According to the Chairman of Dat Xanh Group, the brokerage service segment remains the core, focal segment of Dat Xanh.

On the morning of April 19, Dat Xanh Group Joint Stock Company (Stock code: DXG) held its 2024 annual General Meeting of Shareholders (GMS). Answering a shareholder’s question related to the brokerage service segment in the first quarter and this year, how is it?

The Chairman of Dat Xanh Group, Mr. Luong Chi Thin, said that the brokerage service segment is still the core, focal segment of Dat Xanh. In the past two years, it has been a very difficult period for the market, almost all brokerage companies had to close down, and sales staff quit their jobs. But fortunately, the management board of Dat Xanh restructured in a timely manner to retain core resources. As of December 2023, Dat Xanh identified that the 2024 market would improve and had prepared resources and products.

Regarding Dat Xanh’s business situation, Mr. Luong Tri Thin said that in the first quarter of 2024, Dat Xanh’s transaction volume doubled compared to the same period last year, and the real estate business continued to hand over products at the Opal Skyline project. In this second quarter, Dat Xanh continued to build and has completed houses at the Gem Sky World project for handover to customers. “The entire project has more than 4,000 products, we have sold about 2,300 products, leaving about 1,800 products. The remaining revenue of this project is over 10,000 billion VND”, Mr. Luong Tri Thin shared more.

Mr. Luong Tri Thin, Chairman of the Board of Directors of Dat Xanh Group Corporation (Code: DXG) shared at the 2024 Annual General Meeting of Shareholders. (Screenshot).

According to the Board of Directors’ assessment in the conference documents, 2024 is another difficult year for the real estate market in general and Dat Xanh in particular. In parallel with the core business segments (real estate development, real estate services, personnel recruitment plan, sales), the company continues to focus on searching for, developing land funds and projects.

In 2024, the Group’s revenue target is 3,900 billion VND and 226 billion VND of net profit, respectively increasing by 5% and 31% compared to the results achieved in 2023. The expected dividend payment ratio is 20% (no dividend was paid in 2023).

Mr. Luong Tri Thin, Chairman of the Board of Directors, said that the company is focused on completing the legal procedures for all projects this year. In which, the company aims to complete 8 large-scale projects in the Southern region with over 20,000 products to prepare for the period 2024 – 2026. Typically, the Gem Riverside, Gem Sky World, Plus City, Opal Luxury projects…, each project has a scale of 5-10 hectares, with about 3,000 – 5,000 apartments.

“This year, Dat Xanh will deploy and complete 8 key projects, equivalent to 20,000 products, preparing for the 2024 – 2026 cycle. Especially, the housing demand of people is very high, concentrated in the middle-income segment. Our projects are entirely in these segments, in line with market demand,” said Mr. Luong Tri Thin before the GMS.

Regarding Dat Xanh’s continuous divestment from companies in the recent past, Chairman of the Board of Directors of Dat Xanh Luong Tri Thin said: The Board of Directors decided to restructure the operating model, especially industries that do not bring about effectiveness such as construction. Dat Xanh focuses entirely on the core to better develop the group in the 2025 – 2030 strategy, the rest will be divested to lighten the burden.

Gem Sky World investor earns more than a billion dong per day

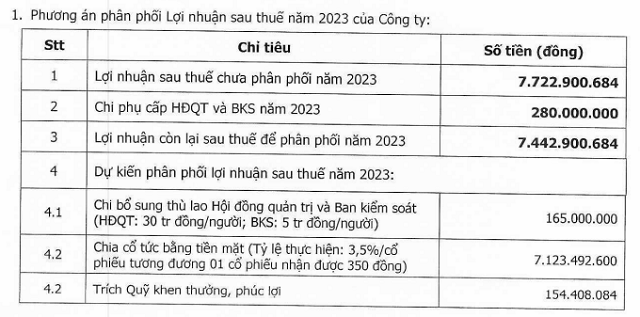

Ha An Real Estate Investment and Trading Joint Stock Company (belonging to Dat Xanh Group) – the investor of Gem Sky World project has just announced its financial situation in 2023.

According to the report, Ha An’s post-tax profit was 378 billion VND, an average profit of over 1 billion VND per day. Compared to the same period, the net profit of this enterprise last year was 5.5 times higher than in 2022, reaching nearly 378 billion VND. However, this figure is lower than the record profit of over 1,300 billion in 2021.

As of the end of 2023, Ha An’s equity was 9,954 billion VND, an increase of 4% compared to the beginning of the year. The business’s payable debt decreased by 10% to 12,940 billion VND.

In which, outstanding bond debt is about 710 billion VND, accounting for more than 9% of the business’s total debt.

Currently, this business is only circulating 1 HAACH2226001 bond, issued on July 20, 2022, with a term of 4 years, with a value of 210 billion VND, and an interest rate of 11%/year. This bond will mature on July 20, 2026.