In accordance with regulations regarding the offering and trading of private corporate bonds, Bkav Pro Joint Stock Company (Bkav Pro) has just disclosed periodic financial information.

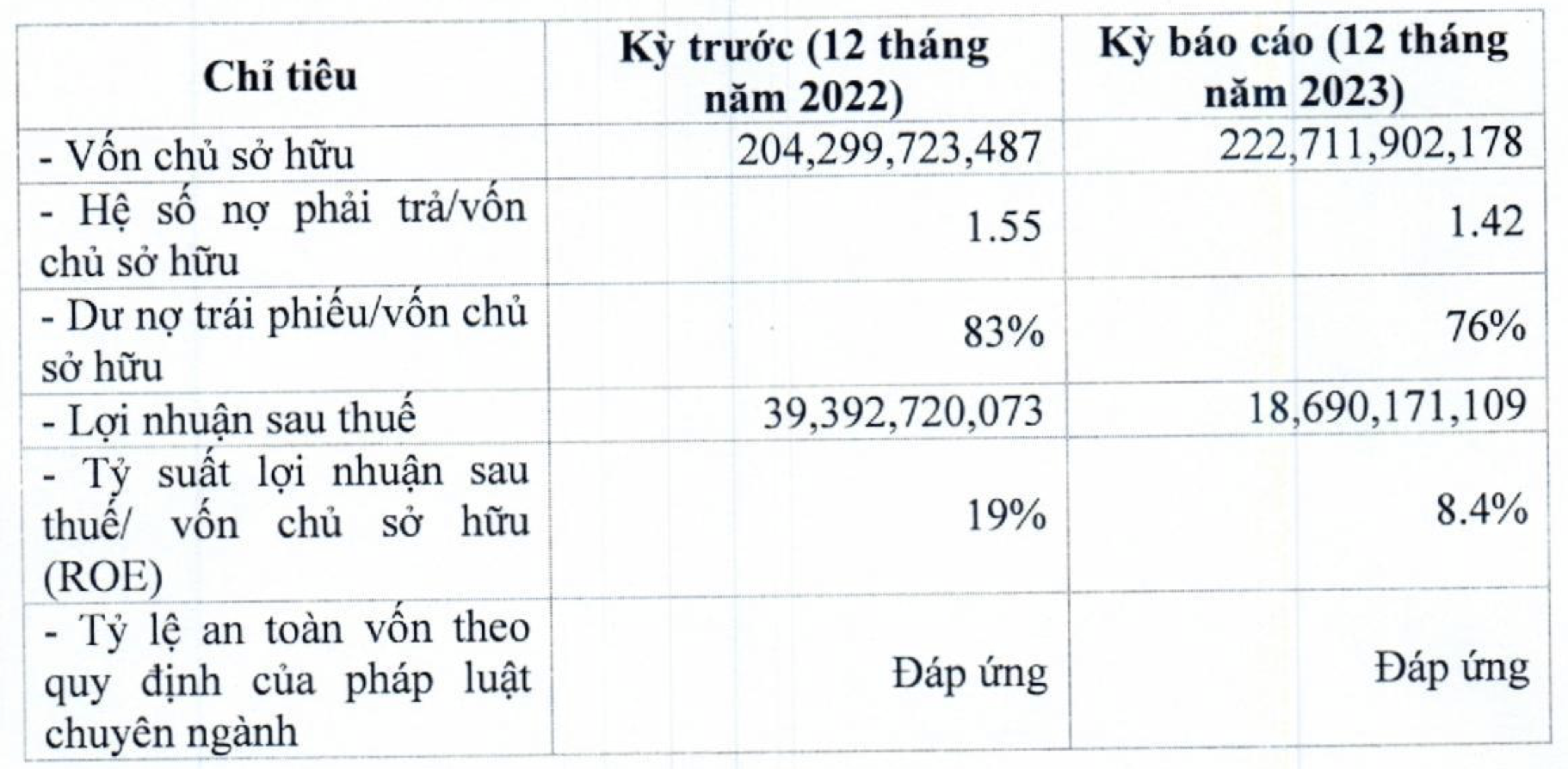

In 2023, Bkav Pro recorded after-tax profits of VND18.7 billion, a 53% decrease compared to the previous year. The after-tax profit/owner’s equity ratio (ROE) also decreased from 19% in 2022 to 8.4% in 2023.

As of the end of 2023, Bkav Pro’s equity reached nearly VND223 billion, an increase of 9% compared to the previous year. The debt-to-equity ratio decreased from 1.55 times in 2022 to 1.42 times in 2023, with the corresponding total debt reaching VND316 billion. The remaining bond debt is around VND169 billion.

Bkav Pro is the company responsible for software publishing for Bkav Corporation. The corporation was founded in 2003 and operates in the fields of cybersecurity, software, e-government, smartphone manufacturing, smart electronic devices, smart cities, and AI cameras. Bkav’s founder, Mr. Nguyen Tu Quang, is currently the Chairman of the Board of Directors and Chief Executive Officer (CEO).

Previously, in May 2021, Bkav Pro raised VND170 billion in bonds with a three-year tenor (due in May 2024). According to the plan, this amount will be used by Bkav Pro to expand and develop its AI camera segment, one of the most potential areas today. In addition, investments will also be made in digital transformation products.

The bonds have a fixed interest rate of 10.5% per year for the first year and a reference interest rate plus 4.5% per year for the next two years. This type of bond is non-convertible and does not come with warrants. The bond lot has the following secured assets: 5,443 million shares owned by Bkav Corporation (valued at VND969.5 billion), 4.9 million shares owned by Mr. Nguyen Tu Quang.

The organization advising on the offering and representing the bondholders is VNDirect Securities Corporation. According to VNDirect’s 2023 financial statements, as of the end of 2023, this brokerage firm had VND31.5 billion in bad debts against Bkav Pro. At the time of December 31, 2023, VNDirect had to set aside a provision of more than VND22 billion for this debt from BKAV Pro.