After 5 months of relentless surge to nearly 1,300 points, unpredictable variables at home and abroad have triggered a sharp decline in the VN-Index. Although the discount is “insignificant” compared to the previous rally, the nearly 60-point correction in the April 15 session also significantly impacted investor sentiment.

Corrective wave creates new cycle for VN-Index to continue its rally

Commenting on the market context at the “Investor Day Q1/2024” recently organized by Dragon Capital, Mr. Vo Nguyen Khoa Tuan – Senior Business Director, Securities Sector, Dragon Capital said that, in the short term, the correction could continue, but this will not affect the market’s medium-term uptrend.

“The correction will create a new cycle for the market to continue conquering new peaks,” Mr. Vo Nguyen Khoa Tuan affirmed.

Speaking about Dragon Capital’s strategy during this period, the expert believes that as soon as it forecasted an upcoming correction, Dragon Capital prepared in advance by increasing the cash ratio and decreasing the stock ratio.

“Strong market fluctuations are also when we need to soberly reassess the investments to restructure the portfolio. Specifically, taking advantage of the opportunity to buy promising stocks at low prices so that when the market recovers, our portfolio also recovers strongly. In fact, when retail investors are selling at all costs, that’s when we prepare to buy,” the Dragon Capital expert said.

According to the expert, during this period, investors have many concerns when information about the Fed’s interest rate policy, geopolitical tensions, exchange rates, domestic monetary policy, etc. emerge frequently. However, the expert believes that reading too much news does not necessarily lead to the right decision. Instead, investors need to stick to their strategy and take a longer-term view.

The market needs to go through small “potholes” before it rises

Sharing the same view, Mr. Le Anh Tuan – Director of Dragon Capital’s Investment Division, believes that the correction period is not the time for investors to leave the market but to take advantage of allocating funds for the medium- to long-term perspective.

The positive view of the stock market was shaped by Dragon Capital experts based on three factors: macroeconomic stability, monetary policy, and profit growth. The economy has shown signs of recovery, and corporate profit growth reflects the recovery of the economy. However, exchange rates and interest rates are unfavorable factors, preventing the stock market from moving in a straight line.

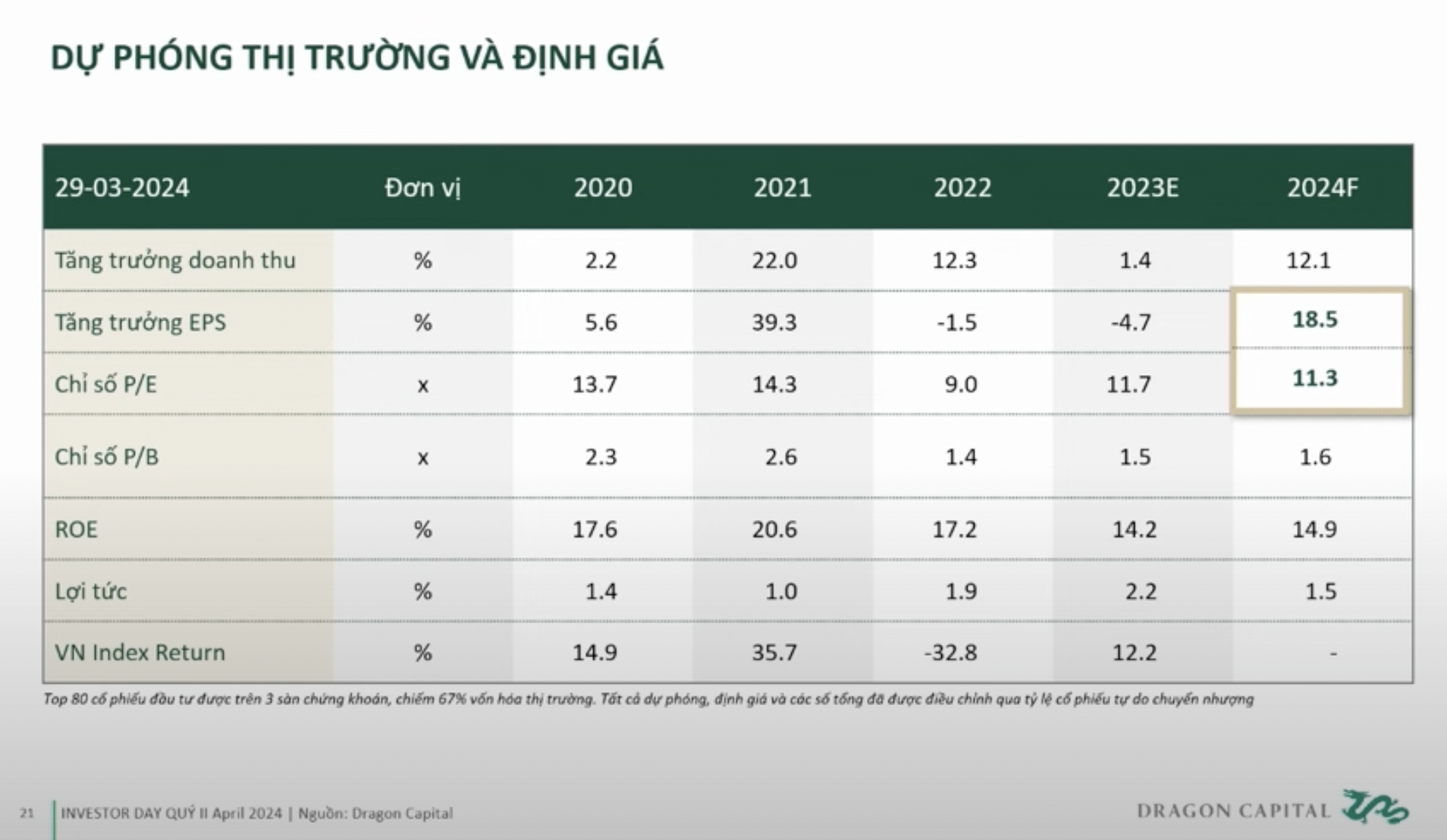

Regarding market valuation, Dragon Capital’s statistics show that the valuation of the top 80 businesses is at 11 times, while EPS growth is up to 18.5%. Accordingly, the valuation is relatively attractive in the medium term.

Expectations of upgrading the stock market are good if they happen, but they do not significantly affect the market. The expert believes that valuation, growth, and loose monetary policy, as it is now, are enough to make the market attractive to cash flow.

Looking back at the previous rally, the market also had 10-15% corrections during the strong upcycle. The current macroeconomic fluctuations are significant, but the market has maintained a good rhythm. This shows that investor sentiment is stable in the face of flexible management policies.

“Once the Fed reverses course and cuts rates, the market will rebound. Of course, to get there, we will have to go through small “potholes,” similar to how the market inevitably experiences a shakeout during an uptrend. Investors should not think that a “pothole” can change the landscape. Instead, if they appear, think about putting more money into the market,” Mr. Le Anh Tuan commented.