The stock market recorded a negative trading week from April 15-19, 2023, influenced by a combination of international and domestic factors that significantly impacted investor sentiment. The VN-Index opened the week with a 60-point loss, which slowed down in the following session but was followed by two consecutive trading days with losses of over 1.5%. At the end of the four-day trading week, the VN-Index had lost almost 102 points to close at 1,175 points, representing a 7.97% decline from the previous week with increased trading volume. This was the steepest weekly decline since October 2022.

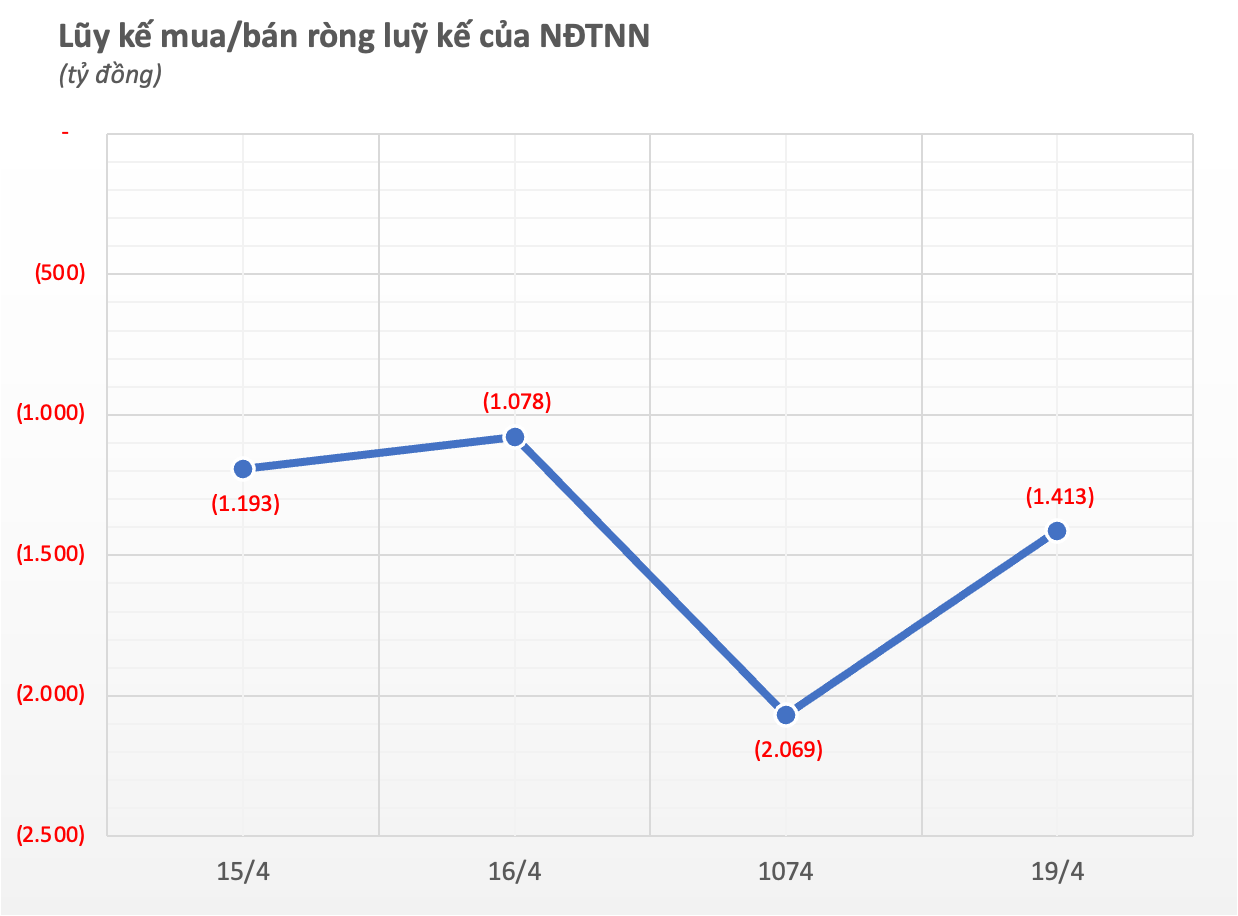

Amidst this bearish sentiment, foreign investors continued their strong net selling, despite some temporary buying periods. In total, foreign investors sold a net 1.413 trillion VND across the market.

