SHB Vice Chairman Do Quang Vinh Registers to Buy Over 100 Million SHB Shares

|

From April 19 to May 17, Mr. Do Quang Vinh, Vice Chairman of SHB‘s Board of Directors, will commence purchasing over 100.2 million SHB shares, expected to increase his ownership to 101.1 million shares, equivalent to 2.79% of capital. If the transaction is successful, Mr. Vinh will become the individual with the largest SHB shareholding ratio on the bank’s Board of Directors. The value of Mr. Vinh’s stake is estimated at over VND 1,160 billion based on market price. In the early afternoon session on April 19, SHB shares traded actively and remained bullish, around VND 11,150 per share.

Following the announcement of the transaction by SHB Vice Chairman Do Quang Vinh, SHB shares rose to the ceiling price in the session on April 15. However, the sharp decline in the overall market caused SHB shares to reduce their uptrend. At the end of the session, SHB shares were the only green in the banking sector and the VN30 group, and were among the 10 stocks with the strongest increase in the market. Trading volume reached nearly 100 million shares during the session, the second highest in history, with foreign investors also net buying over 2.7 million SHB shares. In several subsequent sessions, SHB shares maintained their uptrend despite market fluctuations.

The performance of SHB shares partly reflects investors’ confidence in the information on the large-scale purchase registration by SHB Vice Chairman Do Quang Vinh, as well as expectations for significant steps forward in the future and a strong and comprehensive transformation strategy.

At the organizations led by Mr. Do Quang Vinh, the changes being made are bringing about a new vitality and mindset. The Vice Chairman of SHB is a talented representative of a generation of successor leaders with the enthusiasm of youth and a thirst for conquering new heights. The young entrepreneur always cherishes and inherits the foundations and good values of the past to transform, innovate, break through, and continuously reach for greater heights.

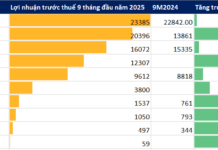

In 2024, SHB aims for a pre-tax profit of VND 11,286 billion, an increase of 22%. Total assets will reach VND 701,000 billion, and charter capital will be VND 40,658 billion, an increase of nearly 12%; strictly controlling the bad debt ratio below 3%.

SHB‘s goals affirm a strong step forward, expanding scale to meet the increasingly large capital needs of the economy; at the same time, increasing competitiveness in the international integration process and meeting the interests and desires of shareholders.