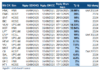

Accordingly, OCB will open five new branches in Lao Cai, Phu Tho, Quang Binh, Dak Nong, and Ninh Thuan provinces, along with 12 transaction offices in Hanoi, Nam Dinh, Ninh Binh, Binh Dinh, Lam Dong, and Gia Lai. The bank’s network will expand to 176 transaction points, serving 48 provinces and cities across the country.

The newly opened units will be prioritized by the bank for investment, construction, and equipment with the most modern and advanced facilities, providing a luxurious and high-class transaction space. In addition, to facilitate customers in the localities to access products and services easily, OCB will select office locations on central roads convenient for movement and densely populated areas.

OCB continuously approved by SBV to expand nationwide transaction network

|

Mr. Nguyen Van Huong, Deputy General Director of Retail Banking, OCB said: “Currently, the trend of cashless payments and the promotion of financial services experience on online channels is increasingly developing. This is also considered a priority strategy of OCB throughout the recent past. However, we also focus on expanding operations through direct transaction points nationwide, increasing brand coverage, and making it easier for customers to use and choose bank products. In addition to creating a comfortable and convenient transaction space, at OCB, branches and transaction offices are required to be increasingly professionalized related to operational work, improving expertise, and optimizing the quality of customer service.”

The role of direct transaction channels remains extremely important

|

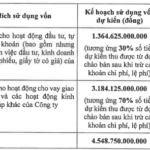

The continuous approval to expand the network of operations nationwide has recorded the effective performance of the bank in the recent past. Combined with the digitalization strategy that has been built since many years ago, OCB confidently sets a target of pre-tax profit plan of VND 6,885 billion, an increase of 66% compared to 2023. Total assets by the end of 2024 are expected to reach VND 286,562 billion, an increase of 19% over the beginning of the year. The total market capital mobilization 1 is expected to reach VND 197,346 billion, and the total outstanding debt in market 1 will reach VND 177,592 billion, increasing by 17% and 20%, respectively.