Despite the volatile and record-high gold prices, the demand for gold investment has surged recently. In both large and small stores, the number of people buying and selling gold is high, and there are even long queues for transactions. Many stores have had to limit the amount of gold sold to each customer due to the sharp increase in demand.

Meanwhile, domestic gold prices have fluctuated dramatically and unexpectedly over the past few days. At times, even as global gold prices recover, domestic gold prices have dived, or vice versa. Notably, in a single session, the prices of gold bars and SJC gold can fluctuate continuously by hundreds of thousands or even millions of dong per tael.

It is worth noting that the price difference between buying and selling plain gold rings has widened to about 2 million VND/tael in the last two weeks, instead of the usual 1 million VND/tael. With both SJC gold and gold ring prices fluctuating sharply in a single day, continuously reversing by millions of dong, the risk for gold speculators is substantial, with potential losses of up to 4 million VND/tael in a single session.

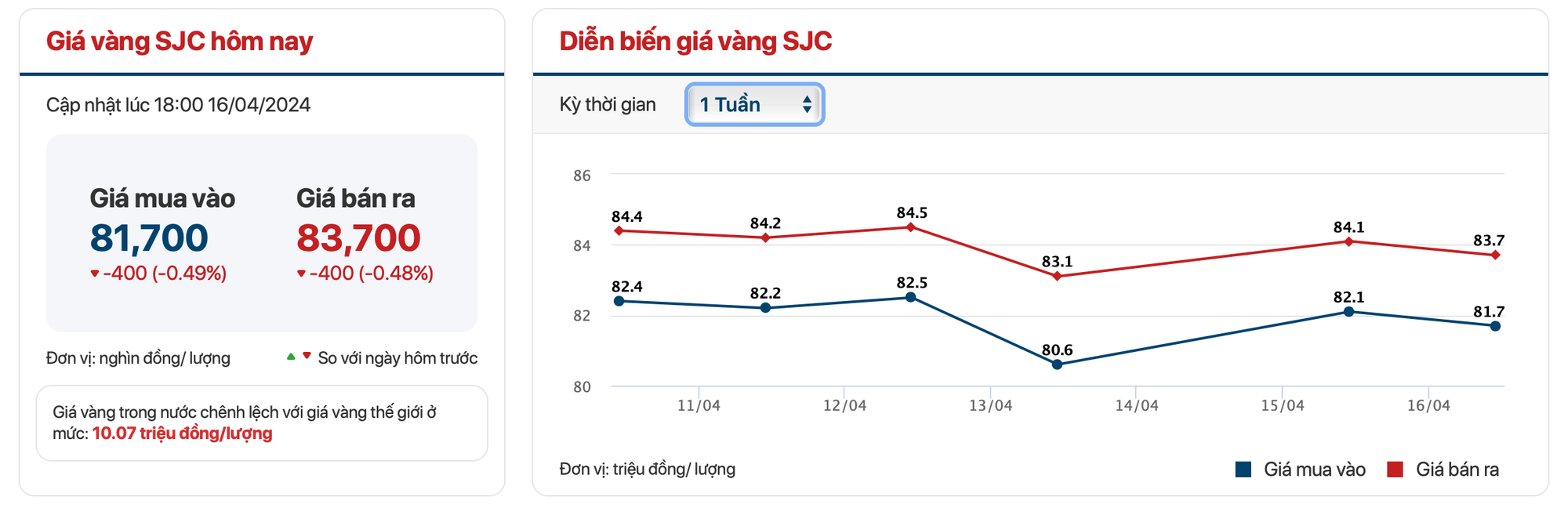

For example, if you bought an SJC gold bar at yesterday’s (April 15) peak price of approximately 85.5 million VND/tael, you would only get about 81.7 million VND/tael if you sold it at the end of the day on April 16, resulting in a loss of 3.8 million VND/tael.

