Despite the continuously strong correction in the stock market, there are still impressive stocks that buck the trend, notably SMC stock of SMC Investment and Trading Joint Stock Company. This stock has just hit the ceiling for two consecutive sessions to reach VND 11,400 per share. SMC even broke the liquidity record in the session on April 17 with a trading volume of nearly 3 million units.

The stock surged amid the context of SMC’s recent announcement of the submission to the 2024 Annual General Meeting of Shareholders on the adjustment and addition of business lines, including real estate. Previously, SMC announced the resolution of the Board of Directors on the transfer of land use rights, house ownership rights, and assets attached to the land according to certificate number BA 399127, number of land use right certificate CT06816 issued by Ho Chi Minh City People’s Committee – Department of Natural Resources and Environment on June 15, 2011.

Specifically, the land plot SMC is preparing to transfer has an area of 329.5 m2. The old address is 396 Ung Van Khiem, Ward 25, Binh Thanh District, HCMC. The current address has been changed to 681 Dien Bien Phu, also in Ward 25, Binh Thanh District. Notably, this is SMC’s headquarters according to the business registration certificate. According to SMC, the transfer value of this office building is VND 170 billion.

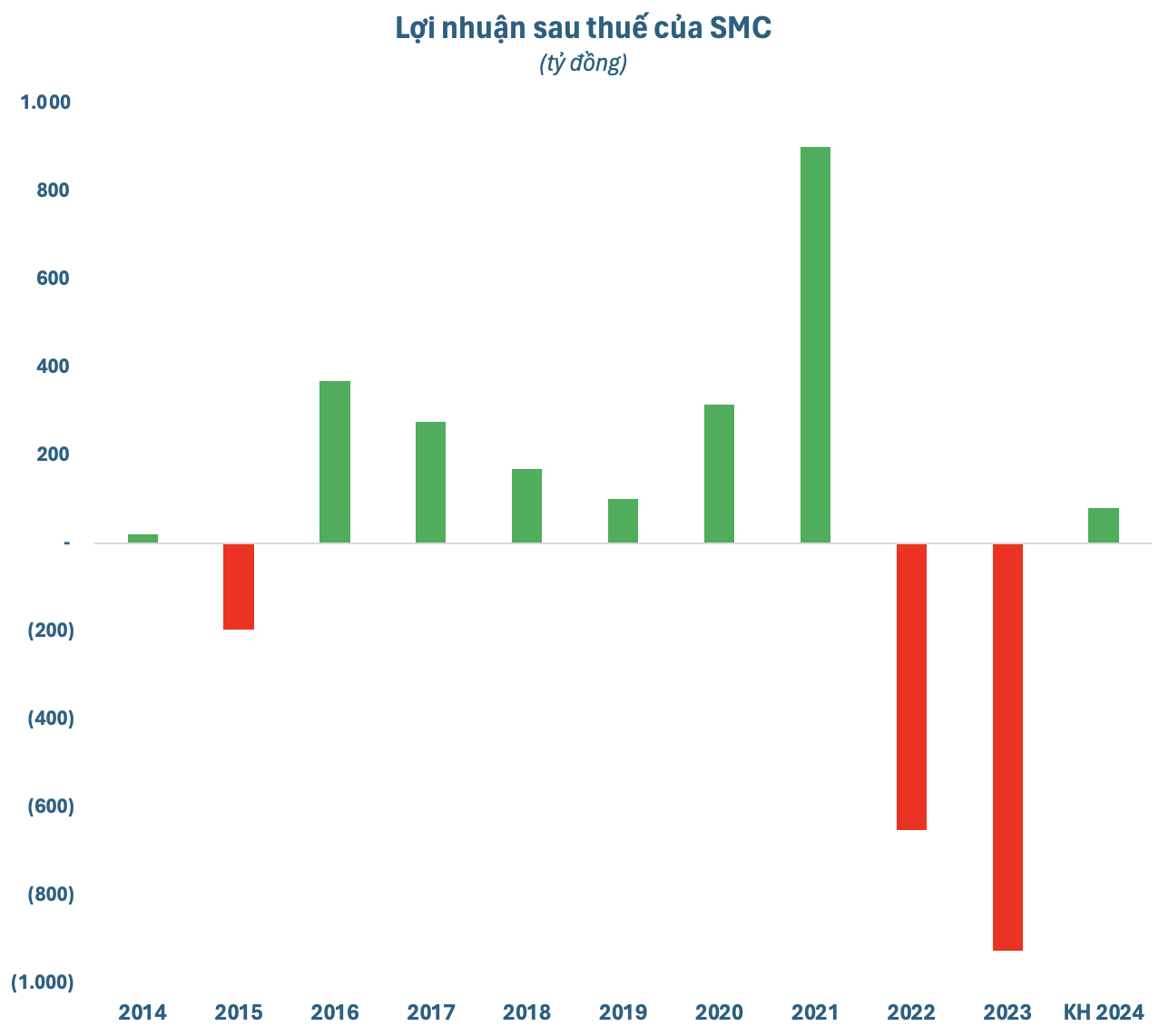

Recently, SMC has made many moves to sell assets to increase liquidity for the enterprise after two consecutive years of losses in the period 2022-23, including the sale of 13 million shares of Nam Kim Steel (code NKG) and the transfer of the right to use land and assets attached to land at SMC Tan Tao 2 and SMC Binh Duong.

As of the end of 2023, SMC’s accumulated loss was nearly VND 169 billion. For this reason, SMC shares have been put on alert and under control by the Ho Chi Minh Stock Exchange (HoSE) since April 10. To overcome this situation, SMC said that it will manage inventory, optimize production processes, cut costs, and especially carry out the transfer and liquidation of assets as well as financial investments.

In the document, SMC revealed that it expects to make a profit after tax in the first quarter of 2024, mainly from the liquidation of financial investments and assets. In the second quarter of 2024, the enterprise will continue to monitor the actual economic situation and the steel industry to come up with appropriate solutions. With the above plan, SMC believes that it can overcome the situation of its shares being warned and controlled within the first 6 months of 2024.

In 2024, SMC plans revenue of VND 13,500 billion, a slight decrease compared to the implementation in 2023. However, the after-tax profit is expected to reach VND 80 billion, much better than last year’s record loss of VND 925 billion. To achieve this goal, SMC is focusing on streamlining the business, saving costs, and strengthening the management and control of accounts receivable and credit risks.

Notably, SMC also plans to offer 73 million shares with a price of VND 10,000 per share, expected to be implemented in 2024. The privately issued shares will be restricted from transfer within 1 year and will only be offered to a maximum of 20 investors. If successful, SMC will raise VND 730 billion to pay for loans, debts to suppliers, and supplement working capital.