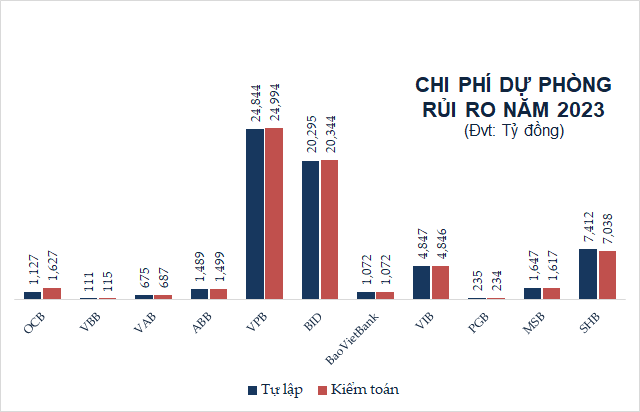

Increased Risk Provisioning Leads to Decline in Profitability

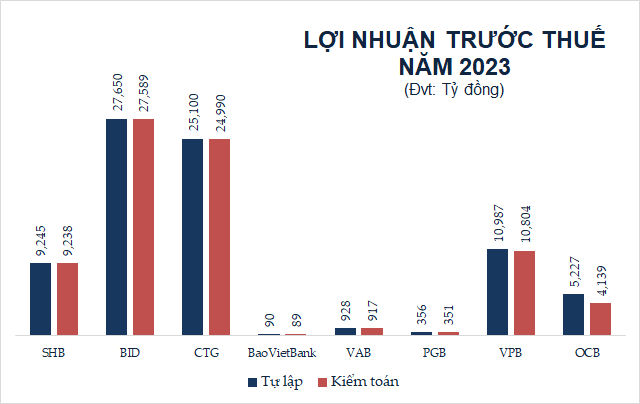

Eight banks have reported a decrease in profits in their audited financial statements compared to their independently prepared reports. The decline in some banks amounts to hundreds of billions or even trillions of Vietnamese đồng.

According to the audited financial statements for 2023, OCB‘s pre-tax profit reached 4.139 trillion đồng, a decrease of 1.088 trillion đồng, due to a 501 billion đồng increase in provisioning expenses and an adjustment to certain revenue items that were actually received from customers in 2023 but will be recognized in 2024.

Explaining the difference, OCB stated that the bank has proactively set aside additional provisions to strengthen its credit risk buffer. OCB‘s management also noted that the adjustment to certain revenue items recognized in 2023 will be completed in Q1 2024. Additionally, for customer debts where collateral has been handed over to replace the repayment obligation, the bank has processed a 50% reduction up to now, so the additional provisions made for these assets at the end of 2023 will also be reversed accordingly. As a result, the bank’s business performance in Q1 2024 is expected to improve significantly.

Similarly, at VPBank, pre-tax profit decreased by 183 billion đồng after the audit, reaching only 10.804 trillion đồng, due to increased provisioning, enhancing the coverage of bad debts.

The consolidated non-performing loan (NPL) ratio also increased by approximately 0.45%, as some bonds were downgraded. These are part of the bond maturity extension program under Decree 08. VPBank has also planned to address these NPLs in Q2.

SHB‘s pre-tax profit decreased by only 7 billion đồng (to 9.238 trillion đồng), but its post-tax profit fell by 146 billion đồng (to 7.324 trillion đồng) after the audit.

The decline in profit at this bank was primarily due to adjustments in revenue sources from business operations, including net interest income, net income from service activities, net income from trading in investment securities, and income from equity stakes. These adjustments led to a decrease in net income from business operations by 380 billion đồng, to 16.276 trillion đồng.

However, credit risk provisioning expenses decreased by 374 billion đồng after the audit, resulting in a decrease of only 7 billion đồng in pre-tax profit. Since the audit resulted in an increase of 140 billion đồng in corporate income tax, SHB‘s post-tax profit decreased by 146 billion đồng.

State-owned banks also reported differences in their audited financial statements compared to their independently prepared reports. BIDV‘s pre-tax profit decreased by 61 billion đồng in the audited financial statements, to 27.589 trillion đồng, due to a decrease in net income from business operations and an increase in provisioning for risk.

VietinBank saw a decrease in both net income from business operations and risk provisioning, leading to a reduction of 110 billion đồng in pre-tax profit, to 20.045 trillion đồng.

Source: VietstockFinance

|

Source: VietstockFinance

|

Profit Variation Not Significant, No Anomalies

Mr. Nguyen Tri Hieu – Financial and Banking Expert stated that the differences between banks’ independently prepared financial statements and the figures reported by audit firms are not uncommon, as auditors employ specific methods to verify and examine the banks’ accounting records, particularly in provisions-related items, which can lead to discrepancies. Certain asset valuation procedures may also differ due to varying deductions, resulting in different profit figures in the two types of reports.

However, Mr. Hieu pointed out that significant variations would be unusual and could indicate subjectivity on the part of the bank or the auditor. Banks may have different accounting practices than auditors, and vice versa.

Moreover, there can be differences in the recognition of provisions for risks, especially for bad debts. Banks may set aside provisions based on both quantitative and qualitative criteria. Quantitative criteria may not vary significantly, but qualitative criteria can lead to different provisions.

Mr. Hieu provided an example of a customer currently classified in loan group 3. If the bank has qualitative information suggesting a decline in market conditions or problems with the management team, it may upgrade the loan to group 4 (with a provisioning rate of 50%). In contrast, the auditor may believe that these issues do not significantly impact the loan and keep it in group 3 with a 20% provisioning rate. As a result, depending on the perspectives of the parties involved, provisions for bad debts may vary, affecting the profit figures reported in the independently prepared and audited financial statements.

Assoc. Prof. Nguyen Huu Huan – Lecturer at Ho Chi Minh City University of Economics emphasized that the reported figures can also be influenced by the timing of their release. When publishing their independently prepared financial statements, some banks may aim to report higher profit figures to satisfy their shareholders.

Independently prepared financial statements are typically released at the end of the year, and reporting higher profits can lead to an increase in the bank’s share price. Once this information is reflected in the share price, a downward adjustment in profits does not have a significant impact; it depends on the objectives of the executive board and the board of directors.

However, compared to the tens of trillions of đồng in profits, the downward adjustments in profits after audits are typically in the range of tens of billions of đồng, which does not significantly impact the banks’ fundamental operations.