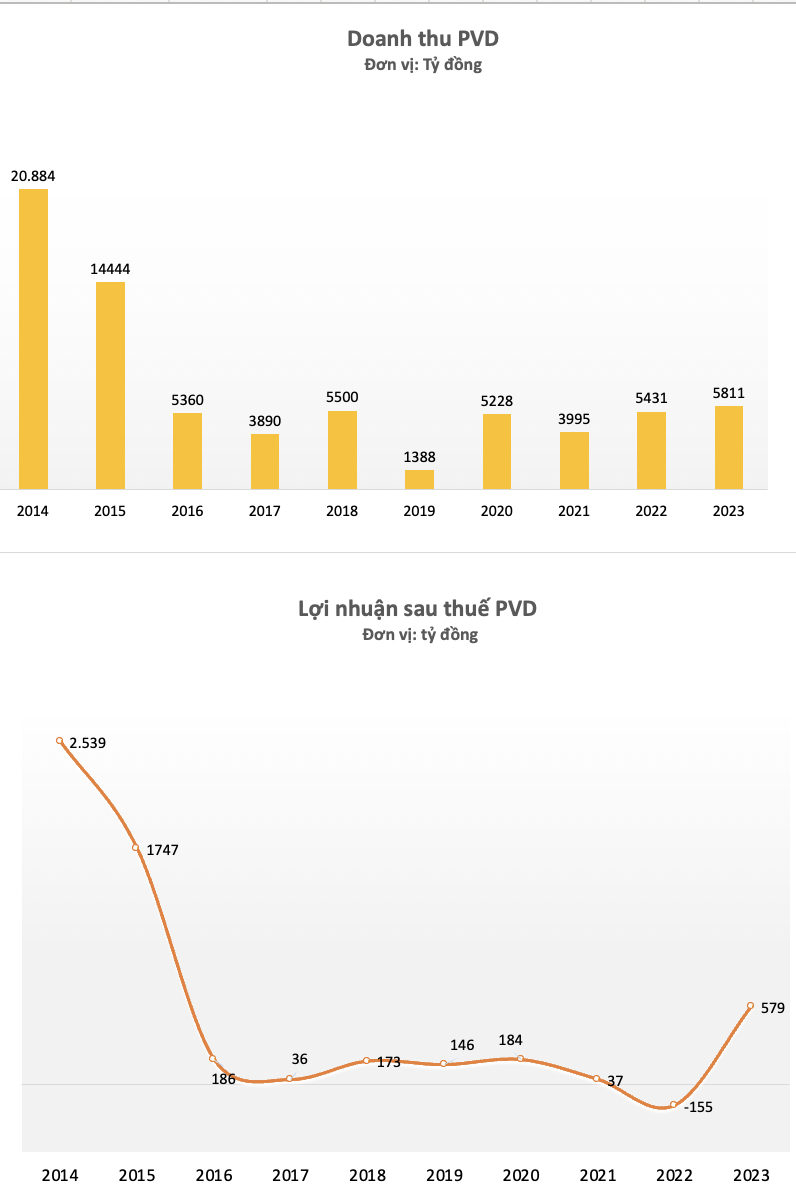

However, the wave of oil company stocks only began to rise strongly in 2014. At that time, the world economy stabilized after the 2008 crisis, and demand began to soar, pushing the oil price continuously above $100 per barrel, which in turn drove up rig rental prices. With historical revenues and profits of VND 20,884 billion and VND 2,539 billion respectively, PVD shares skyrocketed to a historical peak of over VND 53,000 per share (adjusted price due to additional share issuance).

However, the joy was short-lived, as the 60% free fall in oil prices in 2015 blew away all achievements, resulting in a significant decline in PVDrilling’s business performance. At that time, 3 out of 5 of the company’s rigs were “unemployed”, and revenues and profits in 2015 both decreased by over 30% compared to the same period. PVD shares also plummeted, losing more than 70% in less than a year from its peak.

After many ups and downs, PVDrilling seemed to regain its feet, but the ups and downs of oil prices kept the PVD shares struggling at the nominal value. It even reached a low point of VND 5,000 per share in March 2020 when Brent crude oil prices plunged to $30 per barrel amidst a sharp drop in global oil demand due to the Covid punch.

When even patient investors found it difficult to endure, PVD quietly “reached the bottom and rose”. Despite continued fluctuations in oil prices, PVD shares have generally recovered strongly compared to before.

Returning to the present, PVD slightly adjusted to VND 32,800 per share on March 15 but still remained around the highest level in 9 years. Although the current price has increased “several times” compared to over a year ago, it can be seen that after more than a decade, investors who have been associated with PVD since its heyday in 2014 have not yet been able to recover, losing more than 38% of their value.

Potential in the long run

Although the stock has not yet regained its previous peak, the prospects for PVD are positively evaluated by analysts as oil prices remain high and the drilling market is expected to be more active due to the deployment of a series of projects, especially the Lot B project – O Mon project.

In reality, PVDrilling’s business outlook for 2023 is much brighter than the previous loss-making year. Revenues reached VND 5,800 billion, an increase of 7% compared to the previous year, and after-tax profits reached VND 541 billion, while in the same period last year, PVDrilling lost VND 155 billion. These are also the highest figures PVDrilling has achieved in 8 years since the “golden period” of 2011-2015 in the oil and gas industry.

