On the morning of 20/4/2024, Nam Long Investment Joint Stock Company (stock code NLG) organized the General Meeting of Shareholders, passing the plan of net revenue of 6,657 billion – 2 times higher than the financial year 2023 and after-tax profit of 821 billion, after-tax profit of company parent shareholder of 506 billion – a slight increase of 5% compared to last year.

CASH DIVIDEND PAYMENT AND DIRECTORS’ LIABILITY INSURANCE POLICY PURCHASE

With the target above, the company plans to pay cash dividend of 5% of face value in the financial year 2024. In case the net income is more than 30% compared to the plan, this rate will gradually increase, up to a maximum of 10% of face value. Depending on the business conditions, the dividend for the 2024 financial year may receive an interim dividend of 50% in December 2024 and the remaining in 2025. The specific rate will be decided at the 2025 Annual General Meeting of Shareholders.

Nam Long also proposed to issue 446,276 shares in accordance with the long-term incentive reward policy for leaders and senior managers (abbreviated as the ESG program). The shares after issue will be subject to a 1-year transfer restriction.

In addition, the company also plans to purchase liability insurance for the Board of Directors in 2024 with a premium of 20,900 USD, an insurance limit of 10 million USD, with a term from July 31, 2024 to July 30, 2025.

Looking back at 2023, this was a challenging year for the economy in general and the real estate industry in particular due to the impacts of the global economic recession that has persisted since the pandemic. For Nam Long, last year the company delivered 1,609 products, recorded a record handover revenue of 7,033 billion, with after-tax profit of 484 billion VND – reaching 82% of the annual plan.

With the above results, Nam Long plans to distribute cash dividend for 2023 in the second quarter of 2024, with the total amount used for this purpose being more than 192 billion VND. With nearly 385 million shares currently in circulation, it is estimated that for each NLG share, shareholders will receive 500 VND, equivalent to a rate of 5%.

In addition, in 2023, NLG also successfully issued 500 billion bonds to the Orient Commercial Joint Stock Bank (OCB).

OPPORTUNITY FROM LOW LOAN INTEREST RATES

In 2024, Nam Long said that it will continue to orient its development according to the integrated real estate model, including 3 main business segments:

+ Land Development, Housing Project and Urban Area segment: continuing to implement component projects and projects of integrated urban areas including Mizuki Park (26 hectares, Binh Chanh District), Waterpoint Phase 1 (165 hectares, Ben Luc District, Long An Province), Akari City (8.5 hectares, Binh Tan District), EHome Southgate, Izumi City (170 hectares, Dong Nai Province), Nam Long Central Lake (43 hectares, Can Tho City).

At the same time, Nam Long also allocates budget for expanding its clean land fund as well as developing new urban land fund in the long term.

+ Commercial Real Estate Development segment: promoting urban utilities (city facilities) in integrated urban areas. This year, a number of utilities in the Waterpoint integrated urban area will be implemented and put into operation such as EMASI Plus international bilingual school, San Ha Food Convenience Store, Saigon-Waterpoint multidisciplinary clinics, Wisdomland Kindergarten…

+ Investment and Capital Raising segment: raising capital and optimizing capital sources through maintaining long-term cooperation with long-standing partners, expanding opportunities to attract investment from third parties…

According to the sharing of Chairman Nguyen Xuan Quang, Nam Long determines to only sell and focus on what the market needs, avoiding investing heavily but not being able to sell, leading to high inventory.

“The challenge this year is to deal with inventory, overdue debt and customers terminating contracts. All real estate companies, to varying degrees, are all facing all of these difficulties. When the market loses confidence, we must have confidence. According to the roadmap to 2030, Nam Long must complete 14 strategies. This year, the company focuses on three key strategies: Investment and Investment Management, General Finance (including capital raising), M&A and Growth”, Mr. Quang said.

Nam Long’s leadership stressed that the current low loan interest rate is an opportunity. “The interest rate is lower than the period before Covid-19, and can even compete with other countries. For example, in developed countries such as Australia, the US…, loan interest rates for real estate are at 7-8%”.

It is noteworthy that from April 1, 2024, the Company appointed Mr. Lucas Ignatius Loh Jen Yuh (Singaporean) as the new General Director. According to the introduction, Nam Long’s new General Director has more than 20 years of international management experience in positions such as Chairman, CEO, Investment Director and Investment Manager at large corporations such as Capitaland, Hopson, Temasek Holding… in the Singapore and China markets.

