BVBank’s 2024 Annual General Meeting was held on April 19, 2024

|

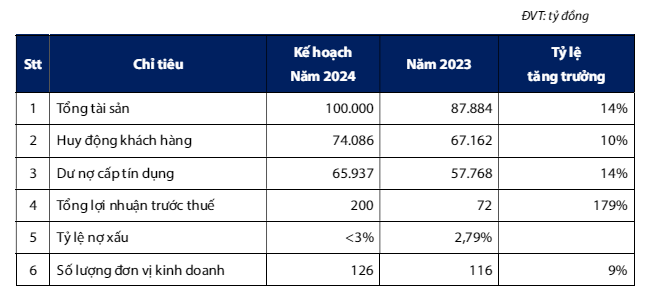

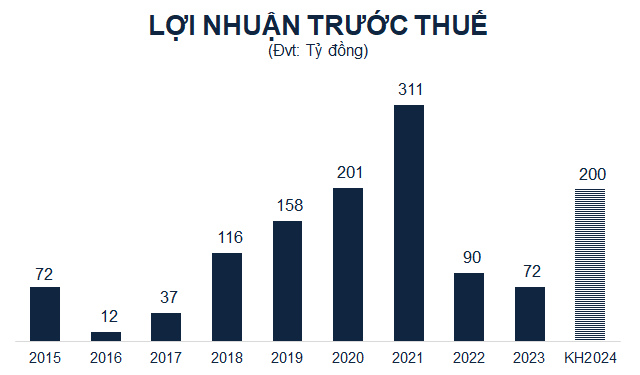

The 2024 pre-tax profit target is 2.8 times higher

BVBank aims to achieve a pre-tax profit of VND 200 billion in 2024, an increase of 179% compared to the 2023 result. The bank aims to reach a total asset value of VND 100,000 billion by the end of 2024, an increase of 14% compared to the beginning of the year. Mobilization is expected to reach VND 74,086 billion, an increase of 10%; outstanding loans to reach VND 65,937 billion, an increase of 14%. The bad debt ratio is controlled below 3%. The number of business units increased to 126, an increase of 9%.

At the General Meeting, the Board of Directors also shared that in the first quarter, BVBank’s pre-tax profit is estimated to reach nearly VND 70 billion, fulfilling 35% of the 2024 target plan.

Source: VietstockFinance

|

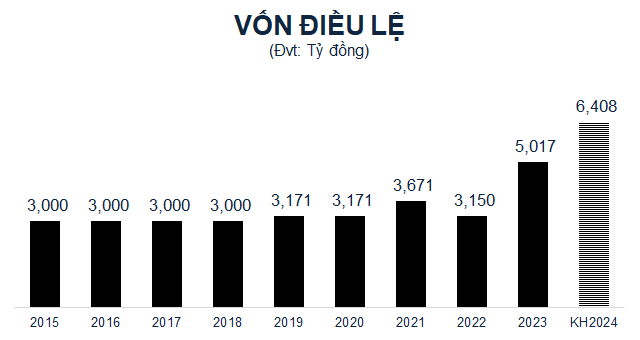

Increase capital to VND 6,408 billion

BVBank achieved a post-tax profit of VND 71.6 billion. After setting aside funds and provisions, the Bank still has more than VND 48 billion in retained earnings.

With the aim of enhancing financial capacity, increasing operating capital, and increasing competitive capacity, the 2024 General Meeting of Shareholders approved a plan to increase charter capital by nearly VND 890 billion in 2024.

Specifically, the Bank plans to issue nearly 69 million shares to the public for existing shareholders at a ratio of 8:1 (shareholders owning 8 shares will receive 1 right to purchase shares, 8 purchase rights will get 1 additional share issued), corresponding to nearly VND 690 billion at par value.

At the same time, the Bank also plans to issue 20 million shares to employees (ESOP), the offering price is VND 10,000/share, corresponding to VND 200 billion. This number of shares is restricted from transfer within 1 year.

If successfully issued, BVBank’s charter capital will increase from VND 5,518 billion (after completing the 2023 capital increase plan) to more than VND 6,408 billion.

Implementation time in 2024 and Quarter 1, 2/2025.

Source: VietstockFinance

|

Transferring transactions from UPCoM to listing on the HOSE

Previously, the 2023 General Meeting of Shareholders approved the transfer of BVB shares from UPCoM to listing on the Ho Chi Minh City Stock Exchange (HOSE). However, due to unfavorable market conditions, BVBank has not yet transferred the floor.

In 2024, the General Meeting of Shareholders approved the plan to continue the floor transfer, with the specific time to be decided by the Board of Directors.