Latest Savings Interest Rates at GPBank

Today (April 19), Global Petroleum Bank (GPBank) officially increased saving interest rates across all terms, with an increase of 0.2 percentage points compared to the previous rates.

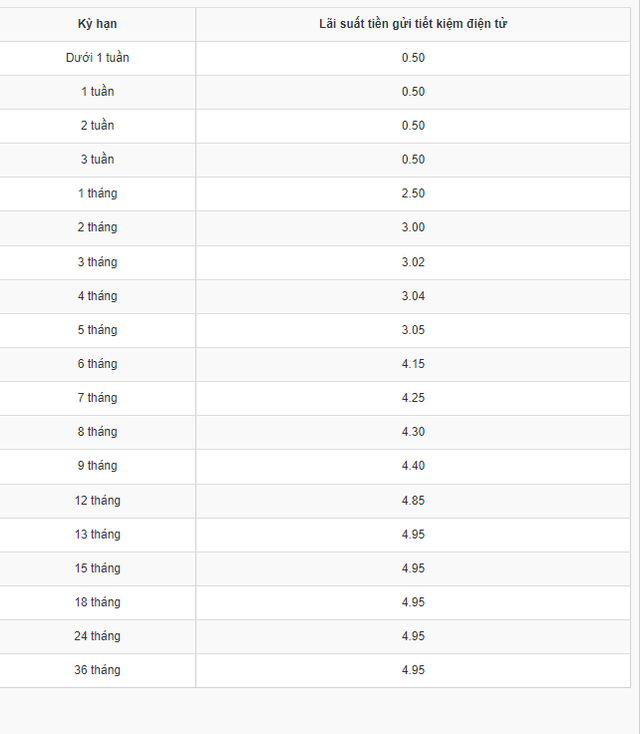

Specifically, the saving interest rate for the 1-month term is 2.5%/year, the 2-month term is 3%/year, the 3-month term is 3.02%/year, the 4-month term is 3.04%/year, the 5-month term is 3.05%/year.

For the 6-month term, the bank has set the interest rate at 4.15%/year, the 7-month term at 4.25%/year, the 8-month term at 4.3%/year, the 9-month term at 4.4%/year, and the 12-month term at 4.85%/year. For the 13-26 month term, GPBank offers an interest rate of 4.95%/year.

Latest saving interest rates at GPBank.

Latest Saving Interest Rates at Bac A Bank

Two days prior (April 17), Bac A Bank also adjusted its saving interest rates upwards across all terms. The increase ranged from 0.15 to 0.4 percentage points.

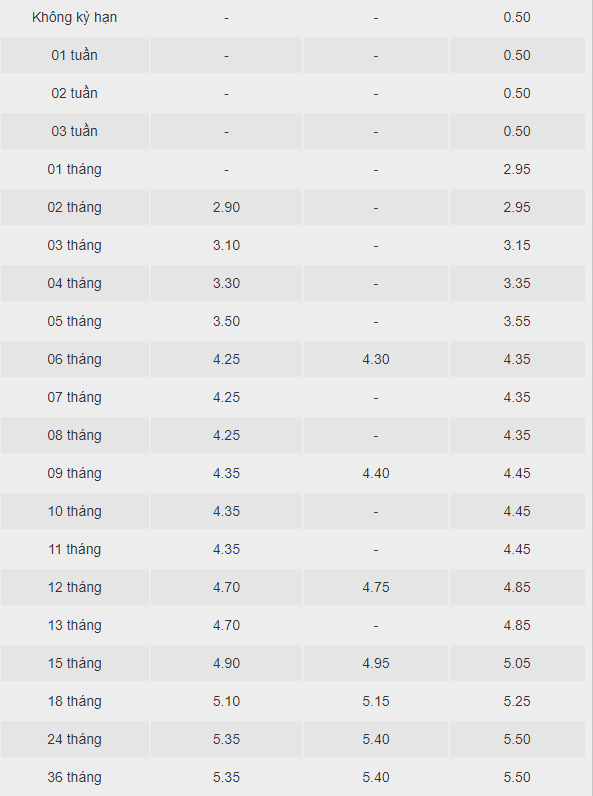

According to the latest saving interest rate schedule, applicable to interest payments at the end of the term and deposits under VND 1 billion, saving interest rates for the 1-11 month and 15-18 month terms increased by 0.15 points.

Accordingly, the saving interest rate for the 1-2 month term is set at 2.95%/year. Saving interest rates for the 3, 4, and 5-month terms are listed at 3.15%/year, 3.35%/year, and 3.55%/year, respectively.

Saving interest rates for the 6-8 month term increased to 4.35%/year, while the 9-11 month term increased to 4.45%/year.

Meanwhile, saving interest rates for the 15 and 18-month terms increased by 0.15 percentage points, now listed at 5.05% and 5.25%/year, respectively.

For the 12-13 month term, saving interest rates increased by 0.25 percentage points from the previous adjustment, now at 4.85%/year.

Saving interest rates for the 24-36 month term were adjusted with a significant increase of 0.4 percentage points, remaining at 5.5%/year. This is also the highest saving interest rate for saving accounts under VND 1 billion.

According to the saving interest rate schedule for customers with deposits over VND 1 billion, the interest rate is increased by an additional 0.2 percentage points across all terms.

Latest saving interest rates at Bac A Bank.

The wave of saving interest rate increases began in late March 2024. In April 2024, many banks have adjusted their saving interest rates upwards, including VietinBank, VPBank, HDBank, MSB, Eximbank, NCB, KienLong Bank, Bac A Bank, GPBank,… Notably, VPBank has adjusted its interest rates upwards for the second time since the beginning of April.

Meanwhile, some banks have reduced their interest rates, such as Vietcombank, PGBank, Eximbank, VietBank, ABBank, Techcombank, Viet A Bank, Dong A Bank, NCB, SCB, Nam A Bank.