All Business Segments Improved in Q1 2024

VND’s after-tax profit surged by 340% year-over-year in Q1, reaching a significant VND617 billion. This remarkable profit performance was driven by positive results across multiple business segments.

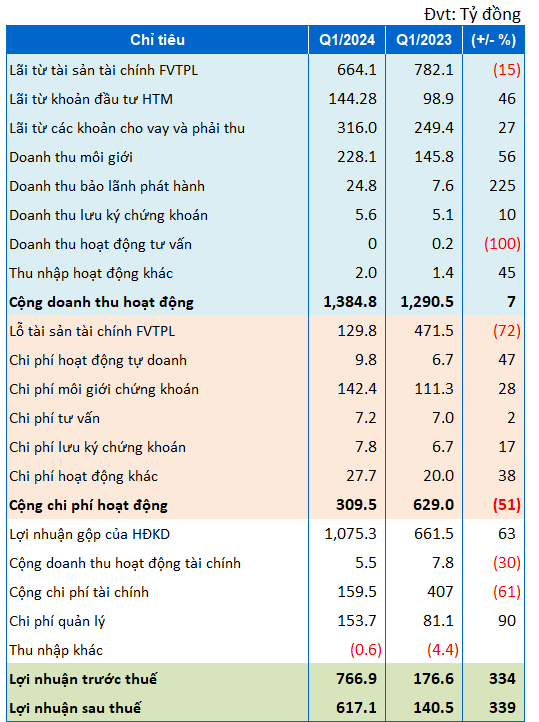

Table 1: VND’s Q1 2024 Financial Results

|

Source: VietstockFinance

|

Proprietary Trading

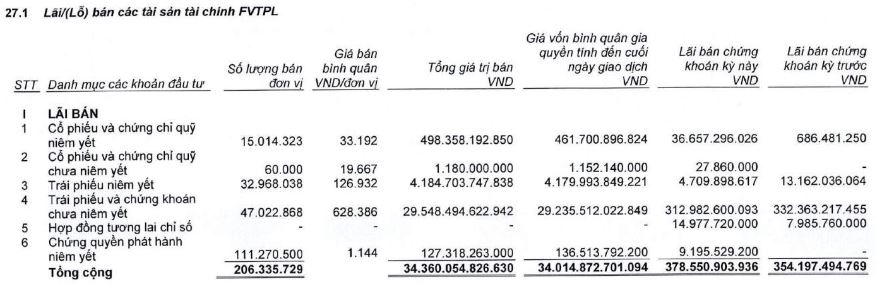

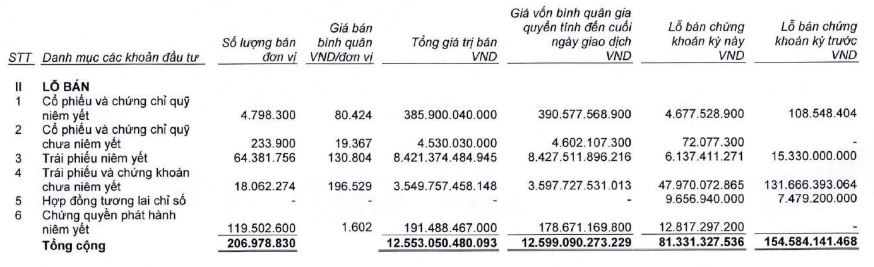

In the proprietary trading segment, despite a 15% decline in gains from financial assets recognized through profit/loss (FVTPL), the total FVTPL loss for the quarter was reduced by over 70% to VND130 billion. Consequently, VND recorded a proprietary trading profit of over VND524.5 billion, a staggering 72% increase compared to the same period last year. The company attributed this growth primarily to its investment portfolio and trading in certificates of deposit, bonds issued by credit institutions, and corporate bonds.

Bond trading significantly contributed to VND’s proprietary trading performance in Q1 this year. The company generated a net profit of VND265 billion from trading bonds and unlisted securities, a 32% increase year-over-year.

