E-commerce Q1 2023 Surges with Strong Growth

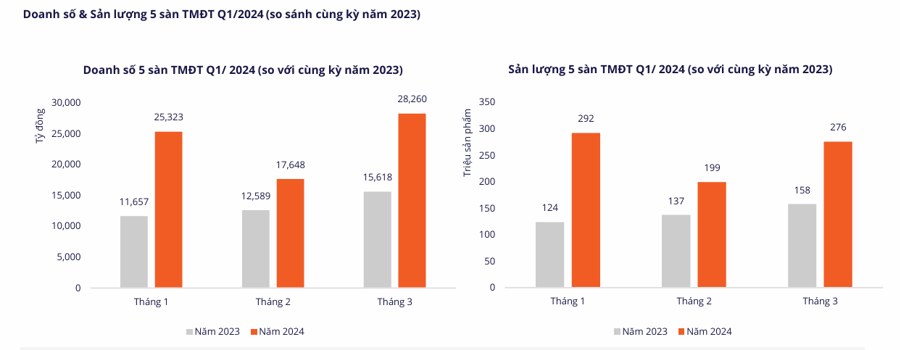

According to a comprehensive report released by Metric, an e-commerce data platform, the total revenue generated by the five largest e-commerce marketplaces in Vietnam (Shopee, Lazada, Tiki, Sendo, Tiktok Shop) reached 71.2 trillion VND in Q1-2024, a significant 78.69% increase compared to Q1-2023, excluding revenue from live-streaming sessions.

This figure surpasses expectations, as many projections estimated e-commerce market growth in 2024 to be around 35% compared to 2023.

Over the past three months, 766.7 million product units were successfully delivered to consumers, a surge of 83.21% year-over-year. With numerous stimulus programs encouraging domestic consumption, consumers are exhibiting greater spending confidence post-COVID-19. Online shopping is progressively becoming an integral part of consumer behavior.

Alongside the remarkable growth in revenue and sales volume, Q1-2024 also witnessed another positive indicator. Notably, for the first time in several quarters, the number of sellers generating orders has shown positive growth.

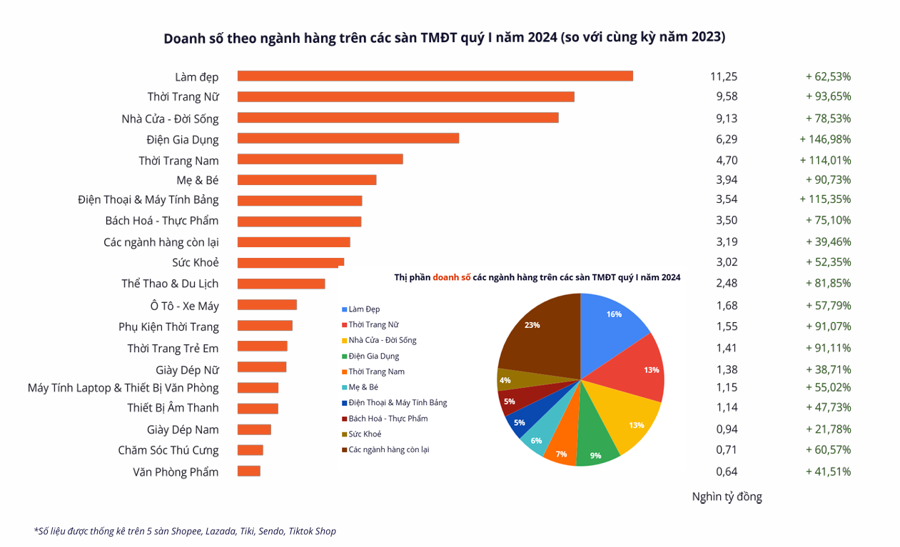

In the overall Q1-2023 e-commerce landscape, the beauty category maintained its dominance as the top-revenue generator for all five e-commerce platforms, accounting for a total of 11.25 trillion VND over the first three months of the year. This represents a growth of nearly 150%.

According to Mr. Pham Bao Trung, Business Director of Metric, the beauty category’s sustained success can be attributed to three key factors: high repurchase rates, frequent promotions compared to offline stores, and a predominantly female customer base, which aligns with the target audience of e-commerce platforms. Facial care products emerged as the most popular segment, with sales revenue reaching 3,223 billion VND and approximately 22.32 million units sold.

In addition, Q1-2024 witnessed the rapid growth of the home appliances category, with revenue growth of 146.8% and sales volume growth of nearly 370%. Top-selling products within this category typically carry higher price tags, such as projectors and robot vacuum cleaners. This suggests that consumers are increasingly comfortable purchasing high-value items online, provided that sellers can demonstrate credibility and product quality.