Breaking down the data by individual exchanges, foreign investors sold a net 1.471 trillion VND on the HoSE, bought a net 22 billion VND on the HNX, and bought a net 36 billion VND on the UPCoM.

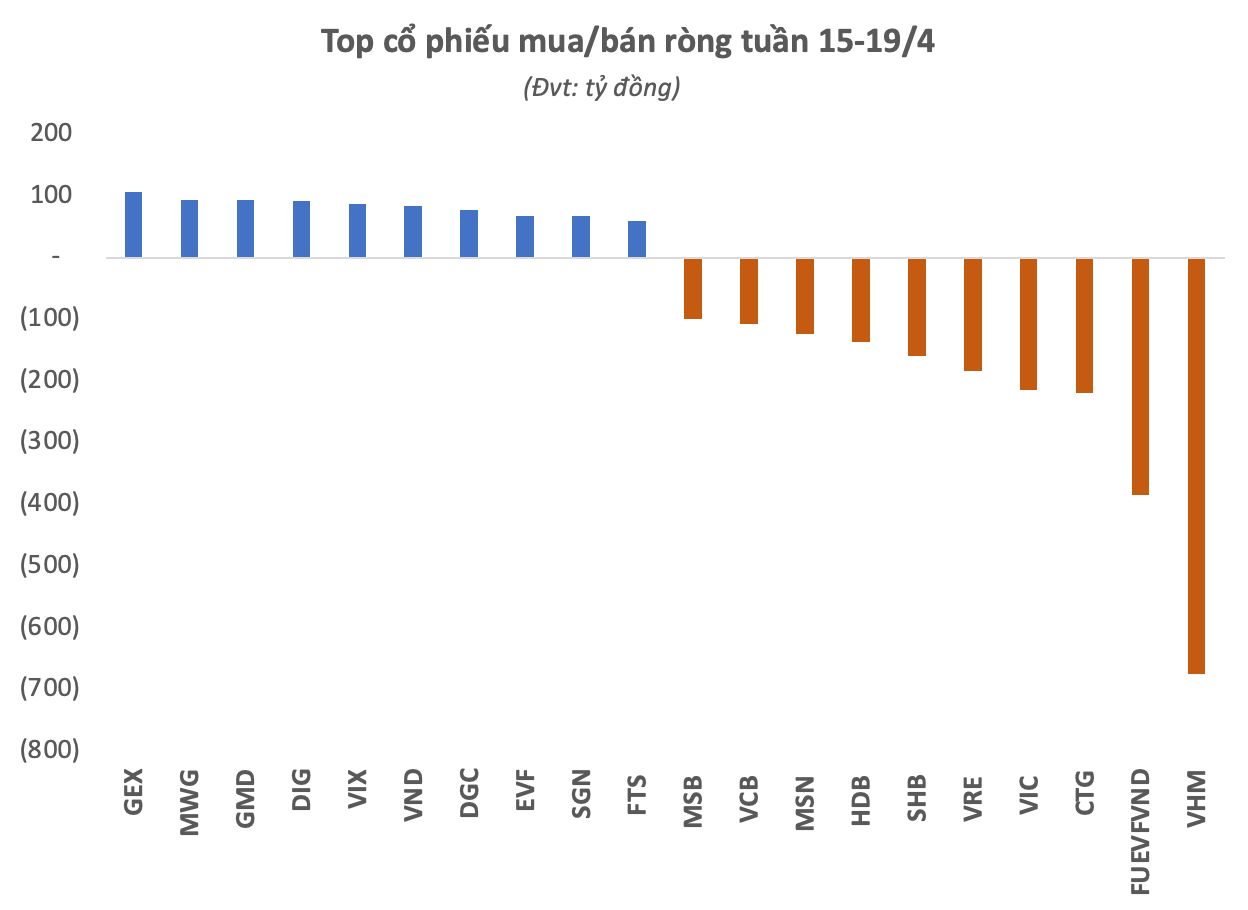

Looking at individual stocks, real estate giant VHM remained the focus of foreign selling, with a net sell-off of 675 billion VND. Fund certificate FUEVFVND was also heavily sold, with a net sell-off of 385 billion VND, followed by bank CTG with a net sell-off of 219 billion VND. Other Vingroup stocks, VIC and VRE, saw net selling of 215 billion VND and 184 billion VND, respectively. SHB shares also suffered a net sell-off of 159 billion VND.

HDB was another notable stock on the foreign net sell-off list, with a value of 137 billion VND. Other stocks sold by foreign investors during the week included MSN, VCB, and MSB, among others.