Business Results of Comeco in Q1/2024

|

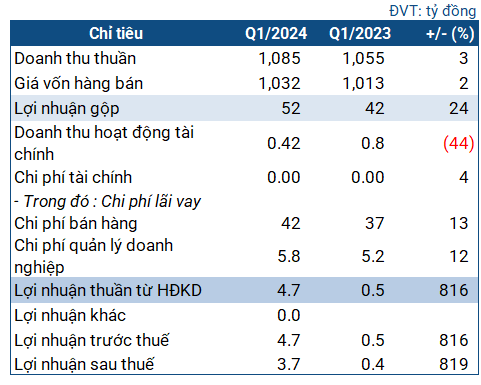

Comeco’s business results in the first quarter of 2024

Source: VietstockFinance

|

Specifically in the first quarter, Comeco achieved nearly VND 1.1 trillion in revenue, an increase of 3% over the same period. The cost of goods sold increased by only 2%, to over VND 1 trillion. After deduction, gross profit increased by 24%, to VND 52 billion.

The indicators with the strongest impact were selling expenses and enterprise management expenses, which increased by 13% and 12%, respectively. Finally, the company’s net profit was VND 3.7 billion, 9 times higher than the same period last year. Compared to the plan approved by the 2024 General Meeting of Shareholders, the company achieved 23% of its after-tax profit target for the year (VND 16 billion).

At the end of the first quarter, Comeco’s balance sheet was relatively sound with total assets of VND 513 billion, an increase of 5% compared to the beginning of the year. Of which, current assets were recorded at VND 225 billion, an increase of 12%, with a cash balance of over VND 111 billion (a slight decrease).

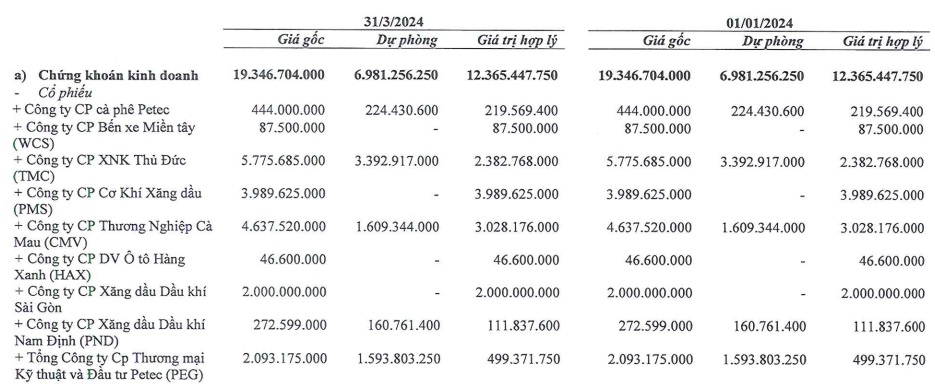

With regard to financial investments, Comeco is currently holding 9 stock codes and is currently at a loss of approximately VND 7 billion from the original cost.

|

Comeco’s financial investments

Source: COM

|

The value of ending inventory was approximately VND 64 billion, an increase of 26% compared to the beginning of the year.

In terms of capital sources, all of Comeco’s liabilities are short-term, recorded at nearly VND 70 billion, 57% higher than at the beginning of the year, but there are no loans. The current ratio is 3.2 times.