According to the Q4 2023 Financial Statement Analysis of Apec Investment, the negative market impact caused a significant decrease in demand, and the limited inventory resulted in fewer choices for customers, leading to a sharp decline in sales revenue and service delivery compared to the same period last year.

Specifically, this quarter the company achieved a revenue of 47 billion VND, a 37.3% decrease compared to Q4 2022. Excluding the cost of goods sold, the company had a gross profit of nearly 6.8 billion VND, while it had a loss of over 6 billion VND in the same period last year. The company’s financial activity revenue reached nearly 20.6 billion VND, a more than 4 times decrease compared to the same period last year.

As a result, API continued to report a loss of over 19.4 billion VND, while it had a net profit of nearly 55.3 billion VND in Q4 of the previous year. This is also the third consecutive quarter that Apec Investment has reported a loss.

For the entire year of 2023, API recorded a net revenue of over 197 billion VND, a 4 times decrease compared to 2022. The post-tax loss of the company was 46.7 billion VND (while it had a post-tax profit of over 121 billion VND in 2022). According to the plan for 2023, API set a target of 650 billion VND in revenue and 132 billion VND in after-tax profit. Therefore, with the above results, API is far from achieving the targets set by the General Shareholders’ Meeting.

The business results of Apec Land Hue, a subsidiary of Apec Investment, are not much better. In the latest reporting period, the first half of 2023, Apec Land Hue also reported a post-tax loss of about 10.8 billion VND, while it had a profit of 8.5 billion VND in the same period of 2022. As of the end of June, the total assets of Apec Land Hue decreased slightly to 722 billion VND.

Rendering of the Royal Park Hue project

It is known that Apec Land Hue is currently investing in the Royal Park Hue project. This project is located in zone B of the new An Van Duong urban area, Hue City, with a total area of 34.7 hectares and a total investment of 10,000 billion VND. According to the plan, the developer will develop nearly 1,000 multi-functional townhouses and 2 condominium buildings with about 3,000 units; 4 service complexes; 2 commercial center buildings.

As of the beginning of June 2023, the low-rise component of the project is being processed with state agencies for valuation. Apec Investment expects to complete the legal procedures by the end of Q3 or early Q4 2023, then work with customers to complete the necessary documents for revenue recognition. It is estimated that the revenue from the low-rise component of the project will be around 850 – 900 billion VND, equivalent to a cash flow of about 700 billion VND.

As for the high-rise component of the project, the company expects to record a revenue of about 2,900 billion VND for the 8.25 hectares of commercial space (including 3 buildings HB1, HB2, HB3) and 2,500 billion VND for the 5 service areas.

2024 Q4 Financial Statement

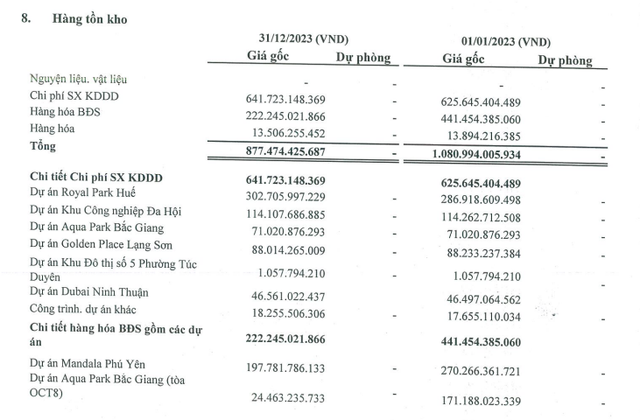

As of December 31, 2023, the inventory at the Royal Park Hue project is nearly 302.7 billion VND, an increase of 5.5% compared to the beginning of the year. This is also the largest unfinished production and business cost of Apec Investment in real estate projects.

The unfinished production and business costs inventory of the company is also recorded in some projects such as Da Hoi Industrial Park (114 billion VND), Golden Place Lang Son project (88 billion VND), Aqua Park Bac Giang project (71 billion VND), Dubai Ninh Thuan project (46.6 billion VND)…

In addition, the real estate inventory includes projects: Mandala Phu Yen (197.8 billion VND) and Aqua Park Bac Giang (OCT8 tower) (24 billion VND).

On the other hand, the customer prepayments at this project amount to 19 billion VND, which is the second largest short-term advance payment that Apec Investment recognizes from real estate projects, following Mandala Phu Yen Condotel project (146 billion VND).