Illustrative Image

Vietnam’s consumer market is considered a “fertile ground” for retailers, especially as the average income of the population continues to rise, the middle class is growing rapidly and modern shopping channels are becoming increasingly popular.

It is estimated that modern shopping channels could account for up to 30% of the market share in the entire retail industry by 2025. Currently, in Vietnam, on average, for every 100,000 people, a hypermarket and a shopping center are needed; for every 10,000 people, a mid-sized supermarket is needed; and for every 1,000 people, 1 to 3 convenience stores are needed.

With such great potential, the competition for market share among retail businesses is also becoming increasingly fierce. In this race, in addition to the long-standing food and consumer goods retail chain Co.op Mart (part of Saigon Co.op), the two chains Bach Hoa Xanh (part of The Gioi Di Dong) and WinMart, WinMart+ (part of Masan Group) are emerging as two chains with great ambitions, aiming to develop mini supermarkets providing fresh food and essential goods on the largest scale in Vietnam.

Double-digit growth target and profit orientation

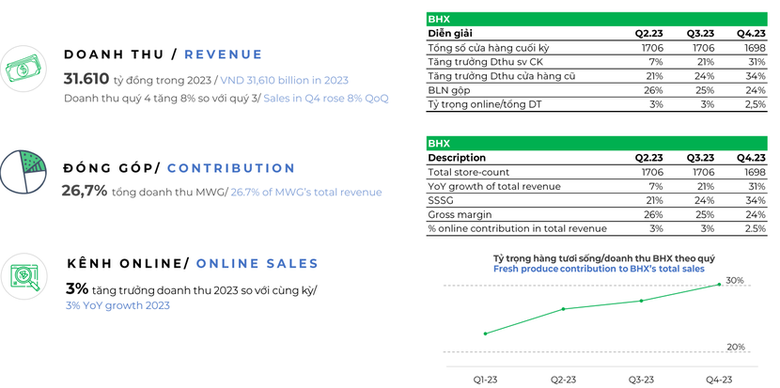

For the Bach Hoa Xanh chain, the company’s leadership does not hide the expectation that it will be the “trump card” that drives the growth of The Gioi Di Dong (MWG code) in the next 5 years. The goal of this food and consumer goods chain in 2024 is to contribute about 30% of revenue to MWG, increase revenue by double digits, increase market share and start to generate profits.

In fact, in 2023, with revenue of 31,500 billion VND, Bach Hoa Xanh for the first time rose to the top of revenue in the domestic food and consumer goods retail chains – which was previously held alternately by Co.opmart or WinMart/WinMart+. The year 2023 was also an important milestone for Bach Hoa Xanh as this chain completed the restructuring process and saw its business recover from the third quarter of 2023.

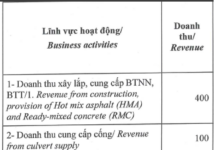

Bach Hoa Xanh’s Business Results in 2023 – Source: MWG

Reaching breakeven in December 2023, and completing the transaction for a 5% private placement to foreign investor CDH Investments in early April 2024, will be the premise for Bach Hoa Xanh to make a breakthrough in the coming period.

“At the end of 2023, the company’s management team set a target that Bach Hoa Xanh must have a profit this year and is trying to pursue that goal,” MWG’s CFO said at the 2024 Annual General Meeting of Shareholders.

According to Mr. Pham Van Trong, CEO of Bach Hoa Xanh, in the first quarter of 2024, everything is going according to plan. The company is confident that it will have a gross profit this year. In fact, in the next 2-3 years, this retail chain can achieve a four-digit profit.

Currently, Bach Hoa Xanh is focusing on increasing average store revenue and “bringing money home for mom,” with a plan to open 100 more stores this year (mainly in Ho Chi Minh City), bringing the total number of stores to nearly 1,800 before expanding further next year. It is expected that by the end of this year, Bach Hoa Xanh’s leadership will sit down to calculate whether or not to expand into the Central and Northern regions.

