With a significant 24-hour trading volume of $2.97 billion and a surging price of $151.34, Solana demonstrates strong market performance.

This 5% increase has pushed Solana’s market capitalization to approximately $67.62 billion, solidifying its position as the fifth-largest cryptocurrency by market cap.

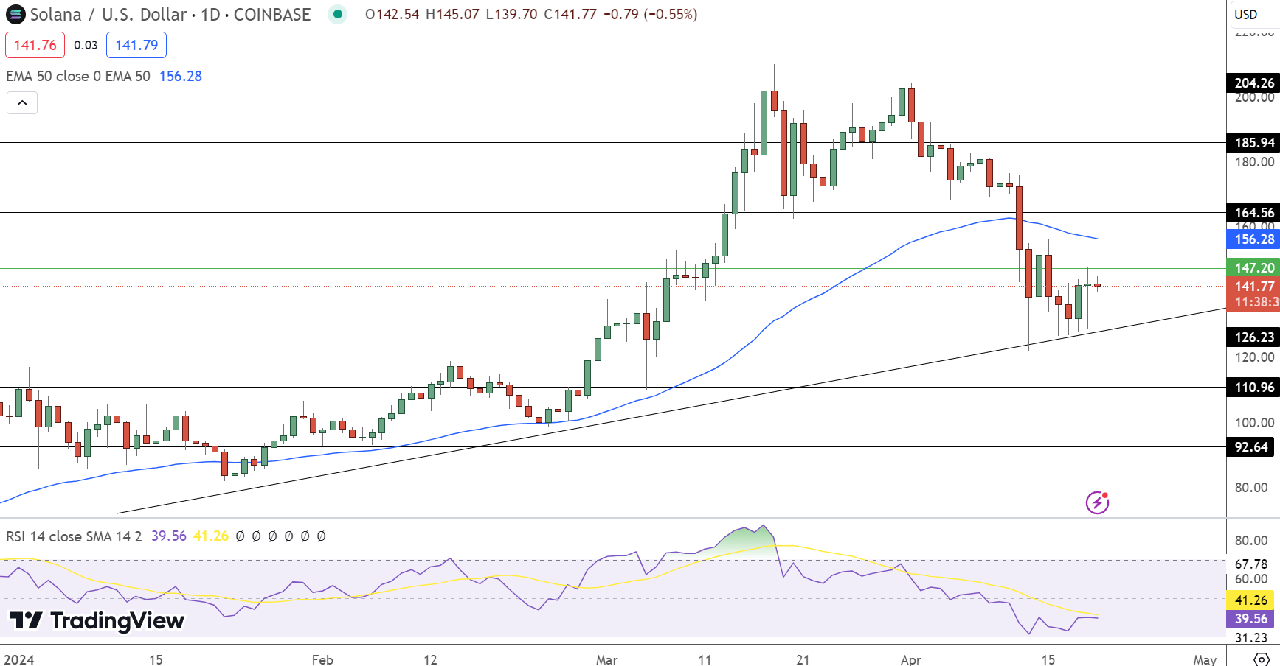

Solana’s pivot point is set at $147.20 with a resistance level at $164.56 followed by subsequent barriers at $185.94 and $204.26.

Should the uptrend continue, breaking through these barriers could indicate a stronger bullish trend for Solana.

Conversely, support levels are identified at $126.23, followed by $110.96 and $92.64. These levels could provide significant bounce points if selling pressure emerges.

The Relative Strength Index (RSI) currently stands at 39, suggesting that Solana is nearing an oversold condition, which may encourage buying momentum if it dips further.

Additionally, the 50-day Exponential Moving Average (EMA) at $156.28 presents a potential resistance level.

In summary, while Solana’s present outlook is bullish above $147.20, a drop below this level could induce a more significant sell-off.

Investors and traders will closely monitor these levels, as a breakout could lead to further gains, while a failure to hold could see Solana retreat to lower support areas.