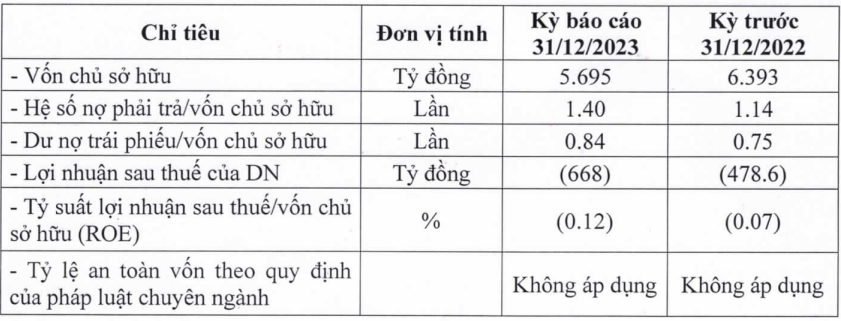

In a report submitted to the Hanoi Stock Exchange (HNX), Bông Sen Corporation reported continued losses after tax of VND 668 billion in 2023, compared to nearly VND 479 billion in losses the previous year.

As of December 31, 2023, Bông Sen’s total assets were recorded at nearly VND 13.7 trillion, which remained unchanged compared to the beginning of the year. In contrast, its liabilities increased by more than 9% to nearly VND 8 trillion, while its outstanding bond debt remained largely unchanged at VND 4.8 trillion.

|

Bông Sen’s 2023 Business Results

Source: HNX

|

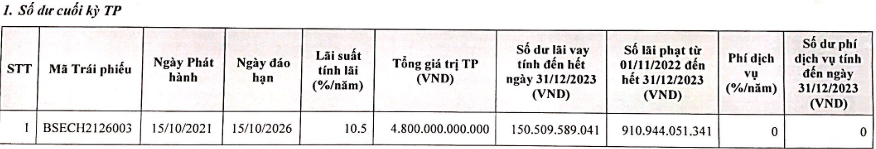

Currently, Bông Sen only has one outstanding bond issuance, BSECH2126003, which was issued on October 15, 2021, with an interest rate of 10.5% per year, a maturity of 5 years, and a value of VND 4,800 billion. However, due to the company’s account being frozen as part of an investigation into the Vạn Thịnh Phát Group, it has been unable to pay the VND 4,800 billion principal amount, in addition to approximately VND 1,062 billion in interest as of December 31, 2023.

Nearly VND 151 billion of the VND 1,062 billion corresponds to bond interest, while almost VND 911 billion represents late payment penalties accrued since November 1, 2022.

Source: HNX

|

To secure funds for the bond repayment, Bông Sen’s Extraordinary General Meeting of Shareholders held in late August 2023 approved a list of secured assets to be liquidated to fulfill the bond’s obligations. However, the company has not yet been able to fully settle the bond issuance.

Regarding Bông Sen’s involvement with Vạn Thịnh Phát, according to the Extraordinary General Meeting minutes, Ms. Vũ Thị Hồng Hạnh, Chairwoman of Bông Sen’s Board of Directors, stated that the company is cooperating with and awaiting the conclusion of the investigating authorities. All proceeds from the bond issuance are also under investigation. Previously, it was reported that Bông Sen is one of 762 companies believed to be connected to the Vạn Thịnh Phát Group, which is being investigated by a unit of the Ministry of Public Security.

Discussing the bond issue, Ms. Hạnh explained that the VND 4,800 billion bond was issued to finance the 152 Trần Phú project. However, due to the investment partner failing to fulfill its commitments, the company has faced challenges in paying interest to bondholders.

Ms. Hạnh also noted that the approval of the asset liquidation to settle the bond will only take place after the investigating authorities have reached a conclusion and determined a course of action. This is because the company is currently not permitted to alter or transfer its assets.

Bông Sen Corporation is a subsidiary of the Saigon Tourist Corporation (Saigontourist). Bông Sen transitioned to a joint-stock company in January 2005 with an initial charter capital of VND 130 billion. In 2014, its charter capital increased to VND 816 billion, which was also the year that Bông Sen delisted as a public company. In early 2015, Bông Sen made headlines when it spent trillions of VND to acquire majority shares in the Daewoo Hotel Complex in Hanoi.

The company owns and operates a chain of renowned hotels and restaurants, primarily located in central Saigon, including the Palace Saigon Hotel, Bông Sen Saigon, Bông Sen Annex, and eateries such as Vietnam House, Lemongrass, Calibre, Bier Garden, Buffet Gánh Bông Sen, and Brodard bakery with its network of 18 stores, among other assets such as Lotus Tours travel agency.