The State Bank of Vietnam’s (SBV) decision to sell USD in an intervention to stabilize the exchange rate unexpectedly attracted a surge in demand, driving prices up significantly. However, it only turned out to be a temporary measure to draw in “bait” funds before a violent sell-off at the end of the day, despite rallies from foreign investors.

The VN-Index made a strong recovery, peaking around 2:50 PM, with its decline narrowing to just over 2 points. The market gave the impression of a remarkable rebound, but a wave of large-cap stock sell-offs then sent prices tumbling again. The index closed down 18.16 points, a 1.52% drop from the reference point.

Today’s recovery momentum was led by a handful of pillar stocks, mostly banks. BID surged by roughly 3.7% from the beginning of the afternoon session until around 2:00 PM. CTG gained over 4.6%, VNM rose 1.74%, and TCB climbed 2.76%… These are intraday fluctuations, but their impact on the index is no less significant. The VN-Index was pulled up from its low point, which was down over 27 points, to a loss of only 2 points.

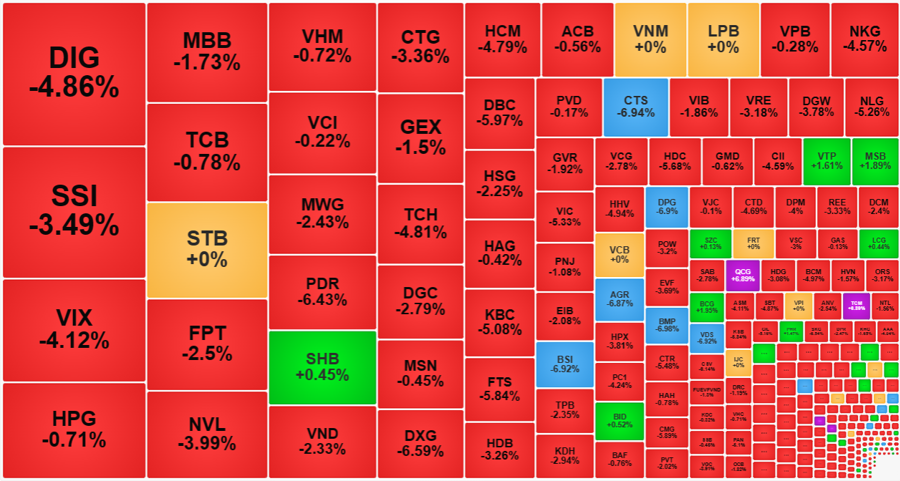

However, market breadth remained weak. Even when the VN-Index reached its highest point this afternoon, there were still 359 declining stocks compared to 134 gainers. Most other stocks recovered by reducing their losses. Since the rally was driven solely by pillar stocks, once they weakened, the market immediately reversed course. The sell-off in the final 30 minutes was quite strong, and even the pillar stocks could not hold up. CTG closed 3.36% lower, TCB dropped 0.78%, FPT fell 2.5%, and VIC notably lost 5.33%. The Vn30-Index also closed down 1.38%, with 2 gainers and 25 decliners.

The market began its downward spiral at precisely 2:00 PM, which is when securities companies often sell the stocks of margin-exceeded accounts to cover their positions. On the other hand, not all investors were optimistic about today’s recovery, and many likely wanted to take advantage of the reduced prices to cut their losses. The rapid decline in prices over the past few days has resulted in all bottom-fishing attempts ending in losses as soon as the stocks settled in accounts.

Traded value on both exchanges actually decreased slightly this afternoon by nearly 3% compared to the morning session, reaching only 12,339 billion VND. The HoSE dropped 1% to 11,187 billion VND. The lack of significant increase in liquidity was partly due to investors no longer being willing to chase prices. This signals a heightened risk aversion among those holding cash.

The VN-Index’s market breadth at the end of the session remained very weak, with only 90 gainers compared to 405 decliners. While the number of stocks falling was slightly lower than in the morning session (447 stocks), there were 17 stocks that hit their floor prices and 150 stocks that dropped by 2% or more. The extent of the losses was not significantly different from the morning, but the widespread bull trap meant that many buyers this afternoon were once again caught holding the bag.

Heavy selling pressure was witnessed across many stocks, notably DIG, which fell 4.86% with a trading volume of 1,090.5 billion VND; SSI, which lost 3.49% on a volume of 1,000.7 billion VND; VIX, which declined 4.12% with a volume of 784.4 billion VND; NVL, which dropped 3.99% with a volume of 562.1 billion VND; and PDR, which plunged 6.43% with a volume of 431.5 billion VND… In the securities sector, CTS, BSI, and AGR hit their floor prices with liquidity in the hundreds of billions of VND.

Among the 90 stocks that bucked the trend, only 15 had trading volumes exceeding 10 billion VND. Very few stocks managed to sustain a decent increase. VTP, MSB, QCG, BCG, TCM, and PHR gained over 1% amid relatively active trading. Meanwhile, stocks like SHB, BID, SZC, and LCG, despite having better liquidity, saw their gains capped at very low levels.

A bright spot was the positive net inflow of foreign capital this afternoon. Specifically, foreign investors net bought 597.4 billion VND on the HoSE, with net purchases of 1,817.9 billion VND and net sales of 1,220.5 billion VND. In the morning session, foreign investors had net bought only 8