Intensifying Market Competition

In terms of brands, the report highlights mobile phones, motorcycles, home & living, home appliances, food & beverage, mother & baby, and beauty as the categories with the highest revenue and sales volume on e-commerce platforms.

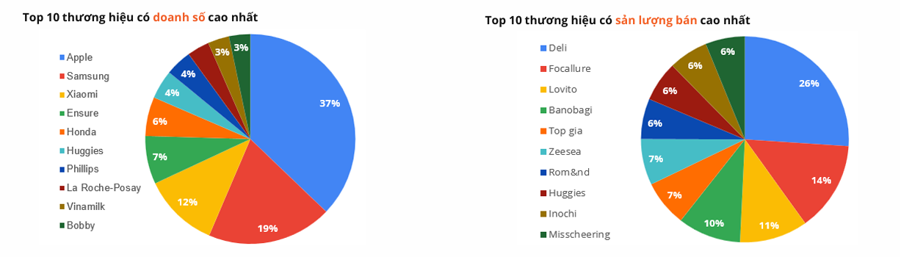

However, a closer analysis reveals that 90% of the top revenue-generating brands currently belong to international companies such as Apple, Samsung, Ensure, and Honda.

It becomes evident that despite high revenue on e-commerce platforms, domestic brands are noticeably absent in these top-performing categories. This situation necessitates that Vietnamese businesses develop astute and effective business strategies to enhance their competitiveness.

The top 10 brands with the highest revenue account for 7.27% of the total market revenue, predominantly originating from the United States, South Korea, and China.

The top 10 brands with the highest sales volume account for 1.02% of the total market volume, with Inochi being the sole Vietnamese brand among them.

Analysts believe that in addition to the economic recovery, businesses are increasingly confident in the growth of the e-commerce market. E-commerce has become an essential platform for businesses seeking to reach a massive customer base.

The rare growth in the number of sellers over the past two years is intensifying competition in the already crowded market. To keep pace and enhance competitiveness, businesses must proactively implement innovative solutions, leverage technology, and utilize data in their operations.

However, e-commerce remains a fiercely competitive market where consumers can find dozens or even hundreds of suppliers offering the same products on different platforms.

Consequently, as the number of businesses participating in e-commerce increases, market competition will undoubtedly become more complex. Experts warn that sellers can face elimination at any moment if they lack effective business strategies.

Currently, local businesses are also making significant progress. According to the report, the total revenue and sales volume of businesses outside the top 10 cities in Vietnam have grown by more than 50%. E-commerce has expanded beyond major metropolitan areas and is now impacting provincial markets.

Establishing warehouses in provincial areas has helped reduce shipping and delivery times, contributing to growth and meeting consumers’ demand for faster delivery.

Hanoi and Ho Chi Minh City account for the majority of revenue and sales volume based on warehouse locations, collectively representing over 70% of the total market. These cities also reflect the cultural consumption patterns of the southern and northern regions of Vietnam.

Within the top 10 provinces with the highest revenue, Quang Ninh, Bac Ninh, Hai Duong, and Binh Duong have experienced the most rapid growth compared to Q1-2023. These are all major cities, with Quang Ninh boasting an international border and the other three provinces hosting numerous industrial zones.

For Q2-2024, the total revenue across the five largest e-commerce platforms in Vietnam is projected to reach 84.87 trillion VND, with 882.12 million product units sold, representing an increase of 19.2% and 13.57%, respectively, compared to Q1-2024.

The peak business season for the e-commerce market is expected to pick up pace from Q2-2024, with a growth rate of 19.2% compared to Q1-2024, equivalent to an approximately 78% increase compared to Q2-2023.

However, geopolitical disruptions impacting supply chains, the influx of foreign sellers, and policy changes from e-commerce platforms prioritizing buyer interests pose challenges that businesses must address effectively to thrive in the remaining quarters of 2024.

Experts emphasize that conducting thorough market research, selecting suitable products and e-commerce platforms, and devising effective strategies based on data and analysis will be the right approach for sellers in the current market landscape.

Over the remaining nine months of 2024, the e-commerce market is anticipated to continue exhibiting positive growth signals. Nevertheless, the recent surge in the number of sellers, which has been scarce in the past two years, will intensify competition in an already crowded market. To keep up with market developments and enhance their competitive edge, businesses must remain proactive in implementing innovative solutions, leveraging technology, and utilizing data in their business operations.