SeABank Successfully Organizes 2024 Annual General Meeting of Shareholders.

|

Maintaining a Steady Growth Rate

At the Meeting, SeABank’s Board of Management informed shareholders of the business results for 2023, which were positive, along with the 2024 business plan targets. Accordingly, in 2023, the global economy continued to experience many fluctuations and challenges, including strategic conflicts between major countries, war, high inflation, and a decline in global trade and consumption. Domestically, the economy gradually recovered but still faced many challenges. Despite these circumstances, SeABank achieved remarkable business results through its efforts.

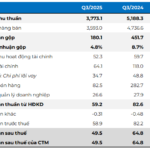

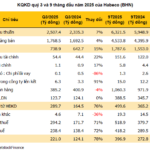

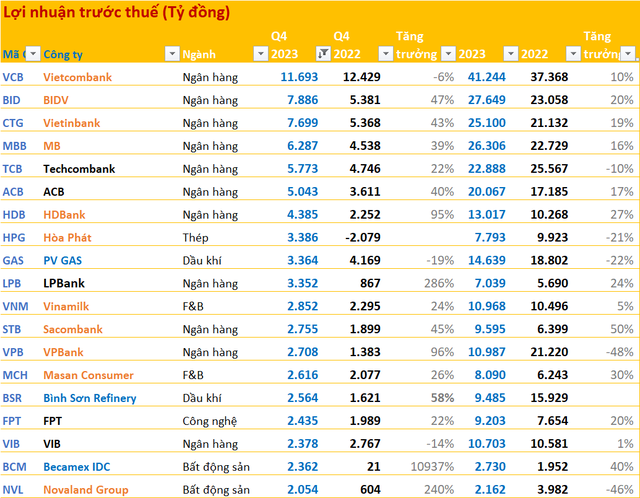

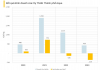

Specifically, the pre-tax profit as of December 31, 2023, was VND 4,616 billion, fulfilling 100% of the plan. Total assets reached VND 266,122 billion. The bad debt ratio was 1.94%, and the Cost to Income Ratio (CIR) was 38.3% due to cost optimization and savings. The consolidated capital adequacy ratio (CAR) reached 13.61% and has always been maintained above the minimum capital adequacy ratio required by the State Bank of Vietnam.

In 2023, by diversifying products, enhancing service quality, implementing cross-selling of products, and expanding the application of technology, SeABank recorded over 32.3 million transactions on its digital platform, a 157% increase year-on-year, with over 71% of new account openings registered online through eKYC.

In 2023, SeABank’s charter capital was increased to VND 24,957 billion, providing the bank with sufficient resources and capital to improve capital adequacy ratios, supplement its operating capital, and invest in technology. At the same time, SSB shares were selected by HOSE for the VN30, confirming SeABank’s reputation, operating efficiency, and financial strength in the financial and banking market. As of December 31, 2023, SeABank was among the seven banks with the largest market capitalization on the stock market.

Notably, with its achievements over the past years, contributions to the country’s development, and numerous meaningful community activities, SeABank was honored to receive the First Class Labor Medal from the President of Vietnam. This prestigious award recognizes the dedicated efforts and outstanding achievements of SeABank’s Board of Management and all of its employees, coinciding with the bank’s 30th anniversary. This further affirms SeABank’s position, brand reputation, stable and sustainable development, and the well-deserved recognition by the State and Government for its contributions to the country and the community.

With its exceptional efforts, SeABank also received recognition from international organizations. Notably, for two consecutive years, SeABank was ranked among the “Top 1000 World Banks 2023” by The Banker magazine, ranking 771st, an increase of 150 places compared to 2022. Additionally, Brand Finance, the world’s leading brand valuation organization, recognized SeABank among the Top 100 Most Valuable Brands in Vietnam 2023, ranking 44th, acknowledging SeABank’s position in the financial and banking industry and the Vietnamese business community.

In the same year, Moody’s affirmed SeABank’s credit rating at Ba3 for its Issuer and Long-Term Domestic and Foreign Currency Deposit ratings. Moody’s affirmation of SeABank’s rating with a Stable outlook reflects the organization’s expectations of the bank’s high and improving capital strength.

In Vietnam, SeABank is one of the pioneering banks to implement and apply Basel III to enhance governance capabilities, mitigate operational risks, and strengthen the bank’s resilience to market shocks. After more than a year of applying Basel III, SeABank has optimized its risk-weighted assets (RWAs) and capital using advanced methodologies that enable risk and market sensitivity calculations. As a result, the bank can balance the risk and profit opportunities of holding capital, improve liquidity, enhance credit risk management capabilities, and simplify operational risk management processes.

Based on the achievements made and an analysis of the economic context in 2024, SeABank’s AGM approved the 2024 business plan with the following targets, aiming to maintain stable growth compared to 2023: Total assets of approximately VND 300,000 billion; Additional capital mobilization of approximately VND 30,000 billion; Pre-tax profit of VND 5,888 billion, a 28% increase compared to 2023; Return on Equity (ROE) of 13.9%; and a controlled bad debt ratio below 3%.

Increasing Charter Capital and Electing Additional Board of Directors Members for Sustainable Development

One of the important contents of SeABank’s AGM was the plan to increase its charter capital from VND 24,957 billion to VND 30,000 billion (an increase of VND 5,043 billion) through the following methods:

- Issuing 329 million SSB shares to pay dividends for 2023 to shareholders at a rate of 13.1826% and issuing 10.3 million shares to increase share capital from equity sources at a rate of 0.4127%, increasing charter capital to VND 28,350 billion.

- Issuing 45 million shares under the 2024 Employee Stock Ownership Plan (ESOP) to increase charter capital by a further VND 450 billion.

- Offering for sale up to 120 million shares through private placement and/or issuing shares to convert debt at an expected offering price of VND 10,000 per share, increasing the bank’s charter capital by an additional VND 1,200 billion.

The continued addition of charter capital is essential for SeABank to achieve its growth targets in the current period. It will enable the bank to further enhance its competitiveness, promote development, and strengthen its financial capacity.

In addition to the capital increase plan, SeABank continues to improve its governance structure, ensuring readiness to achieve the targets and plans for the 2024-2028 period, with particular emphasis on sustainable development (ESG) in accordance with international standards. The AGM approved the resignation of Ms. Ngo Thi Nhai – a member of the Board of Directors and elected Ms. Tran Thi Thanh Thuy as a new member of the Board of Directors (BOD) for the 2023-2028 term.

Ms. Tran Thi Thanh Thuy is elected as a member of SSB’s BOD for the 2023-2028 term.

|

The members of SeABank’s BOD and Supervisory Board meet the standards and conditions prescribed by the Law on Credit Institutions 2010, the Law on Amending and Supplementing a Number of Articles of the Law on Credit Institutions, and are individuals with high capacity and expertise, extensive experience in management in the financial and banking sector, strategic vision, solidarity, and dedication to SeABank’s development.

The completion of the senior management team will enable SeABank to enhance its management and governance capabilities, bringing the bank closer to its goal of becoming the most preferred retail bank based on the following fundamental factors: promoting the digitization of the banking system; achieving sustainable growth combined with risk control; enhancing credit quality while controlling the bad debt ratio below 3%; and diversifying products and services to improve customer experience.