On March 17th, the Board of Directors of Vingroup (stock code: VIC) signed an agreement to sell up to 100% of the charter capital in SDI company – the unit that owns over 99% of the charter capital of Sado Trading and Business Joint Stock Company, a major shareholder of Vincom Retail. After this transaction is completed, SDI Company, Sado Company and Vincom Retail Company will no longer be subsidiaries of Vingroup.

Sado Trading and Business Joint Stock Company is currently the largest shareholder of this company, owning 943.2 million VRE shares, equivalent to 40.5% of the charter capital and 41.51% of the voting rights of this company.

Regarding this deal, Mr. Nguyen Viet Quang, CEO of Vingroup, said that this is the time to concentrate all resources to develop the strongest this corporation and its flagship brands, which have high growth potential. And to accomplish this mission, the company will devote all its efforts, especially financial resources, to create the momentum for breakthrough development in the next turning point.

A Vincom Retail shopping center.

This is not the first “high-profile” divestment deal of Vingroup in recent years. Specifically, in the context where VinFast is still a “money-burning” business segment, requiring a lot of capital without bringing profits, and real estate, which is still facing difficulties in the general market.

By the end of 2018, Vingroup announced its desire to become a world-class Technology-Industrial-Service Corporation, in which Technology accounts for the majority. Therefore, divesting from subsidiaries that are not aligned with this direction or closing inefficient business areas is almost mandatory for the conglomerate of billionaire Pham Nhat Vuong in order to raise capital.

Vingroup’s high-profile divestment deals

The first high-profile divestment deal of Vingroup was the sale of all shares of Vincom Securities (VincomSC). Specifically, from 2007 to 2008, when the Vietnamese stock market was at its peak, VN-Index continuously exceeded 1,000 points, Vingroup aspired to join the market with Vincom Finance Group (VFG) by initially establishing Vincom Securities Company (VincomSC) in 2007.

However, the global economic crisis that took place in 2008 caused Vingroup to announce the cancellation of its financial participation plan. As a result, billionaire Pham Nhat Vuong had to stop the plan to establish a financial group. By 2011, Vingroup sold all capital in VincomSC.

Currently, this company’s activity in the Vietnamese stock market with the name VIX Securities.

From 2009 to the present, Vingroup has opened and closed countless projects such as VinDS (a system of clothing and footwear stores in Vincom shopping centers), Vinlink, VinExpress (logistics sector), Emigo (VinFashion fashion company), Vinpearl Air (aviation)…

The next notable divestment deal that Vingroup made from the retail – e-commerce segment. At the end of 2019, the market was “shocked” by the news that Vingroup withdrew from the retail industry after a period of investment and development.

Specifically, Vingroup announced the decision to swap shares in VinCommerce Joint Stock Company, the unit that owns the VinMart supermarket chain and VinMart+ convenience stores, with Masan Group (stock code: MSN), officially saying goodbye to the retail segment. In addition, Vingroup also sold VinEco to Masan Group in this deal. At the time of parting, VinCommerce had been incurring losses for many years and was struggling to gain market share.

In addition to selling VinCommerce and VinEco to Masan Group, the company of billionaire Pham Nhat Vuong decided to close the VinPro electronics and technology store chain and the Adayroi e-commerce platform.

However, not all of Vingroup’s deals have been supported by many people. In particular, the decision of Vingroup to stop producing Vsmart phones and TVs has caused many consumers to have mixed reactions.

At the time of its launch, Vsmart was chosen by many consumers. From zero and by the end of 2020, Vsmart phones ranked 3rd in the domestic market with a market share of 12.7%. By the beginning of 2021, three models of AT&T-branded phones manufactured by VinSmart were officially launched in the US.

However, in May 2021, Vingroup announced the cessation of production of Vsmart phones and smart TVs. Mr. Nguyen Viet Quang, CEO of Vingroup, shared: “Producing smartphones or smart TVs no longer brings breakthrough potential or creates different values for users.” Together with the unsuccessful acquisition of LG’s factory, this became a factor that made Vingroup withdraw from this business segment.

However, VinSmart is still operating. The company has shifted its focus to developing smart features for VinFast vehicles and homes. The group’s goal is to develop smart-entertainment-service features for VinFast cars.

The most recent “notable” divestment deal is Vingroup’s withdrawal from One Mount Group. In mid-2022, Pham Nhat Vuong’s company transferred all shares in One Mount Group Joint Stock Company – a company established by the largest corporations in Vietnam including “Masan Group, Techcombank, and Vingroup.”

The main business of this company is agency, brokerage, and commodity auction. In addition, One Mount Group also engages in transportation, support services for transportation, real estate business, management consulting, advertising… Famous brands under One Mount include Vin ID, VinShop, and One Housing.

Specifically, Vin ID aspires to become a super personal assistant application, integrating various functions such as payments, home management, and shopping. One Housing is a platform serving buying, renting, and other related real estate services.

Meanwhile, VinShop is a platform that serves grocery stores at all stages, from shopping, transportation, store management, payment, to financial support, suppliers, with the potential to become a distribution channel for financial products and other services.

The ecosystem of One Mount.

Although Vingroup has divested from many business areas, as of December 31, 2023, it still owns a huge number of subsidiaries, totaling 110 companies. Among them, the corporation still owns famous brands such as Vinhomes (real estate), VinPearl (resort tourism), VinFast (industry), Vinmec (hospital), Vinschool (education), VinBrain (artificial intelligence)…

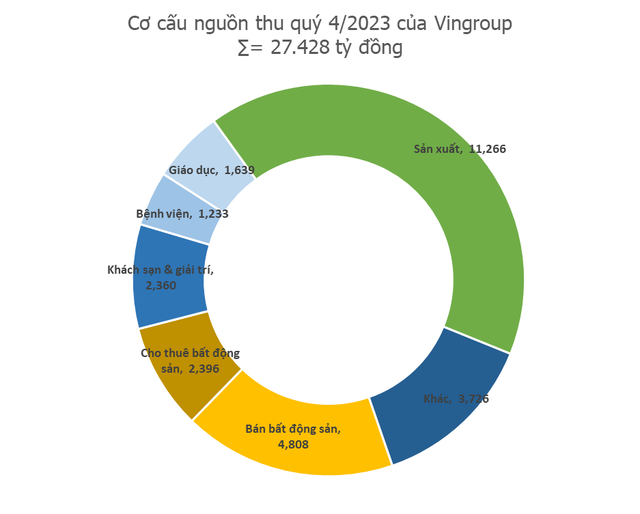

Investing heavily in the industry, although it costs a lot of money, has started to pay off for Vingroup. Specifically, the corporation recorded net revenue of 27,428 billion VND in the fourth quarter, a decrease of 34% compared to the same period.

In the net revenue structure, revenue from production activities accounted for the majority, bringing Vingroup 11,266 billion VND in the quarter, up 2.8 times compared to the same period. Meanwhile, revenue from real estate transfers sharply decreased by 84% compared to the same period to 4,808 billion VND. Rental real estate revenue brought in the third largest revenue with 2,396 billion VND.

This is the first quarter since VinFast has started commercial operations that Vingroup’s production activities have surpassed revenue from real estate business activities and become the main source of revenue for Vingroup.