DISCUSS: POTENTIAL DIVESTMENT IN A NUMBER OF PROJECTS

1. What is the value of unrecognized backlog as of the end of 2023? How much is recorded in the period 2024-2025?

Backlog at NLG is understood as pre-sales revenue, around 8,000 billion from 2023 transferred over. Of which, 6,000 billion might be recorded as handover revenue this year, the remaining will be gradually recorded in 2025-2026.

However, the actual handover progress depends on the efforts of both parties, the buyer and the seller. This year, the market is difficult, so it is important to work with customers. There are some cases where NLG cannot force the customers to receive the handover on schedule, but the policy is to work with the customer by supporting negotiations with banks to extend the payment schedule.

2. Business results for the first quarter of 2024?

In the first quarter of this year, the handover situation was slow, related to the Can Tho project. Currently, the handover has been completed, pending recording (delayed due to waiting for the recording of land valuation).

Revenue in the first quarter is estimated at 1,160 billion, higher than the same period last year. This is a good sign this year.

3. Legal status update for current projects? When will the Paragon and Izumi projects be recorded?

Mr. Van Viet Son, General Director of Nam Long Land: Currently, the Izumi project is located in Long Hung Urban Area, Dong Nai – this is a component project with 4 other investors. The overall project has been set up by the Government to remove difficulties. The Government, the Ministry of Construction and the People’s Committee of Dong Nai Province are adjusting the planning, with NLG’s project expected to be approved for 1/500 planning in December 2024 to the first quarter of 2025.

The Paragon project is part of DIC Corp’s Dai Phuoc project (stock code DIG), which has been extended to 2027. NLG will soon submit a new planning approval for the Paragon project.

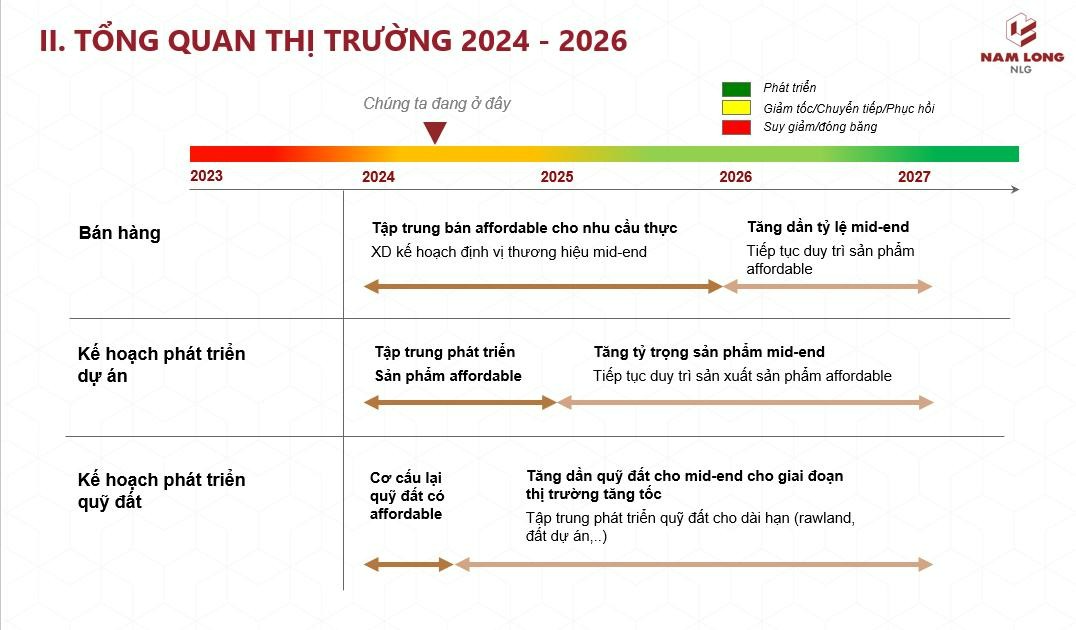

In the period 2024 – 2026, NLG can introduce 15,000 products to the market with GSAV of 87,000 billion VND

4. Which projects will the 2024 business plan come from?

NLG’s 2024 revenue plan will come from Akari Phase 2, Southgate (over 2,000 billion).

NLG’s current land bank of 681 hectares is sufficient for development until 2030.

5. When will the Can Tho project complete its financial obligations?