MB Bank Announces Strong Financial Performance in Q1 2023, Sets Conservative Growth Targets for 2024

Speaking at the company’s annual shareholders’ meeting today (April 19th), Mr. Pham Nhu Anh, CEO of MB Bank, announced that the bank plans to release its financial report later this week.

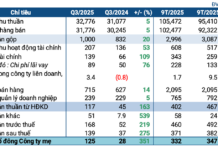

He provided preliminary details regarding MB Bank’s business results, with the bank estimating consolidated revenue of approximately 12,000 billion VND and net income approaching 5,800 billion VND. The parent bank expects revenue to reach 9,782 billion VND, with net income of over 5,258 billion VND. Subsidiary companies contributed revenue of 5,218 billion VND and estimated net income of 550 billion VND.

In the first quarter of 2023, the bank recorded a consolidated pre-tax profit of over 6,500 billion VND. However, Q1 2024 profit is projected to decline by around 11% year-over-year.

Regarding business plans, MB Bank’s management intends to present a conservative profit target compared to the 16% growth achieved in 2023. The bank is forecasting pre-tax profit growth of 6–8%. Based on 2023’s net income of 26,306 billion VND, MB Bank’s consolidated pre-tax profit in 2024 is anticipated to range between 27,884 billion VND and 28,411 billion VND.

In terms of total assets, the bank aims for a 13% increase, reaching close to 1,068 trillion VND by the end of 2024, making it the next bank to surpass the 1 trillion VND milestone after the Big4 group.

Loan growth is projected at 15–16% in 2024, subject to limits set by the State Bank of Vietnam (SBV). Deposits will be adjusted based on capital demand.

MB Bank anticipates ranking among the top in the industry for metrics such as ROE, ROA, and CIR. By the end of 2024, the bank aims to serve 30 million customers, increasing to 40 million by 2029.

Explaining the decision to target a 6–8% profit increase, Mr. Luu Trung Thai explained, “The bank analyzed the industry’s NIM decline in 2023 and its potential impact in 2024. We anticipate NIM will continue to decrease in 2024. Additionally, loan growth in the first quarter of this year has been slower. Ordinarily, Q1 credit growth is 4–5%, but there has been no growth this year, with only a modest increase of around 0.23% to date. Meanwhile, the industry’s non-performing loan ratio rose sharply in 2023, increasing the pressure for bad debt provisioning. Therefore, management has opted for a cautious approach with a profit plan of 6–8%, aiming to achieve 10%. This year, we will proceed calmly and lay the groundwork for greater stability in the future.”