Table 2: VND’s FVTPL Gains/Losses

|

Source: VND

|

Source: VND

|

Brokerage and Lending

The brokerage and lending segments also saw significant improvements. Brokerage revenue reached VND228 billion, a 56% increase, while interest income from loans and receivables grew by 27% to VND316 billion. The positive performance in these segments was attributed to increased market liquidity in Q1.

VND’s loan balance stood at VND9.9 trillion as of the end of Q1, a 3% decrease from the beginning of the year.

Income from HTM Assets

Revenue from held-to-maturity (HTM) assets also increased by 46%, reaching VND144 billion. The company reported that this improvement was due to increased investments in fixed-term deposit contracts during the period.

Underwriting Fees

Notably, the company’s underwriting fees reached nearly VND25 billion, a remarkable 225% increase.

Other Factors Contributing to Profit Surge

Another factor contributing to VND’s profit surge was a significant reduction in financial expenses by approximately 61% to VND248 billion, resulting from lower interest expenses on borrowings compared to Q1 2023.

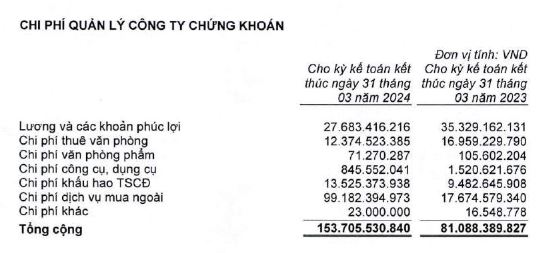

However, VND recorded a substantial increase in administrative expenses to VND153 billion in Q1, nearly doubling year-over-year. Of note, outsourced service expenses amounted to almost VND100 billion.

Table 3: VND’s Administrative Expenses

|

Source: VND

|

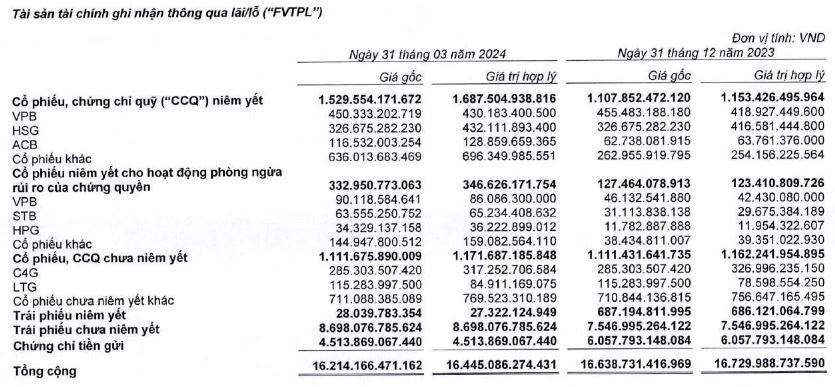

Shift in FVTPL Asset Composition

At the end of Q1, the size of VND’s FVTPL asset portfolio remained largely unchanged from the beginning of the year, standing at VND16.2 trillion. However, there were some shifts in the composition of assets among different asset classes.

Certificates of deposit declined by 25% to over VND4.5 trillion. Listed bonds decreased by 95% to VND28 billion.

Conversely, the proportion of listed stocks and unlisted bonds increased. The balance of listed stocks and fund certificates increased by 38% to over VND1.5 trillion. Meanwhile, the value of unlisted bonds rose by 15% to VND8,698 billion.

Equity Portfolio

In terms of the equity portfolio (listed and unlisted), VND holds notable positions in stocks such as VPB, HSG, ACB, C4G, and LTG. Compared to the beginning of the year, the company increased its investment value in other stocks, from VND263 billion to VND636 billion.

Table 4: VND’s FVTPL Asset Portfolio

|

Source: VND

|

VND’s total assets reached over VND41.3 trillion as of March 31, 2024, with minimal change compared to the beginning of the year.

Author: Yến Chi