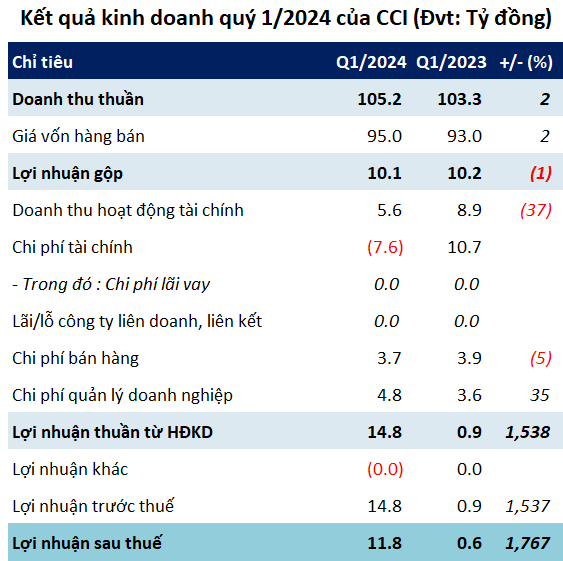

In Q1/2024, Cu Chi Industrial Commercial Development Investment JSC (HOSE: CCI) recorded net revenue of over VND105 billion, up 2% year-on-year; while financial revenue decreased by 37% to nearly VND6 billion. After deducting the cost of goods sold, the company’s gross profit reached over VND10 billion, down slightly by 1%.

A highlight in CCI‘s business picture in the first quarter was the reversal of nearly VND8 billion in impairment provision for investment in VAB securities, which helped the company achieve a net profit of nearly VND12 billion, 18.7 times higher than the same period last year.

Source: VietstockFinance

|

In 2024, CCI sets its business plan with revenue of nearly VND473 billion and after-tax profit of nearly VND27 billion, up 3% and 6% respectively compared to 2023. Compared to the plan, CCI has reached 22% of the revenue target and 44% of the after-tax profit target after the first quarter.

It is worth noting that after announcing positive business results, CCI‘s share price went against the market trend and hit the ceiling (6.79%) in the session of April 17, closing at VND20,450 per share. However, compared to the beginning of the year, CCI‘s share price has decreased by nearly 19%.

CCI share price movement since the beginning of 2024

As of March 31, 2024, CCI‘s total assets reached nearly VND797 billion, a slight increase of 2% compared to the beginning of the year. In which, most of the assets are concentrated in the form of short-term assets with nearly VND499 billion, accounting for 63% of total assets. The company also has nearly VND57 billion in cash and cash equivalents, an increase of 56%. Meanwhile, construction in progress costs over VND99 billion, down 6%.

On the other side of the balance sheet, CCI has over VND545 billion in liabilities, up 5% compared to the beginning of the year, mostly long-term unearned revenue of nearly VND482 billion. Notably, the company does not record any financial borrowings.

CCI was formerly Cu Chi Trading Company, established in 1992 on the basis of the merger of Supplies Company and General Trading Company. CCI‘s main business activities are investing in the construction and trading of industrial park infrastructure, construction and trading of real estate, and selling fuels and construction materials. The company has a total land use area of 475.25 hectares and has implemented large-scale projects such as the Tay Bac Cu Chi Industrial Park project, the Tay Bac Cu Chi industrial park resettlement area project, the Tan Phu Hung resettlement area project, the Dinh Kiep residential area project, etc.