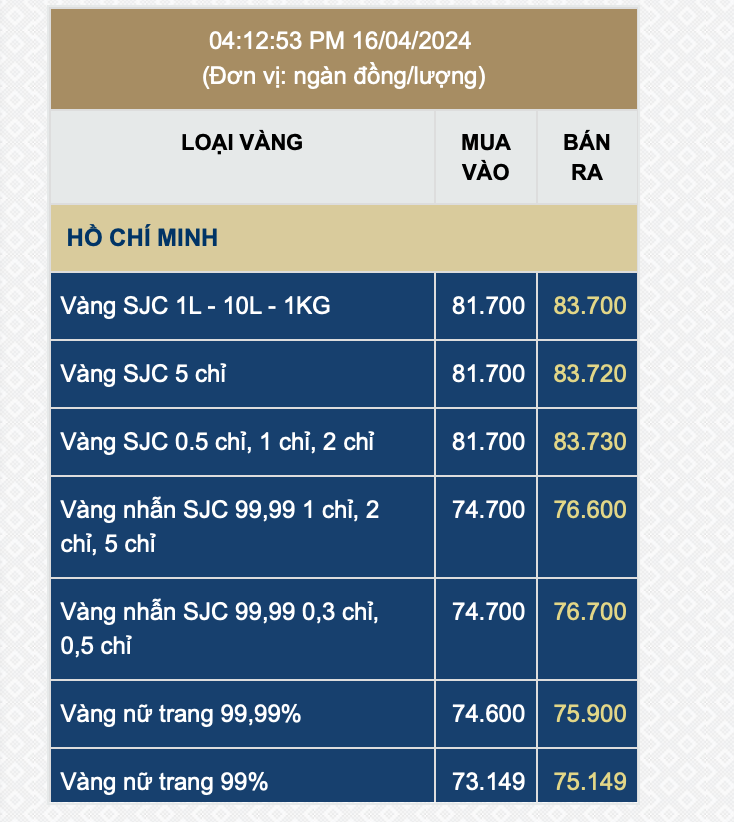

Specifically, on the afternoon of April 15, some stores raised the price of SJC gold bars to 83.5-85.5 million VND/tael. However, on April 16, the price of this type of gold plummeted to 81.7-83.7 million VND/tael.

Similarly, the price of 24k plain gold rings has also been adjusting significantly across various brands. For instance, at DOJI, the price of gold rings on April 10 peaked at 76.8-78.6 million VND/tael, then gradually decreased to 75.55 – 77.55 million VND/tael on April 15, and at one point on April 16, it dropped to 74.6-75.8 million VND/tael. Thus, those who “bought at the peak” on April 10 and sold at this time could lose up to 4 million VND/tael.

Yet, in reality, while some people are “losing sleep” over the constant fluctuations in gold prices, others believe that “no loss is realized until it’s sold” because gold prices will continue to rise in the future. Investors are also paying more attention to global gold prices because they significantly impact and set the trend for domestic gold prices. However, the price difference between global and domestic gold remains substantial and does not always move in tandem.

Currently, the spot gold price on the international market is around USD 2,390/ounce, having recovered significantly after falling to USD 2,332/ounce at the end of last week. At this price, the converted global gold price in Vietnamese currency (excluding taxes and fees) is approximately 73 million VND/tael. Thus, the global gold price is about 4 million VND/tael lower than domestic gold rings and nearly 11 million VND/tael lower than SJC gold bars.

Regulatory agencies have begun taking steps to address the price difference between domestic and international gold. Yesterday (April 15), the State Bank of Vietnam announced that it would hold a gold bar auction this week (April 15-19) at the Foreign Exchange Reserve Management Department to increase the gold supply to the market. This is the first time in 11 years that the State Bank has returned to organizing gold bar auctions.

However, some experts believe that gold bar auctions may have a short-term psychological impact but are not a fundamental solution to the current price disparity. According to Dr. Le Xuan Nghia, a member of the National Monetary and Financial Policy Advisory Council, since the promulgation of Decree 24/2012/ND-CP, the gold supply has been cut off, and businesses are not allowed to import gold, while domestic demand remains high, leading to an imbalance between supply and demand. To compensate for this imbalance, there are two options: smuggling or increasing domestic gold prices.

The price difference between SJC gold and other branded gold of the same quality is also significant. “Vietnam is the only country in the world where the central bank has a monopoly on the import and export of gold bars. So, let’s abolish this monopoly,” said Mr. Nghia.

Commenting on the SBV’s preparation to resume gold bar auctions, Dr. Le Xuan Nghia believes that this is only a solution that can create a short-term psychological impact, and eliminating the price difference between domestic and international gold requires trade measures, which are fundamental and in line with international practices. This means allowing qualified companies to import and export gold and using taxes and electronic customs to manage them.