Liquidity Explodes, Retail Investors “Carry” Everything

VN-Index has embarked on a growth trajectory since the end of 2023, reaching the 1,290-point mark, representing an increase of over 20%. Market growth has been supported by expansionary monetary policy, economic recovery, and corporate performance. Furthermore, a lack of alternatives in other investment channels has made the stock market more attractive. Positive news about the KRX system and the market’s upgrade have also boosted investor confidence.

Accompanying the index’s growth is a significant increase in liquidity. Over the past month, average liquidity has reached 29,000 billion VND per session, as buoyant as during the boom periods of late 2021 and early 2022.

Another notable factor reminiscent of two years ago is the resilience of small-scale investors. Despite foreign investors continuously selling off trillions of VND, individual investors have been net buyers and have become the main driving force behind the market’s upward momentum.

Currently, many experts have made optimistic forecasts for the VN-Index. Several brokerages predict that the VN-Index could surpass the 1,400-point mark. Mr. La Giang Trung, CEO of Passion Investment, also predicts that the VN-Index could reach 1,500 points. These forecasts reflect optimism about the outlook for the Vietnamese stock market in the coming period. However, like any predictions, they are subject to various factors, including economic, political, and market sentiment.

Nearly 200 Stocks Surpass Peaks

Although the VN-Index has yet to exceed its previous peak of 1,531 points, almost 200 stocks have set new records. According to statistics from VietstockFinance, across all three exchanges, approximately 214 stocks have surpassed their peaks from 2021 to 2022.

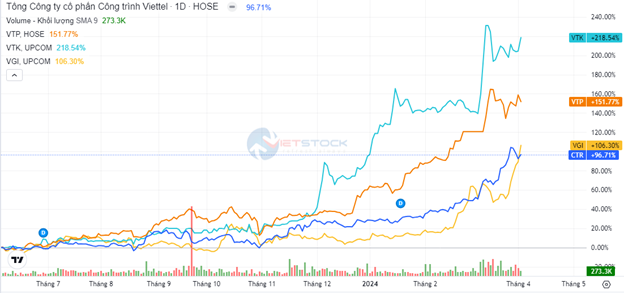

Of these, two groups of stocks have attracted the most attention: the FPT family (including FPT, FRT, FTS, FOX) and the Viettel family (including CTR, VTP, VTK, and VGI).

Within the Viettel family, the stock CTR of Viettel Contructions has been one of the most notable performers. Currently, the share price has surpassed 140,000 VND/share, an increase of almost 60% since the beginning of 2024. CTR has benefited from positive business conditions, with 2023 revenue of 11,299 billion VND and after-tax profit of 517 billion VND, representing increases of 19% and 13%, respectively, compared to 2022.

The stock VTP of Viettel Post has also been one of the standout performers, with its share price exceeding 90,000 VND/share. In 2023, Viettel Post recorded a net profit of over 380 billion VND, a 49% increase compared to 2022. The two remaining stocks in the Viettel family, VGI and VTK, have also set new record highs at 44,000 VND/share and 60,000 VND/share, respectively.

Within the FPT family, FRT of FPT Retail is one of the brightest spots. After a 60% surge since the beginning of February 2024, the stock has reached a new peak of 160,000 VND/share. FPT, a leading software company, is also trading at a record high of over 116,000 VND/share, an increase of more than 22% over the past two months.

Another stock in the FPT family, FTS of FPTS Securities, has also garnered significant attention as one of the strongest recent performers, reaching an all-time high of 62,000 VND/share.

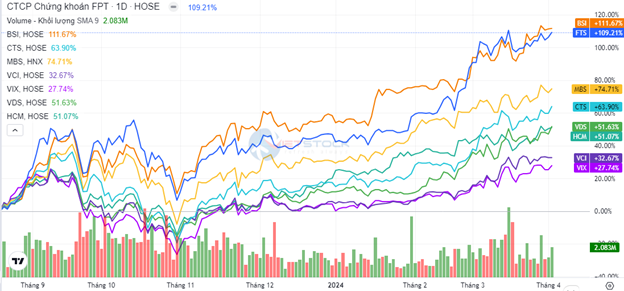

Securities Stocks Approach Peaks

The securities group has recently demonstrated its strength, particularly those companies planning to sell capital.

The stock BSI of BSC Securities Company is a prime example. Despite market volatility, this stock has surged to a new record high of 63,200 VND/share. Over the past two months, BSI has increased by more than 40%.

CTS of the Vietnam Joint Stock Commercial Bank for Industry and Trade has also performed strongly, rising by over 25% in the past two months, setting a new peak of almost 40,000 VND/share.

Other securities stocks such as MBS, VIX, and VCI are also advancing and approaching new highs.

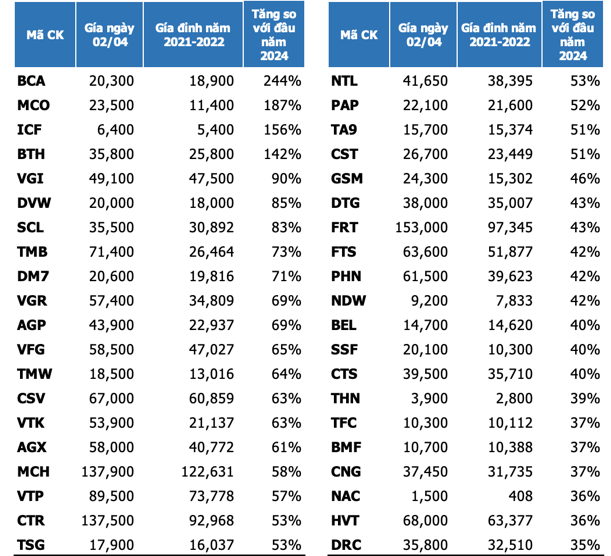

Top 40 Stocks Surpassing Peaks Based on Year-to-Date Increase

Source: VietstockFinance

|