In addition, according to MWG’s management, after completing the sale of 5% of its shares in a private placement to foreign investors, Bach Hoa Xanh has no plans to raise more capital. Instead, the chain will focus on developing to a scale large enough to generate several trillion VND in profit before being listed on the stock exchange, as committed to investors and expected by shareholders.

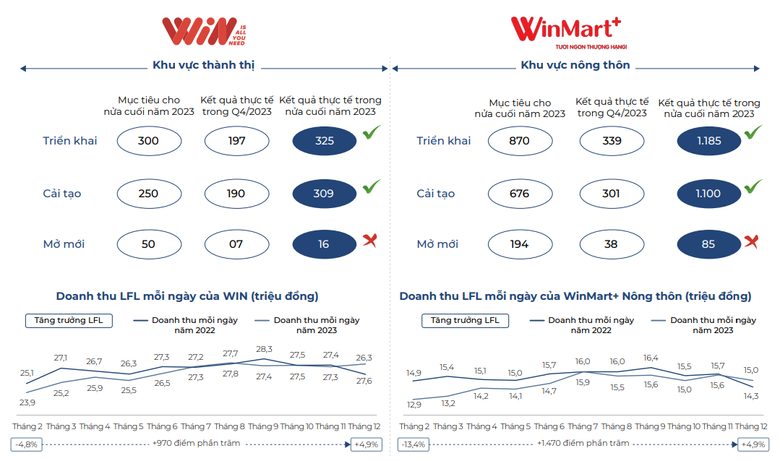

For the WinCommerce chain, Chairman of Masan Group (MSN code) Nguyen Dang Quang is also confident that this retail chain is on track to reap sustainable profits in 2024. “For WinCommerce, the measure that most clearly reflects its effectiveness is its net profit after tax. Although WinCommerce has not yet achieved this, it has a roadmap in hand to make it happen,” said the Chairman of Masan in the 2023 annual report.

In 2024, Masan expects consolidated net revenue to reach between 84,000 and 90,000 billion VND, equivalent to a growth of 7% to 15% compared to the same period in 2023. In which, WinCommerce’s net revenue is expected to reach from 32,500 to 34,000 billion VND, an increase of 8% to 13% compared to last year. This growth is driven by a faster LFL (Like For Like – a widely used metric for measuring current trading performance by retailers) growth rate, network expansion and positive results from new stores.

In the base scenario with net revenue of 32,500 billion VND, in which the market recovers at a slower pace than expected, LFL growth is cautiously forecast to be in the range of 0% to 5%, WinCommerce plans to open 400 new convenience stores. In case consumer sentiment picks up at the beginning of 2024, LFL growth is forecast to reach between 9% and 13%, and WinCommerce will open 700 new convenience stores.

Previously, in 2023, in the context of a difficult modern retail industry, instead of implementing a plan to open 800 – 1,200 new stores, WinCommerce decided to shift its focus from pure network expansion to store renovation and operational efficiency to strengthen the company’s competitive edge while delivering profit growth. By the end of 2023, the total number of Winmart supermarkets and Winmart+ stores nationwide reached 3,633 supermarkets and stores.

In 2023, WinCommerce decided to shift its focus from pure network expansion to store renovation – Source: Masan’s 2023 Annual Report

Thanks to the positive impact of new store openings, the strong growth of converted stores and the success of upgrading the store model, WinCommerce’s revenue returned to the 30,000 billion VND mark (reaching 30,054 billion VND) in 2023, an increase of 2.3% compared to the same period last year.

Notably, after achieving positive EBIT for the first time in Q3/2023, WinCommerce has maintained profitability with a slight increase in EBIT and EBITDA margin, reaching breakeven and 3.2% in Q4/2023, respectively. The LFL minimart store’s net profit margin reached 3.7% in Q4/2023.

According to Masan’s management, the achievement of a positive net profit margin for the first time in Q4/2023 will provide a solid foundation for WinCommerce to expand its network sustainably and profitably.

What are the competitive advantages?

<