|

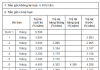

DBC’s Business Indicators in Q1/2024

Source: VietstockFinance

|

In the first quarter, DBC recorded nearly 3.3 trillion VND in revenue, up 41% year-on-year. After deduction, the Company recorded a gross profit of 349 billion VND (a loss of 70 billion VND in the same period last year).

Selling and administrative expenses were recorded at 110 billion VND and 97 billion VND respectively, up 13% and 17% year-on-year. High expenses have eroded the Company’s profit, resulting in a net profit of only 73 billion VND. However, this is still a large profit compared to a loss of up to 321 billion VND in the same quarter last year.

However, compared to the target approved by the 2024 General Meeting of Shareholders, DBC has only achieved nearly 13% of the revenue plan and 10% of the after-tax profit target for the year.

DBC explained that the Company benefited from lower prices of some key raw materials for animal feed production, resulting in lower production costs. Besides, domestic farmers have a demand to restore their herds, so the consumption of animal feed has increased, leading to improved results.

In addition, the price of live pigs has increased quite stably since the beginning of the year due to a decrease in supply due to disease, which has contributed towards the Company’s improved results. The average live pig price nationwide on May 2 was 61,800 VND/kg, up 26% compared to the beginning of the year.

In terms of financial situation, DBC‘s balance sheet at the end of the first quarter is not quite safe. Total assets decreased slightly compared to the beginning of the year to over 12.5 trillion VND. Of which, more than 6.6 trillion VND is current assets, down 6%. The amount of cash and cash equivalents held is about 851 billion VND, down 21%. Inventory slightly decreased to nearly 5.3 trillion VND.

On the equity side, short-term debt decreased by 8% to over 6.5 trillion VND, accounting for the majority of the Company’s liabilities. The current ratio is 1 time, but the quick ratio is only 0.2 times, indicating that the Company is able to repay short-term debt, but faces risks in repaying it in full within a short period of time.

Short-term borrowings amounted to 4.5 trillion VND, slightly decreased compared to the beginning of the year; long-term borrowings slightly increased to over 1.05 trillion VND, all of which are bank loans.

Livestock giant Dabaco plans for profit surge, seeks to issue over 140 million shares