In terms of oil price prospects, according to the January 2024 report by the US Energy Information Administration (EIA), oil prices are expected to remain above $85 per barrel in 2024. This will stimulate exploration and oil and gas exploitation activities, which is an opportunity for PVD to sign drilling contracts with good service prices.

Mirae Asset Vietnam Securities expects that the self-elevating rig rental price in Southeast Asia has reached $110,000 – $130,000 per day, an increase of over 25% compared to 2023.

The rig rental price in Southeast Asia is forecasted to remain high in 2024 due to the shortage of rig supply when some rigs are being withdrawn to serve the Middle East market, where drilling demand is booming. S&P Global market research predicts that the demand for self-elevating rigs will gradually return to normal levels in 2025.

Signing contracts to rent rigs at rates exceeding $100,000 per day will help PV Drilling achieve breakthrough profits, according to Mirae Asset Vietnam. It is worth noting that signing continuous contracts will reduce the time it takes to transport rigs between locations, thereby optimizing the utilization efficiency.

Under the current market conditions, Mirae Asset Vietnam predicts that PV Drilling’s full-year revenue in 2024 will reach VND 6,720 billion and net profit will reach VND 788 billion, increasing 15% and 46% respectively compared to the 2023 figures.

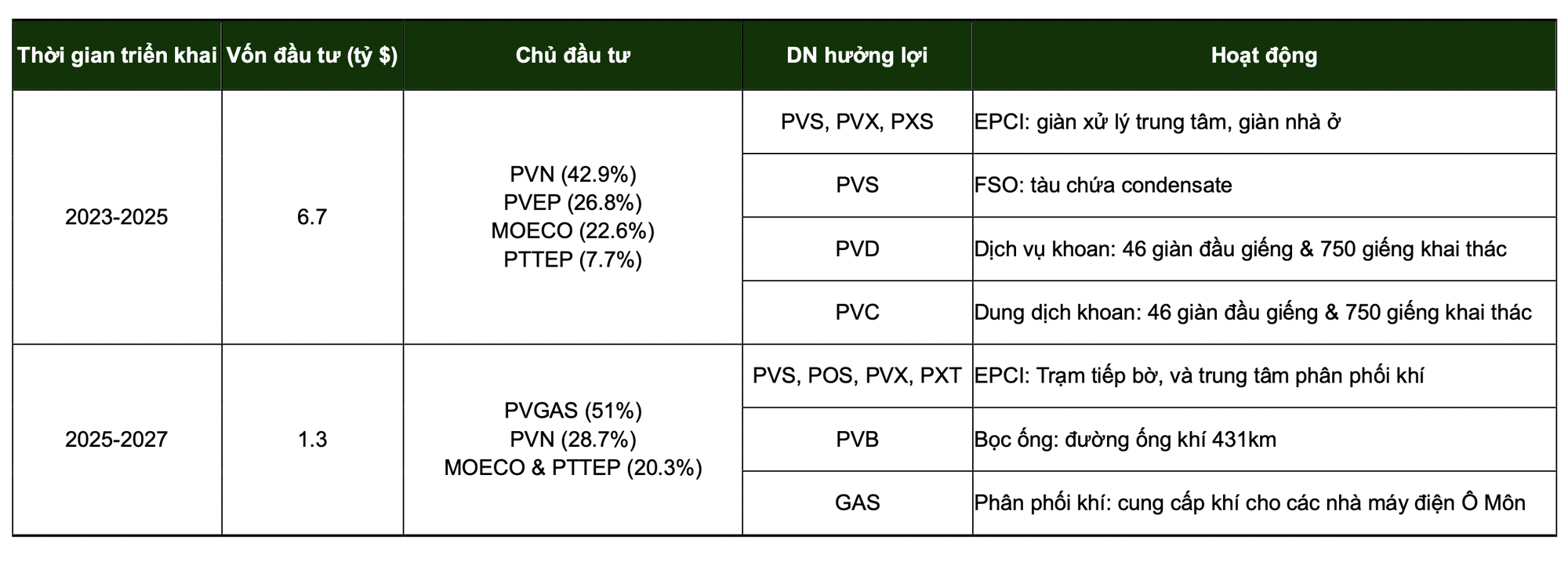

In the domestic market, there are currently about 13 rig bidding campaigns, but most of these drilling campaigns are relatively short. This year, the drilling market is expected to be more active with more consolidated drilling campaigns as some major projects are deployed, such as Lac Da Vang, Su Tu Trang 2B, and Lot B – O Mon.

Among them, the Lot B – O Mon project is being implemented to provide potential work volumes for PVD’s drilling and well technical services in the coming years. In a recent statement, Mr. Nguyen Xuan Cuong – General Director of PV Drilling assessed PV Drilling as one of the qualified contractors to participate in the drilling work for the Lot B – O Mon super project, expected to start producing the first gas flow (FG) in 2026.

According to the plan, the first phase of the Lot B project will drill more than 80 wells from 2025-2026 with a demand for 2 self-elevating rigs. In the following phases, additional production wells, about 911 wells, will need to be drilled from FG until the end of the project life cycle. Therefore, this project will ensure long-term work opportunities for PV Drilling’s rigs and well drilling technology in the domestic market.

“With the strategy to “continue to expand overseas,” currently all PV Drilling-owned rigs are providing services abroad with long-term contracts, including contracts that extend until 2028. Therefore, PV Drilling is deploying additional investments in rigs and specialized machinery and equipment to timely serve market demand, especially the Lot B – O Mon super project,” said the General Director of PV Drilling.