Rồng Việt Securities has recently released a research report that provides an updated outlook on the seafood industry for 2024. The report anticipates a recovery in the seafood sector due to increased demand resulting from a low base in 2023 and a recovering global economy. The Pangasius segment is expected to rebound early in the US market, while the Shrimp segment is projected to grow in the Japanese market sooner than in other markets.

Accordingly, the Pangasius segment is forecasted to recover from a low base in 2023. In the US market, production in 2024 is expected to grow due to an improving economy and a low base in 2023. The opportunity for Pangasius from the US ban on Pollock imports is considered insignificant, as Pollock export volumes exceed imports, and allowable catch in the Bering Sea region is projected to be similar to last year. Therefore, the US is unlikely to face a Pollock supply shortage.

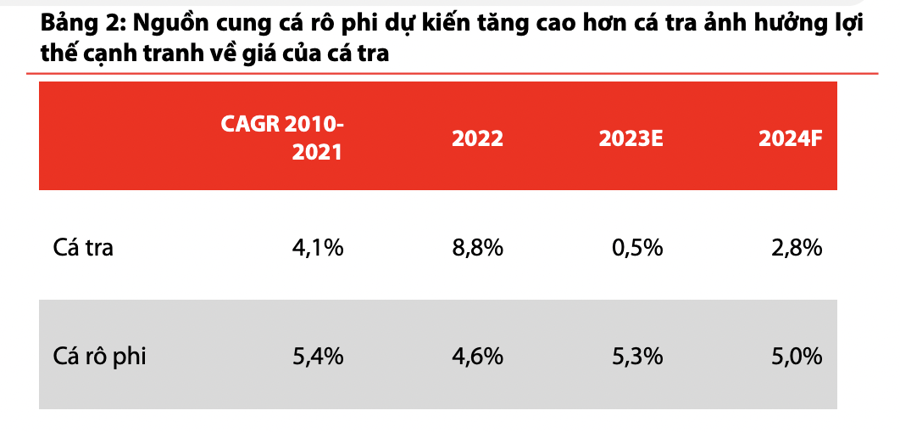

Sales prices in the US in 2024 are expected to remain similar to the previous year due to price competition from Tilapia, as Tilapia supply is projected to increase significantly. The 19th Anti-Dumping Duty (POR 19) reduction compared to POR 18 for some Vietnamese companies will help maintain a competitive price advantage.

In the EU market, production and prices are anticipated to be similar to the previous year due to competition from abundant Pollock supplies. The EU has imposed a 13.7% import duty from January 2024 until 2026 on Russian fish products, but the large supply pressure from Russian Pollock due to its blocked exports to the US has kept Pollock prices in the EU low. Consequently, import prices may not differ significantly from Pangasius.

In the Chinese market, Pangasius exports from Vietnam in 2024 are expected to continue growing steadily as the Chinese economy improves. However, price increases may be challenging due to ongoing price competition from Snakehead and Tilapia. Increased production in China will help reduce inventory levels for businesses and create conditions for Pangasius prices to rebound as supply gradually decreases.

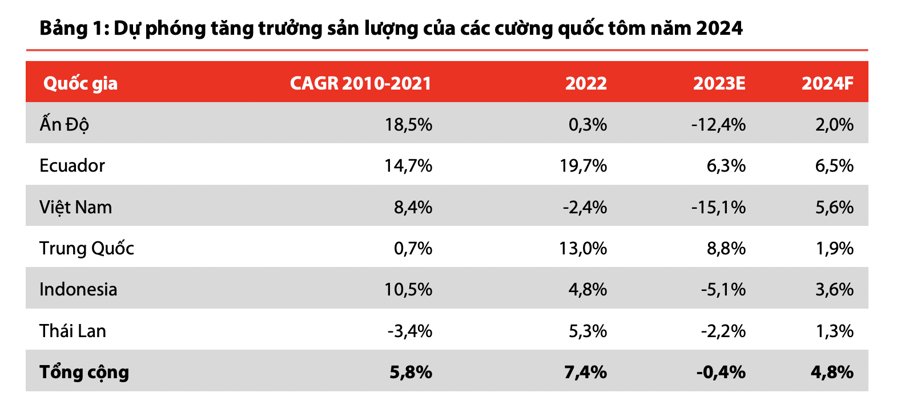

For the Shrimp segment, 2024 is expected to bring volume growth while prices may not fully recover. In the Japanese market, production and prices are projected to increase in 2024 due to rising Japanese wages and a low base. The Chinese and US markets anticipate production growth driven by economic recovery, while prices are expected to remain similar to the previous year due to competitive pressure from raw Shrimp.

However, the Chinese market will continue to face intense competition in 2024. In China, Vietnam must compete fiercely with Ecuador, as China is a key market for Ecuador (accounting for 57% of production in 2023). Ecuador’s export volume in 2023 increased by 18% year-over-year, driven by a 21% increase in exports to China.

Data from the first two months of 2024 shows that Vietnam’s export volume to China increased by 77%, and the average price for the two months rose by 91% due to reduced supply from Ecuador caused by sulfite residue and increased freight rates. However, these factors are considered short-term, as Ecuador’s supply is expected to recover soon with better control of sulfite residue levels, and freight rates have also been decreasing gradually.

Vietnam’s production growth in various markets will depend on the preliminary results of the US’s CBPG tax on India and Ecuador in April 2024.

In the EU market, production and price growth will likely be challenging due to high competition and economic difficulties in the EU.

Business profit margins are expected to rebound from the lows seen in Q3 and Q4 of 2023. Most companies have recorded bottoming-out financial results in Q3 of 2023. Gross margins have declined significantly due to falling sales prices. However, an appreciating exchange rate and lower feed prices in 2024 will support gross margin recovery.

Increased shipping costs due to the Red Sea conflict will put pressure on the net margins of businesses exporting under CFR terms or limit price increases due to cost-sharing with buyers for businesses under FOB terms.

For the Shrimp segment, valuations remain attractive compared to current prices. Stocks within the sector that will benefit significantly from the US market include VHC, and highly competitive stocks such as FMC are suitable for medium to long-term investments.