According to the report of BVBank’s Board of Directors and Executive Board, BVBank has always closely followed the policies and guidelines of the Government and the State Bank of Vietnam (SBV) in 2023. It has promptly and flexibly implemented action plans to accompany customers during the economic difficulty period, maintaining a sustainable relationship between the bank and its customers, and at the same time ensuring some important financial indicators.

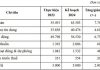

As of the end of 2023, total bank assets reached nearly VND 88,000 billion, an increase of 11% compared to 2022, of which outstanding loans to customers reached VND 57,800 billion, an increase of more than 14% over the same period. Retail customer loans accounted for the majority with 70% of the total outstanding loans. Total capital mobilization reached over VND 67,000 billion, an increase of 13% compared to the previous year.

In 2023, BVBank always pioneered in offering loan packages with preferential interest rates to individual customers and corporate clients to share difficulties for long-term development. Reducing interest rates to support production units to develop the economy has somewhat affected the decline in profit in 2023. However, BVBank’s action to provide practical support to customers in a timely manner, along with continuing to promote utilities on the digital platform, has helped BVBank increase its customer base by 34%, reaching 1.7 million customers.

In parallel with that, to promote retail business through expanding its presence, BVBank has increased the number of business units by nearly 1.5 times compared to 5 years ago, with 116 locations in 31 provinces and cities across the country.

BVBank’s SHM on April 19

General orientation in 2024, BVBank continues to follow market developments, be flexible in management and operation, adhering to the orientation of “growth – quality – efficiency – sustainability”. According to the general assessment, the economy will recover in 2024 but still faces many difficulties due to factors such as global geopolitical instability, slow inflation reduction, etc. Accordingly, at the congress, the Board of Directors and the Executive Board submitted and approved the main business targets in 2024. Specifically, compared to 2023, total assets will reach the milestone of VND 100,000 billion, an increase of 14%; customer deposits will reach over VND 74,000 billion, an increase of 10%; outstanding credit balance will reach nearly VND 66,000 billion, an increase of 14% (according to the credit limit permitted by the SBV), profit will reach VND 200 billion.

At the conference, BVBank’s Executive Board shared that in the first quarter, BVBank’s pre-tax profit is estimated to reach nearly VND 70 billion, or 35% of the target plan for the whole year 2024.

Also at the conference, BVBank continued to present a plan to increase charter capital in 2024 in order to enhance financial capacity, increase operating capital scale and competitiveness in the market. The conference also agreed to continue implementing the 2023 capital increase plan that has been approved and increase an additional VND 890 billion in 2024, raising the total charter capital after the increase to over VND 6,400 billion.

2024 is the first year after switching to the new brand identity BVBank (SBV approved the abbreviated English name BVBank in May 2023), BVBank continues to promote retail activities, expanding 10 more business locations to 126 points, present in 33 provinces and cities nationwide, accompanying customers through flexible lending policies, reducing interest rates …, while aiming to be one of the effective digital transformation banks and bring the best experience to customers.