In the 2023 audited consolidated financial report, GKM Holdings Joint Stock Company (GKM, HNX floor) recorded net revenue of 387.7 billion VND, a decrease of 24% compared to 2022. After deducting the cost of goods sold, gross profit reached 64 billion VND, a decrease of 14% compared to the previous year.

During the period, financial revenue increased fourfold to reach 47 billion VND. Similarly, financial expenses increased slightly to 28.4 billion VND, and enterprise management expenses nearly doubled to 18 billion VND. Sales expenses decreased by 45% to just over 14 billion VND.

After deducting taxes and fees, GKM Holdings reported after-tax profit of over 39 billion VND, double that of 2022. As of the end of 2023, total assets of GKM Holdings stood at 433 billion VND, a decrease of nearly 200 billion VND compared to the beginning of the year. Of these, the sharpest decline was in short-term accounts receivable, which amounted to nearly 15 billion VND, down from 195 billion VND at the beginning of the year.

In addition, the enterprise no longer recorded any inventory, down from a value of 52 billion VND at the beginning of the year. The amount of cash decreased from more than 52 billion VND to only 11 billion VND.

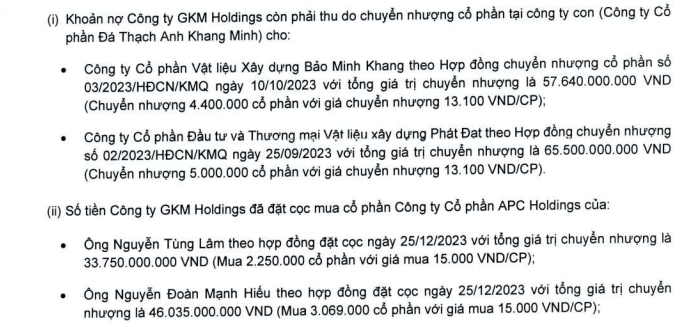

Instead, other current receivables increased dramatically from over 22 billion VND to 151 billion VND. The main reason for this was the incurrence of a debt receivable from the transfer of shares in a subsidiary, Khang Minh Quartz Stone JSC, and the amount used to deposit for the purchase of more than 5 million shares in APC Holdings JSC.

GKM explains the sharp increase in other current receivables. Source: GKM

Regarding investments in joint ventures and associates, GKM Holdings newly created an investment of 60 billion VND in Power Trade JSC. For Khang Minh Quartz Stone JSC, after GKM divested some of its capital, it was recorded as an investment in other entities with a value of 18.8 billion VND. Similarly, Khang Minh Aluminium JSC recorded 7.6 billion VND.

Total debt payable at the end of 2023 of GKM Holdings decreased sharply to only over 96 billion VND, while at the beginning of the year it was still over 300 billion VND. This entire amount is short-term debt, of which short-term financial debt is only over 52 billion VND, including 44 billion VND of outstanding bonds. The company has cleared over 91 billion VND of long-term debt over the past year.

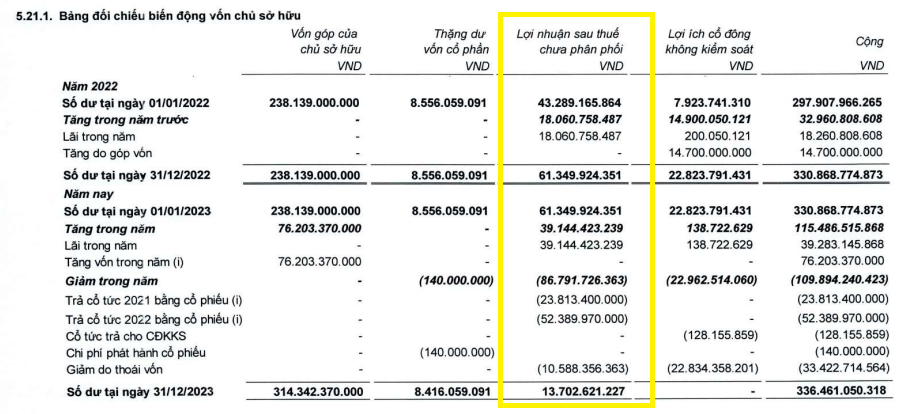

It is noteworthy that in this report, the auditor emphasized the payment of stock dividends to existing shareholders in 2023, and the fact that the BOD of GKM Holdings used the 2023 profit to pay these dividends.

According to the explanation, in January 2023, GKM Holdings spent 23.8 billion VND to pay the 2021 dividend in shares in accordance with the resolution of the 2022 Annual General Meeting of Shareholders. After this issuance, GKM Holdings was listed with an additional 2.38 million shares, equivalent to an additional listing value of 23.8 billion VND. As a result, the total number of listed shares increased to 26.19 million shares, equivalent to a total listing value of 261.95 billion VND.

Following that, in July 2023, GKM Holdings continued to pay the 2022 dividend in shares in accordance with the resolution of the 2023 Annual General Meeting of Shareholders. With a ratio of 100 dividend rights equivalent to receiving an additional 20 new shares, the company issued an additional 5.23 million shares, corresponding to a value of 52.38 billion VND. After completing this issuance, GKM Holdings increased its total number of listed shares to 31.4 million shares, equivalent to a total listing value of 314.3 billion VND.

According to GKM Holdings, the payment of the 2021 and 2022 dividends in shares as mentioned above resulted in the company’s retained earnings deficit at the end of 2022. The company’s Board of Directors has rectified this by using the after-tax profit from operating activities in 2023 to make up the difference.

Changes in GKM’s retained earnings after tax in 2023. Source: GKM

Thanks to the net profit of over 39 billion VND in 2023, the company of Chairman Dang Viet Le has escaped the accumulated loss situation. At the end of 2023, GKM Holdings’ retained earnings after tax stood at 13.7 billion VND.

GKM Holdings JSC (formerly known as Khang Minh Group) is the successor to Gach Khang Minh JSC, which was established in 2010. The company operates primarily in the production of concrete and cement and gypsum products, plastic products, and non-metallic mineral products…mainly serving the Ha Nam, Hanoi, and neighboring province markets.