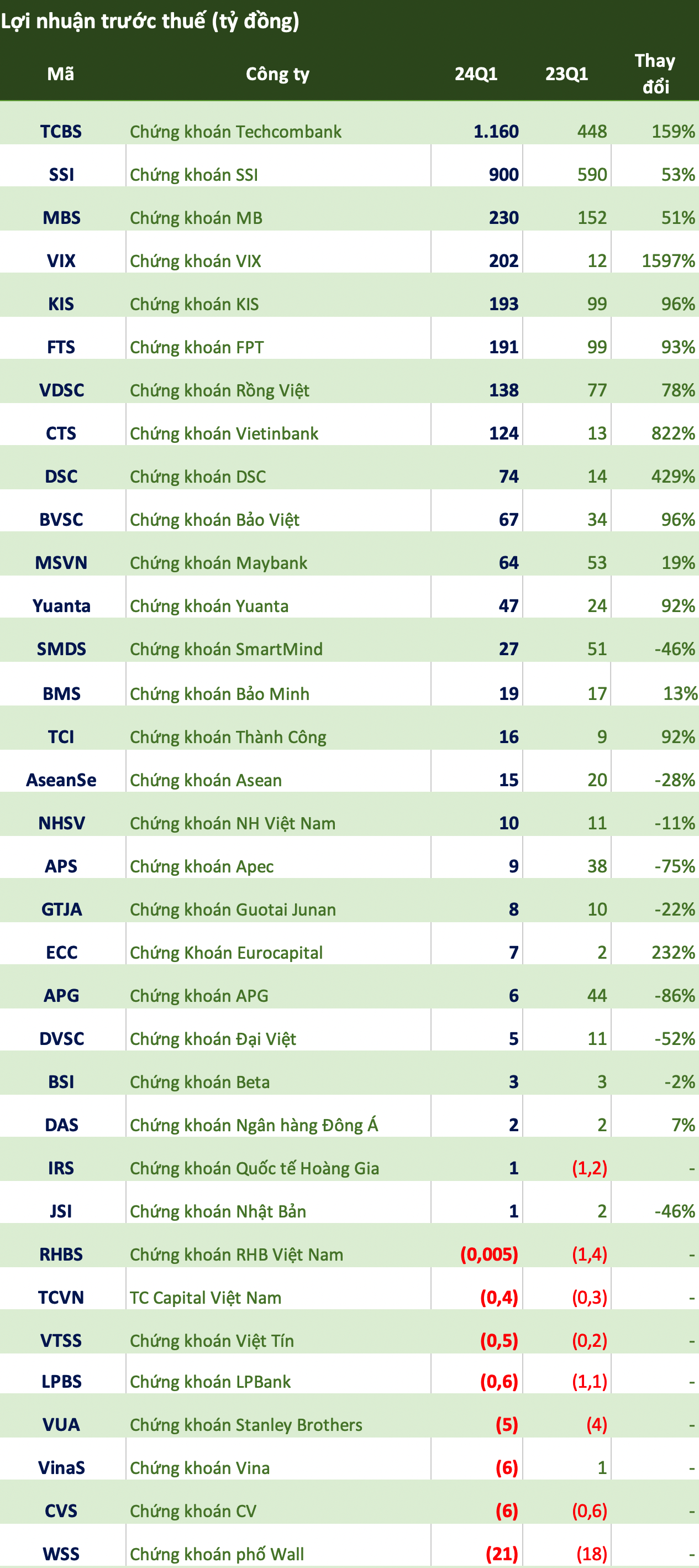

As of the morning of April 18, 2024, 34 brokerages had released their Q1 2024 financial statements.

In the group with the highest profits to date, SSI Securities has announced its standalone financial report for the first quarter with total revenue reaching VND 1,945 billion, a 33% increase over the same period previous year.

In the first quarter of the year, the brokerage service segment recorded revenue of nearly VND 911 billion, accounting for the largest proportion of total revenue at 47%. brokerage, custody, investment consulting and other services reached VND 464 billion, up 66% over the same period. Interest income on margin loans and pre-sale advances reached VND 447 billion, up 32% over the same period.

Revenue from investment activities reached approximately VND 902 billion, a 33% increase over the same period and contributing 46% to total operating revenue. in addition, revenue from capital sources and financial trading recorded nearly VND 132 billion, accounting for 7% of total revenue.

As a result, SSI’s profit before tax in the first quarter of 2024 reached VND 900 billion, an increase of 53% compared to the same period in 2023.

FPT Securities (FPTS, code FTS) recorded operating revenue of over VND 299 billion in the first quarter of 2024, an increase of 68% compared to the same period. As a result, net profit after tax increased by 93% to VND 191 billion, of which realized profit was over VND 123 billion, an increase of 25%, while unrealized profit was over VND 68 billion.

In the group of bank-owned brokerages, Vietinbank Securities (code CTS) recorded a 63% increase in operating revenue to nearly VND 324 billion. The best growth was recorded in profit from FVTPL assets with an increase of nearly 88% to VND 165 billion. Interest income from loans and receivables also increased by nearly 72% compared to the same period, to more than VND 79 billion.

After deducting expenses, CTS earned a pre-tax profit of over VND 124 billion, an increase of 822% compared to the modest profit of VND 13 billion in the first quarter of the previous year.

Profit growth was also recorded at Bao Viet Securities (BVSC, code BVS) with net profit after tax reaching VND 67 billion, almost double that of the same period last year. Specifically, thanks to the favorable market, BVSC’s total revenue increased by 71% to 236 billion, of which 219 billion was operating revenue, an increase of more than 86%. The largest proportion was brokerage revenue with over 91 billion, followed by interest income from loans and receivables with 75 billion.

In contrast, Vina Securities and Stanley Brothers Securities are the next names to report losses in the first quarter of 2024. While Vina Securities lost nearly VND 6 billion, in the same period of 2023 it still earned nearly VND 1 billion; Stanley Brothers (VUA) lost more than VND 5 billion, higher than the loss of nearly VND 4 billion in the first quarter of last year.