The Economic Outlook: A Look at Global and Domestic Factors

Mr. Le Anh Tuan, Director of Investment, speaking at the event. Screenshot

|

Discussing the global macroeconomic landscape, Mr. Tuan noted that the US economy is performing better than expected, with minimal risks of significant downturns. However, European countries face their own challenges, with growth falling short of expectations.

Consequently, a divergence in monetary policies is emerging. While the US is hesitant to ease too quickly, the Swiss National Bank has taken the lead in cutting interest rates, with the European Central Bank, Bank of England, and Bank of Canada likely to follow suit, potentially with more aggressive rate cuts than the Fed.

Dragon Capital’s expert observed that Fed members are growing cautious about the number of rate cuts in 2024. At their March meeting, the Fed projected 75 basis points of cuts, or three reductions this year. Market expectations, on the other hand, range from one to two cuts, a significant departure from the previous expectation of six, underscoring the heightened volatility in market expectations regarding the Fed’s actions.

The ongoing Middle East tensions have also led to significant fluctuations in oil prices, which are anticipated to remain elevated for an extended period. If inflation does not subside quickly, the Fed may postpone its rate cut schedule. The USD is projected to continue strengthening.

This is the final cycle of high US interest rates, which has typically led to a strong USD and impacted currencies in emerging markets, including Vietnam.

On the domestic macroeconomic front, the positive takeaway is the recovery not only in manufacturing but also in services, with self-reported GDP growth projections for 2024 ranging from 6% to 6.5%. The government’s intention to continue easing and supporting the economy is evident.

The downside lies in exchange rate pressure due to negative interest rate differentials, influenced by the gold and cryptocurrency markets.

Market Unlikely to Drop by 15-20%

Dragon Capital’s Investment Director highlighted three pillars supporting the economy and the stock market: macroeconomic stability, profit growth, and monetary policy.

He noted that Vietnam previously had a period of strong and stable monetary easing, but without profit growth. Currently, while profit growth is present, monetary policy is being tightened, and stability is a concern. A strong market requires a confluence of all three factors.

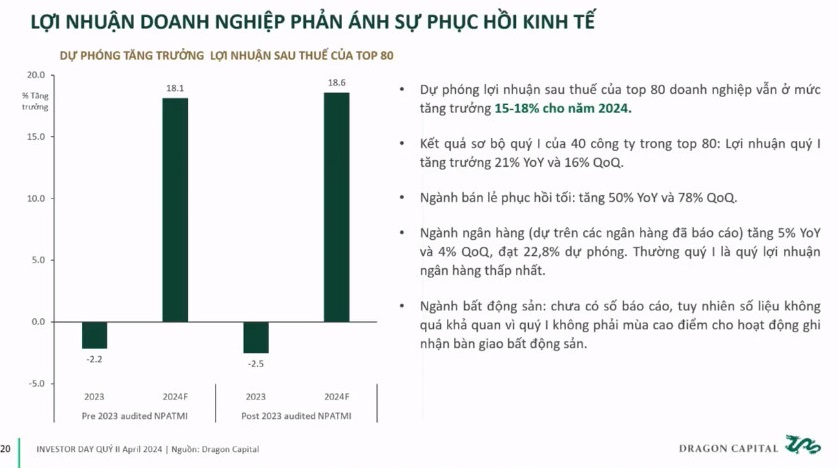

According to Dragon Capital, profit growth for the top 80 companies is projected at 18-19% in 2024, with a recovery seen across various sectors, including retail, banking, and real estate. While the real estate sector’s profits have yet to recover, property markets in Ho Chi Minh City and Hanoi have shown some signs of warming.

Preliminary results for Q1 from 40 companies in the top 80 indicate a 21% profit growth compared to the same period last year.

Screenshot

|

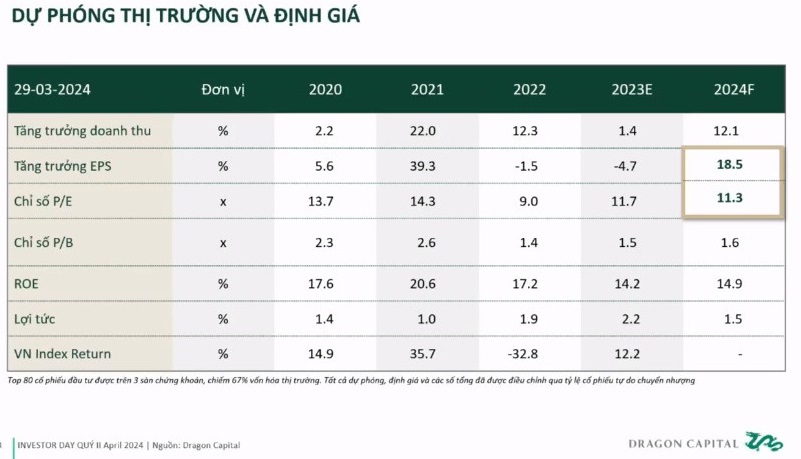

Regarding valuations, the P/E ratio for the 80 companies stands at 11 times, and with projected EPS growth of 18-19%, this valuation is relatively attractive, considering the medium term, excluding short-term fluctuations.

Screenshot

|

Screenshot

|

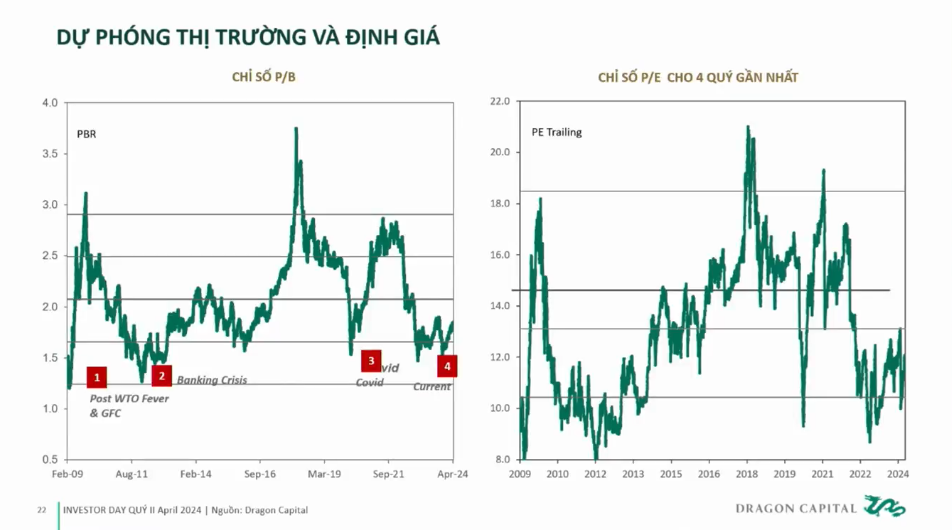

The P/B valuation remains around one standard deviation below the ten-year average. This implies that the probability of a 15-20% market decline is extremely low. When price corrections occur, it should be seen as an opportunity for sustainable medium- and long-term investment, not as an exit point, advised Mr. Tuan.

Regarding the exchange rate, he acknowledged that recent fluctuations have been moderate compared to the region. However, due to unfamiliarity, a 4-5% fluctuation is perceived as significant by investors. Monetary policy in 2024 is expected to be more expansionary than in 2019, with mortgage rates currently in the range of 4.8-6%. To balance exchange rates and interest rates, monetary policy will likely involve short-term increases in deposit rates of 50-100 basis points over the next 3-6 months.

Mr. Tuan also noted that while interest rates may rise, the increase is unlikely to be aggressive due to slow credit growth and a partially recovered but still sluggish economy.